In a bold move to invigorate economic growth and transform the financial landscape, the Budget 2024 introduces a comprehensive suite of initiatives designed to bolster infrastructure, streamline business operations, and expand digital and green finance.

The government has unveiled a substantial increase in capital expenditure targeting critical infrastructure projects, while also rolling out significant tax reforms and enhanced support for Micro, Small, and Medium Enterprises (MSMEs).

Key highlights include a streamlined Insolvency and Bankruptcy Code (IBC), a robust push for digital payments, and substantial investments in agriculture, housing, and sustainable finance. These measures collectively aim to drive growth, create new lending opportunities, and foster innovation within the BFSI sector.

Here are the Top Announcements of Budget 2024:

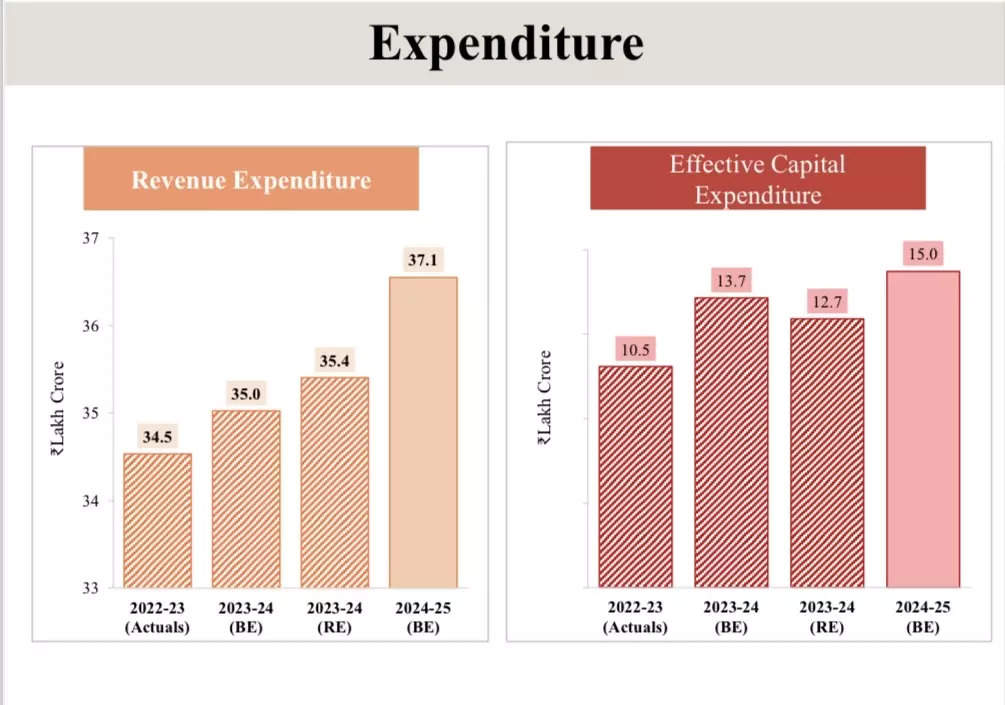

1) Increase in Capital Expenditure:

The government has announced a significant increase in capital expenditure aimed at infrastructure development. This includes investments in roads, railways, and urban infrastructure, which is expected to boost economic growth and create opportunities for financing and lending by banks and financial institutions.

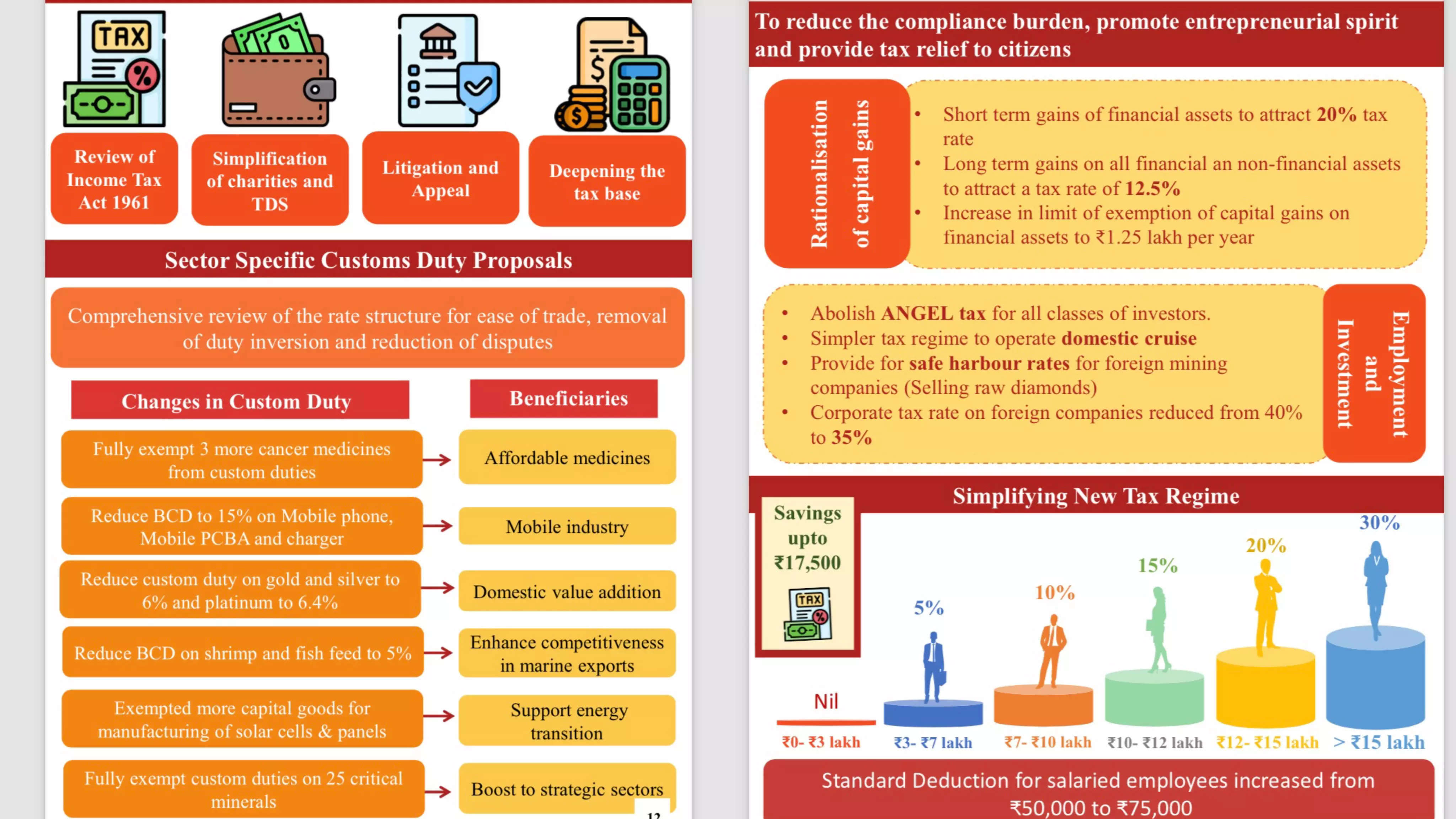

2) Tax Reforms:

The budget proposes several tax reforms, including rationalization of tax slabs and reduction in corporate tax rates for small and medium enterprises. These reforms are aimed at improving the ease of doing business and providing relief to businesses, which can enhance credit flow and investment opportunities.

3) Support for MSMEs:

The budget includes measures to support Micro, Small, and Medium Enterprises (MSMEs) through easier access to credit and financial support schemes. This is expected to enhance the growth prospects of the MSME sector and provide opportunities for banks and financial institutions to expand their lending portfolios.

4) IBC Reforms:

Significant reforms have been announced for the Insolvency and Bankruptcy Code (IBC) to make the resolution process more efficient and transparent. These reforms aim to expedite the resolution of stressed assets and improve the recovery rates for creditors.

Also read: IBC to get a tech platform for streamlined insolvency

5) Expansion of Digital Payments:

The government has reiterated its commitment to promoting digital payments by increasing incentives for digital transactions and strengthening the digital infrastructure. This will support the growth of fintech companies and increase the adoption of digital banking services.

6) Agriculture and Rural Development:

A substantial allocation has been made for agriculture and rural development, including measures to enhance farm credit availability and improve rural infrastructure. This is expected to boost the rural economy and create lending opportunities for financial institutions.

7) Economic Growth Projections:

The budget outlines optimistic economic growth projections, driven by reforms and investments in key sectors. Positive economic growth can lead to increased demand for credit and financial services.

8) Privatization and Asset Monetization:

The budget includes plans for the privatization of certain public sector enterprises and monetization of government assets. This can provide new investment opportunities and revenue sources for financial institutions.

9) Housing and Real Estate:

The government has announced measures to boost the housing and real estate sector, including tax incentives for homebuyers and increased allocation for affordable housing schemes. This is expected to stimulate demand in the housing market and provide lending opportunities for banks and housing finance companies.

10) Green and Sustainable Finance:

The budget emphasizes the importance of green and sustainable finance, with incentives for investments in renewable energy and sustainable projects. This aligns with global trends towards ESG (Environmental, Social, and Governance) investing and creates new avenues for financial institutions to support sustainable development initiatives.

These announcements collectively aim to stimulate economic growth, support key sectors, and enhance the overall financial ecosystem, providing various opportunities for the BFSI sector to expand and innovate .