“Regulations must set boundaries to contain irrational exuberance among participants and ensure a sound institutional framework, promoting financial stability,” stated the RBI report on Currency and Finance (RCF) for the year 2023-24, themed “India’s Digital Revolution”.

The rapid digitalisation of the financial sector in India poses significant regulatory challenges, requiring regulators to stay ahead of the innovation curve while balancing financial stability, competition, and customer protection.

This necessitates enhancing the capacity of regulated entities, updating legal frameworks, engaging stakeholders to identify risks, and expanding consumer education.

In the context of peer-to-peer lending, regulations have positively impacted trust-building, thereby enabling financial innovation adoption.

Challenges in FinTech and Non-Bank Payment Services

Loosening entry barriers could promote FinTech lending based on weak business models and inadequate cyber infrastructure, stated the RBI report on currency and finance.

Unregulated non-bank payment services could disadvantage traditional banks, leading to regulatory arbitrage and deposit disintermediation, it added.

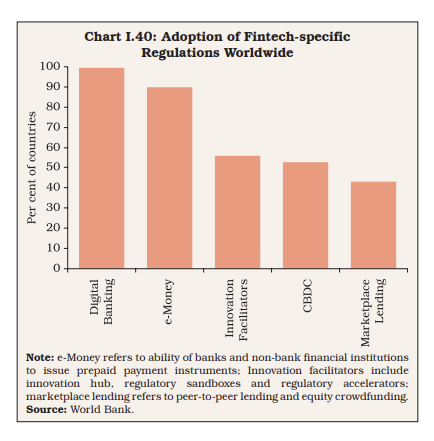

Globally, countries have enacted regulations to strengthen enforcement in FinTech activities to address these challenges.

BigTechs and Market Dominance

BigTech companies, due to their potential to become ‘too big to fail,’ pose significant regulatory challenges.

According to the RBI report, their extensive data collection and interconnected activities can lead to adverse economic and welfare outcomes, such as promoting their own products at higher margins and engaging in anti-competitive practices like product bundling and cross-subsidisation

Regulatory frameworks must address these unique risks to ensure fair competition and market stability, stated the Indian Central Bank

Data Utilisation and Privacy Concerns

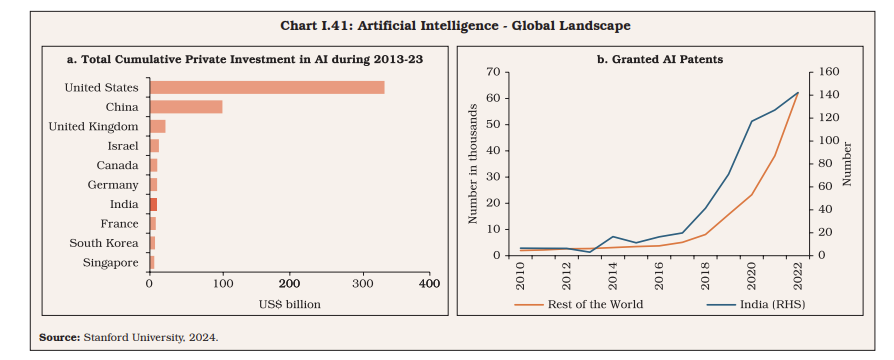

Digitalisation generates vast amounts of data, facilitating the use of advanced models like AI and Generative AI in the financial sector.

The share of India in granted AI patents in the world is also low, it revealed.

However, balancing financial security through data analytics with individual privacy protection remains a significant challenge, as stated in the report.

The increased use of AI algorithms by financial institutions presents additional challenges such as lack of explainability, potential biases, false signals, and substantial integration costs.

According to the report, Central bankers must also closely monitor quantum computing developments due to growing concerns about the vulnerability of current cryptographic methods in securing financial transactions

International Collaboration

The cross-border nature of digital payments and trade necessitates effective regulation through international collaboration.

“Efforts are underway globally to harmonise cybersecurity regulations and anti-money laundering frameworks to foster convergence in cyber resilience strategies,” said the central bank in the report.

Organisations like the Group of Seven (G7), Basel Committee on Banking Supervision (BCBS), and the Financial Stability Board (FSB) have issued principles to support this harmonisation.