McAlinden Research takes a look at shares of U.S. banks, which it believes are surging in the wake of recent quarterly earnings.

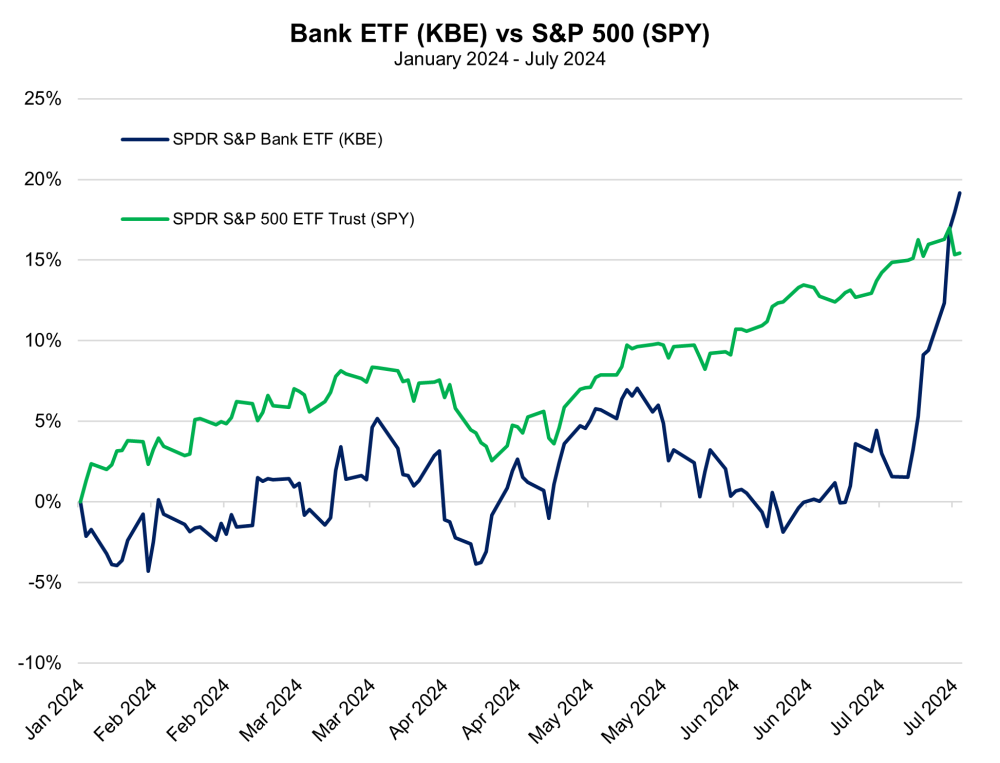

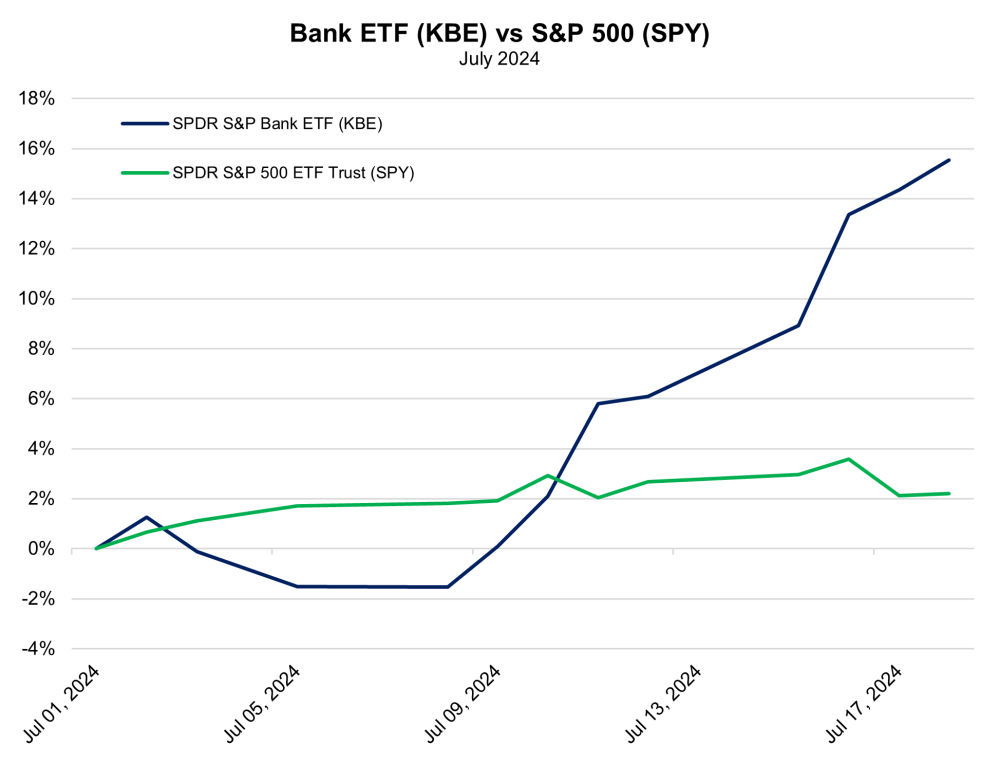

The latest spate of bank earnings coincided with the SPDR S&P Bank ETF’s (KBE:NYSEARCA) best 5-day span of trading since November 2020, rising by 12% in the period to Wednesday. The market’s positive reaction to second-quarter results was largely based on an ongoing rebound in the investment banking divisions of America’s largest financial institutions and some light at the end of the tunnel for beaten-down regional banks that have languished under persistently high short-term rates at the Fed.

In our July 1 Intelligence Briefing, we noted that results from Jefferies Financial Group, which come in well before most other financial firms, demonstrated a powerful performance from its capital markets and IB businesses. That disclosure resulted in Jefferies’s stock price touching an all-time high. We noted that the bounce in revenues could foreshadow similar strength for its larger peers. This was to be expected as global M&A volumes were up about 8% in Q2 YoY, but JPMorgan, Citigroup, and Wells Fargo reported particularly strong annual increases in their IB revenue of 46%, 60%, and 38%, respectively.

In fact, the Financial Times reports that Q2 was Wall Street’s best quarter for investment banking in more than two years, and four of the five largest US banks (with Goldman Sachs being the exception) announced higher-than-expected investment banking revenues for the quarter.

That was a helpful boost, but U.S. banks will need to see a continued resurgence of M&A to keep an increasing level of fees rolling in. Goldman Sachs noted that M&A volumes were still about 20% below 10-year averages, largely as a result of persistently slow private equity dealmaking volume. Bloomberg notes that PE sponsors have constituted up to 30% of investment banking revenue in some recent years. A burgeoning recovery in the underwriting of new public listings would also help to juice the fortunes of financial shares in quarters to come.

MRP recently highlighted a slight uptick in IPO proceeds YoY in Q1, along with a similarly moderate bounce in the number of initial listings, noting that a critical pillar of any potential IPO market recovery will be an expansion of PE exits. In 2023, US exits fell to a tenth of the 140 recorded in 2021, and it has been a tough start to 2024 as well, as PitchBook data showed only two private equity-backed IPOs over $100 million had been completed by the end of April, raising about $1 billion.

A gradual decline in rates should assist in the bounce-back of M&A activity. Long-term rates in the U.S. have already eased significantly since the end of April, but banks will also need a steeper fall in short-term rates to see earnings improve more significantly. One of the headwinds banks highlighted in second-quarter results was the consistent elevation of funding costs for the capital they lend out. Banks borrow money at the short end of the yield curve and end at the long end and a more than 20-month-long inversion of the 10-year U.S. Treasury yield versus the 3-month yield (10yr-3mo) has continually diminished net interest margins (NIMs which measure interest earned on loans versus interest paid to depositors) across four of the past five quarters.

When short-term rates are high, depositors tend to demand greater compensation for providing banks with their deposits — typically the cheapest source of liquidity for banks. As such, banks end up having to raise rates paid on deposits to compete with money market funds, as well as each other, for flows. Relief on this front is increasingly likely as a continued softening of consumer price inflation and a gradual weakening of labor market tightness is boosting bets on a rate cut in September. In fact, CME’s FedWatch tool calculates that bets made by Fed Funds futures have increased the odds of more than one cut by the end of the year to roughly 95%.

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

McAlinden Research Partners Disclosures

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.