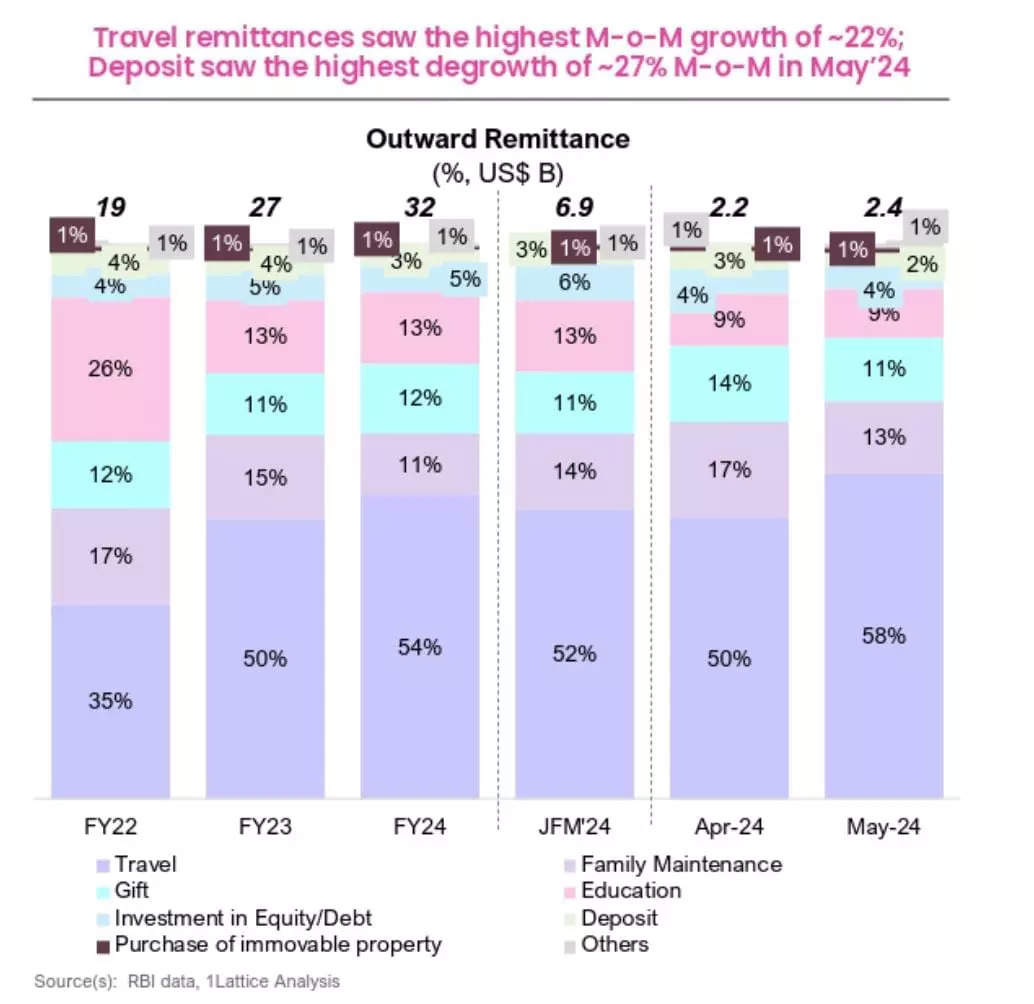

The outward remittances from India has witnessed a slight uptick of approximately 6 per cent, month on month in May 2024 after a 2 per cent dip in April, 14 per cent increase in March and 23 per cent dip in February, revealed latest data by 1Lattice.

For the past 3 years, overseas travel and leisure has had the highest share in outward remittances from India, while education remittances declined from FY22.

ALSO READ: Outward remittances from India show marginal fall of 2% in Apr’24

The month of May has recorded outward remittances worth USD 2.4 billion compared to USD 2.2 billion in April, USD 2.3 billion in March and USD 2 billion in February.

Travel held the majority share of 58 per cent, followed by family maintenance of 13 per cent, gifts of 11 per cent and education of 9 per cent. Investment in equity/debt held a 4 per cent share, the data highlighted.

Remittances clocked a record high of USD 27.14 billion in FY23. According to latest data by RBI, remittances increased 16.91 per cent year-on-year from the previous high of USD 27.14 billion clocked in FY23.

Indians remitted USD 29.43 billion abroad during the April-February period as compared to USD 24.18 billion in the same period of the previous year.

ALSO READ: Outward remittances from India witnessed 14% uptick in Mar’24

Forex remittances had averaged over USD 3 billion a month between April-Sept 2023 before the increased tax collection at source (TCS) came into effect in October.

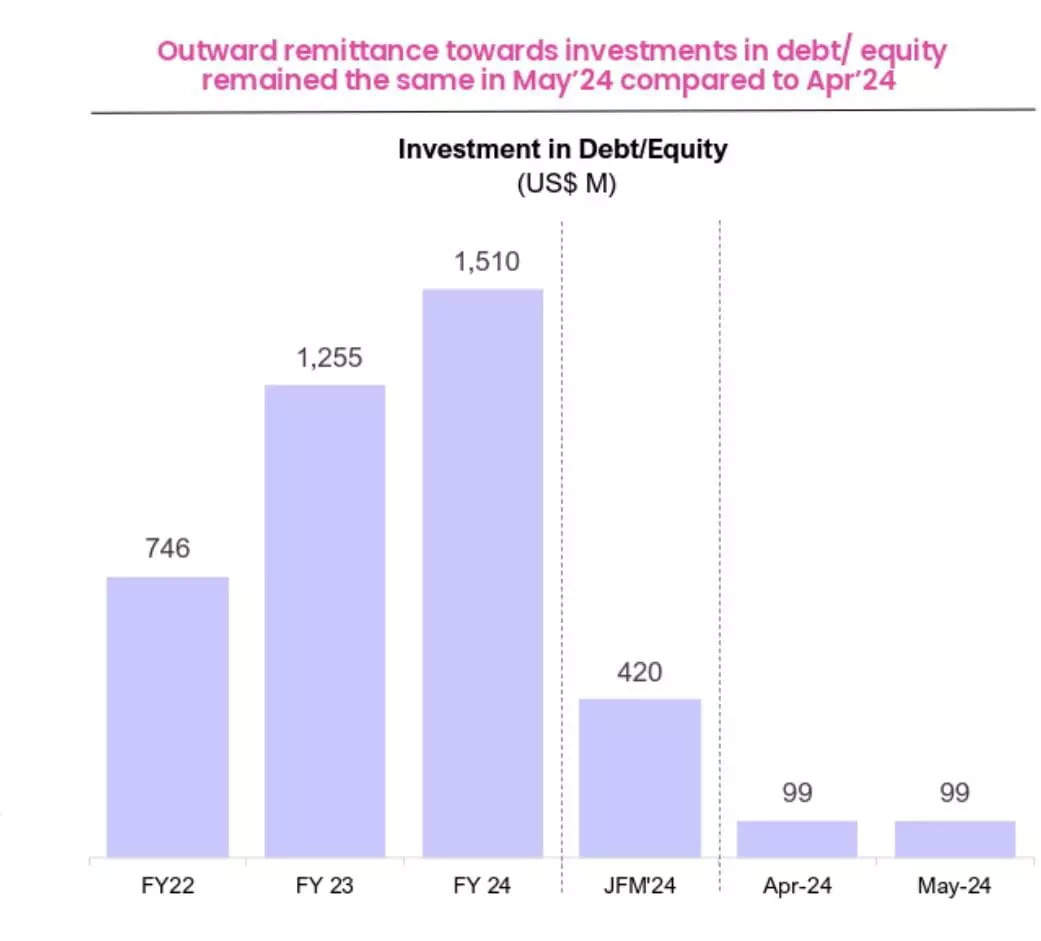

Outward remittance towards investment on debt/equity remained same as April in the month of May, while it witnessed a significant decrease of about 56 per cent m-o-m, in April 2024, in comparison to 66 per cent jump in March, 126 per cent increase in February and 41 per cent decline in January, 2024.

After international travel, Indians spent most on maintenance of close relatives, followed by gifts and education.

Remittances under LRS Scheme

The Indian government had recently raised the tax collection at source (TCS) rate on foreign remittances under the Liberalised Remittance Scheme (LRS) from 5 per cent to 20 per cent, which has been effective since October 1, 2023.

Outward remittances under the Reserve Bank of India’s (RBI’s) Liberalised Remittance Scheme (LRS) declined by over 16 per cent in May 2024 from the year-ago period due to the base effect.

According to latest data by the Reserve Bank of India, the amount remitted under LRS stood at USD 24.80 billion in the 9-month period ended in December 2023, compared to USD 20.63 billion in the same period last year.

ALSO READ: Outward remittances from India witnessed 9% uptick in Jan’24

In the first half of FY24, money sent abroad by Indians under the Liberalised Remittance Scheme (LRS) hit a record high of USD 18.34 billion. The introduction of the TCS saw remittances drop sharply from nearly USD 3.5 billion in September to about USD 2.2 billion in a month’s time.

The LRS allows resident Indians to transfer funds abroad without restrictions, up to a specified limit. This month-on-month fall was due to a decline in funds sent for maintenance of close relatives.

The Liberalised Remittance Scheme (LRS) allows every Indian to send up to USD 250,000 abroad annually.

Outward remittances recorded in FY20 was USD 18 billion, in FY21 it was USD 12 billion and in FY22 it was a whopping USD 19 billion, said the 1Lattice data.

Overall remittances hit a new high of USD 31.73 billion in FY24, on the back of robust growth in the international travel segment.

ALSO READ: Outward remittances hit record high at $29 billion during Apr-Feb FY24

Economic Survey Remittances Projection

The Economic Survey 2023-24, presented by Finance Minister Nirmala Sitharaman on Monday, projects a steady increase in remittance inflows to the country over the next two years.

According to the survey, remittances to India are expected to grow by 3.7 per cent in 2024, reaching an impressive USD 124 billion. This upward trend is forecasted to continue into 2025, with a projected 4 per cent growth that would bring the total remittance inflow to USD 129 billion.

“India’s efforts to link its Unified Payments Interface (UPI) with source countries such as the United Arab Emirates (UAE) and Singapore are expected to reduce costs and speed up remittances,” as per the survey.

The diversification of India’s migrant pool — between a large share of highly skilled workers employed mostly in high-income OECD markets, and the less-skilled migrants employed in the GCC markets — is likely to lend stability to their remittances in the event of external shocks, it added.