Markets

After last-week’s softer than expected US CPI data, global investors gained ever greater confidence that the Fed will embark for a genuine, protracted easing cycle soon. Yields turned south, especially at the short end of the (US) yield curve. The dollar faced an uphill battle, but losses after all remained modest. Key support levels mostly survived. Even as (US) yields steadied, FX markets today tried/succeded some kind of catching up move. Remarkably, this USD decline occurred even as equities mostly trade in red, pondering the impact of a protectionist Trump trade policy regarding IT-related exports to China (amongst others). It has been different of late and a yen rebound after presumed BOJ interventions stalled earlier this week. Even so, today the Japanese currency was first to profit from a weak USD and forced the break. USD/JPY dropped below the 157.19 correction low, triggering further stop-loss unwinding of stale yen-short/USD-long positions. At 156.40, USD/JPY trades about 3.5% below the multi-year peak touched early this month. The euro isn’t the front-runner to profit from the USD setback, but the USD/JPY decline also pushed EUR/USD beyond 1.0916/20 resistance (currently 1.0945). The 1.0981 March top is the last stop before the 1.10 barrier. The broader USD decline and easing of global financing conditions broadly supports smaller currencies that are often sensitive to global (risk)sentiment (NOK, SEK, AUD, CAD and NZD, the latter after mixed domestic CPI data). In CEE, the Czech krone and the forint also succeded modest gains. The zloty, regional outperformer YTD, for the second day in row lost ground. We saw no obvious trigger for PLN underperformance. The technical break in several major USD cross rates is noteworthy, but we look out whether/how long this combination of USD-weakness and equity risk-off lasts.

Cable (1.3035) today was squeezed beyond the 1.30 barrier, a level last seen this time last year. Aside from USD weakness, sterling strength was also in play. The UK currency of late profited from a return of political stability after the UK Parliamentary election. Today, UK inflation data didn’t provide a clear trigger for the BoE to aggressively downsize sterling’s interest rate support anytime soon. At 0.1% M/M and 2% Y/Y, UK inflation for the second consecutive month matched the BoE target. Still, core- 3.5 % Y/Y and services inflation (5.7% Y/Y) flagged a clear warning signal that there is some work to do for the BoE. The minutes of the June meeting showed that the unchanged decision at that time was a rather close call as several members wanted to gradually scale back policy restriction. Today’s data don’t make it easier for ‘middle-of-the-road’ MPC members to change camp already at the August meeting. UK monetary policy is again drifting closer to the Fed’s path rather than to an ECB scenario. UK yields added between 3.5 bps (2-y) and 2.5 bps (30-y). The market now only sees a

News & Views

Belgian newspaper De Tijd reports that Belgium is running a €27.8bn budget deficit according to preliminary data by the Budget Monitoring Committee in preparation of federal formation talks (4.6% of GDP). That’s close to the €27.5bn estimated by the outgoing government. For next year, the deficit is expected to widen to €29.4 bn. Under unchanged policy settings, this rises to €46.5bn by 2029 (vs previous estimate of €45bn). The lion share of these deficits are on a federal rather than regional level. To comply with EU rules, the federal government needs to finds €27.6bn by 2029.

An analysis by the National Bank of Poland showed that domestic companies expect their financial conditions to worsen in Q3 amid demand worries. A particularly clear weakening of demand forecasts was noted in consumer services and in the construction industry. Companies lowered their employment forecasts and reduced their planned increase in salaries. The number of companies planning new investment has decreased as well.

Graphs

USD/JPY: Yen taking the lead on broad USD correction

Cable (GBP/USD) jumping beyond 1.30 for the first time in a year as BoE maybe won’t be able to frontrun Fed policy easing.

NZD/USD: mixed New Zealand inflation report raises doubts on August RBNZ rate cut. Kiwi dollar rebounds.

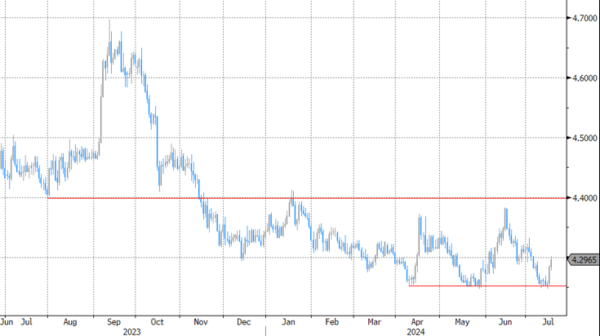

EUR/PLN: zloty underperforms as EUR/PLN 4.25 proves tough support (zloty resistance).