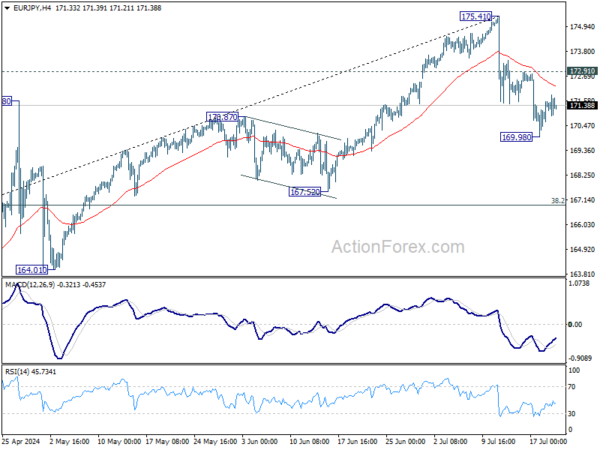

EUR/JPY’s fall from 175.41 short term top extended lower last week but recovered after hitting 169.98. Initial bias remains neutral this week first, and further fall is in favor as long as 172.91 resistance holds. Below 169.98 will target 38.2% retracement of 153.15 to 175.41 at 166.90, as a correction to whole rise from 153.15. On the upside, though, break of 172.91 resistance will revive near term bullishness and bring retest of 175.41 high.

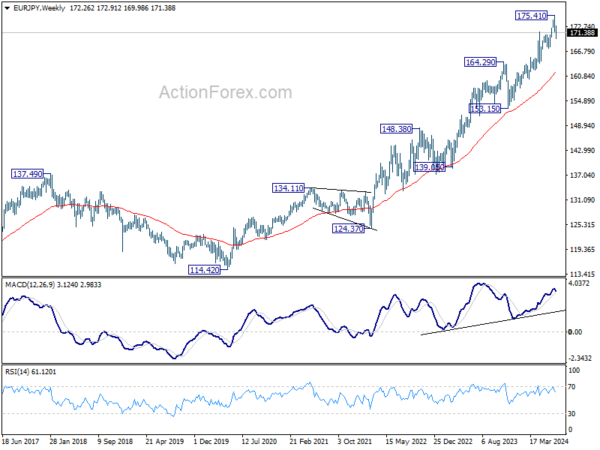

In the bigger picture, medium term outlook will stay bullish as long as 164.29 resistance turned support holds. Long term up trend is still in favor to continue through 175.41 at a later stage. However, firm break of 164.29 will be a strong sign of bearish trend reversal.

In the long term picture, rise from 114.42 (2020 low) is seen as the third leg of the whole up trend from 94.11 (2012 low). Next target is 138.2% projection of 94.11 to 149.76 from 114.42 at 191.32. This will remain the favored case as long as 164.29 resistance turned support holds.