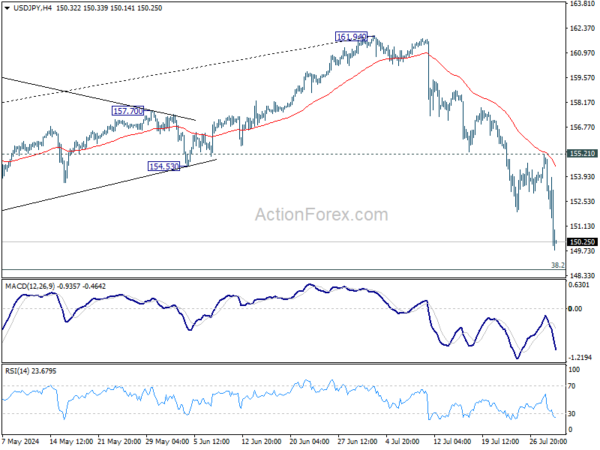

Daily Pivots: (S1) 151.86; (P) 153.54; (R1) 154.43; More…

USD/JPY’s fall from 161.94 accelerates lower again to as low as 149.77 so far. Intraday bias stays on the downside for 148.66 fibonacci level, which is close to medium term channel support (now at 148.22). Strong support could be seen there to bring rebound. But break of 155.21 resistance is needed to confirm short term bottoming. Otherwise, risk will stay on the downside in case of recovery.

In the bigger picture, considering the depth and momentum of the current decline, 161.94 should be a medium term top already. Fall from there is seen as correcting the whole rise from 127.20 (2023 low) at least. Next target is 38.2% retracement of 127.20 to 161.94 at 148.66. Decisive break there will pave the way to 140.25 support next. Risk will now stay on the downside as long as 55 D EMA (now at 156.90) holds, in case of rebound.