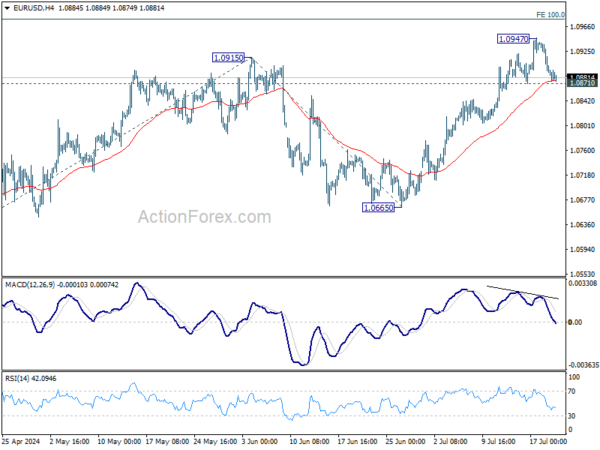

EUR/USD edged higher to 1.0947 last week but retreated since then. Initial bias remains neutral this week first, and further rise is in favor as long as 1.0871 minor support holds. Break of 1.0947 will target 100% projection of 1.0601 to 1.0915 from 1.0665 at 1.0979. However, firm break of 1.0871 will turn bias to the downside for deeper fall to 55 D EMA (now at 1.0807) and possibly below.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern, possibly a triangle, that’s still be in progress. Break of 1.1138 resistance will be the first signal that rise from 0.9534 (2022 low) is ready to resume through 1.1274 (2023 high). This will now remain the favored case as long as 1.0601 support holds.

In the long term picture, a long term bottom is in place at 0.9534 (2022 low). Sustained break of 55 M EMA (now at 1.1013) will raise the chance of long term reversal. But even in this case, firm break of 1.2348 structural resistance is needed to confirm. Rejection by 55 M EMA will maintain bearishness for extend the down trend from 1.6039 (2008 high) through 0.9534 at a later stage.