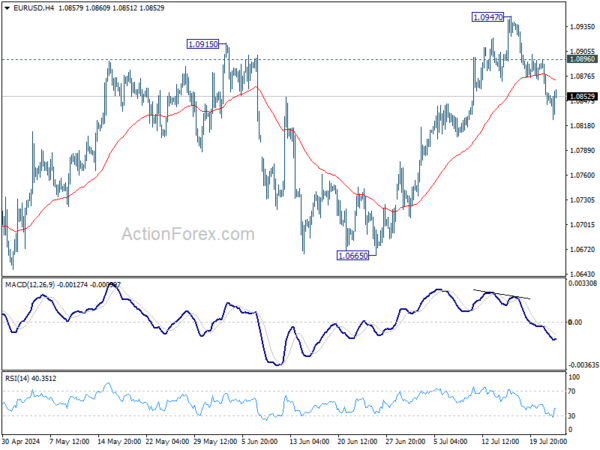

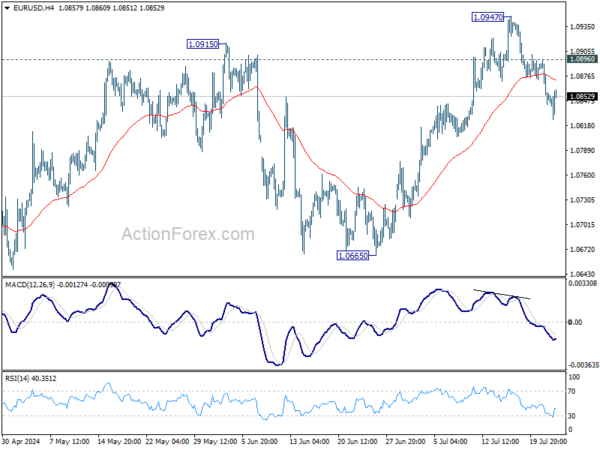

Daily Pivots: (S1) 1.0832; (P) 1.0865; (R1) 1.0885; More…..

No change in EUR/USD’s outlook and intraday bias stays on the downside. Fall from 1.0947 short term top should extend to 55 D EMA (now at 1.0813). Sustained break there will argue that whole rebound from 1.0601 has completed with three waves up to 1.0947, and target 1.0601/0665 support zone. On the upside, above 1.0896 minor resistance will turn intraday bias neutral first. But, risk will stay on the downside as long as 1.0947 resistance holds, in case of recovery.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern that’s still be in progress. Break of 1.1138 resistance will be the first signal that rise from 0.9534 (2022 low) is ready to resume through 1.1274 (2023 high). However, break of 1.0665 support will extend the correction with another falling leg back towards 1.0447 support.