Sterling suffered an initial sell-off in European trading and remained weak following BoE’s decision to cut the Bank Rate by 25 basis points to 5.00%. However, it stabilized during Governor Andrew Bailey’s press conference. The tight 5-4 vote to cut the rate underscored that monetary policy easing is not on auto-pilot for BoE. Bailey highlighted that today’s reduction is a slight easing of policy restriction, maintaining that the policy must stay restrictive for sufficiently long. He stressed that the MPC remains “highly alert” to the risks of inflation persistence and will make future decisions on a “meeting to meeting” basis.

Meanwhile, Yen softened today, digesting the gains it made earlier in the week. With USD/JPY touching a key Fibonacci level at 148.66, there is potential for a rebound in USD/JPY, i.e., a pullback in the Yen. Conversely, Swiss franc emerged as the strongest currency of the day, benefiting from safe-haven flows due to ongoing tensions in the Middle East.

Also in the currency markets, Dollar and commodity currencies are struggling to find clear direction. The greenback is particularly focused on the upcoming ISM manufacturing data and tomorrow’s non-farm payroll data for further guidance.

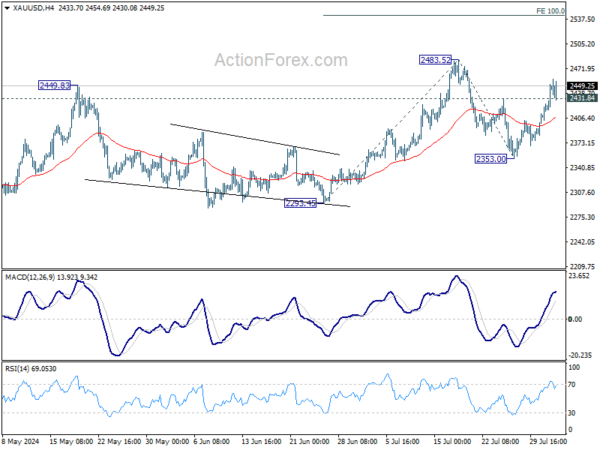

Technically, Gold’s break of 2431.84 resistance suggests that correction from 2483.52 has completed at 2353.00. Further rise should be seen to retest 2483.52 first. Firm break there will resume larger up trend to 100% projection of 2293.45 to 2483.52 from 2353.00 at 2543.07.

In Europe, at the time of writing, FTSE is flat. DAX is down -1.07%. CAC is down -1.19%. UK 10-year yield is down -0.0575 at 3.912. Germany 10-year yield is down -0.0173 at 2.288. Earlier in Asia, Nikkei fell -2.39%. Hong Kong HSI fell -0.23%. China Shanghai SSE fell -0.22%. Singapore Strait Times fell -1.04%. Japan 10-year JGB yield fell -0.0263 to 1.035.

BoE cuts Bank Rate by 25bps to 5.00% in 5-4 tight vote

BoE cut the Bank Rate by 25 bps to 5.00% today, in a closely contested 5-4 vote. Governor Andrew Bailey, Deputy Sarah Breeden, new Deputy Clare Lombardelli, known dove Swati Dhingra, and Dave Ramsden voted in favor of the cut. Chief Economist Huw Pill, Megan Greene, Jonathan Haskel, and Catherine Mann voted against the change.

In the accompanying statement, BoE stated it is now “appropriate to reduce slightly the degree of policy restrictiveness.” The central bank noted that the impact of past external shocks “has abated” and there has been “some progress” in moderating inflation risks.

Despite the cut, BoE emphasized that restrictive policy will continue to weigh on economic activity, leading to a looser labor market and reducing inflationary pressures.

UK manufacturing PMI finalized at 52.1, inflation pressure moving to manufacturing sector

UK PMI Manufacturing was finalized at 52.1 in July, up from June’s 50.9. Production growth was the fastest since February 2022, while input price inflation hit an 18-month high.

Rob Dobson, Director at S&P Global Market Intelligence, noted that UK manufacturing has started the H2 on an “encouragingly solid footing.” July saw increased production and new orders, with staffing levels rising for the first time since September 2022. Confidence reached its highest level in two-and-a-half years, with 60% of companies expecting output to rise over the next 12 months.

However, inflationary pressures are a “blot on the copybook”, with input costs rising at the highest rate in 18 months. The ongoing Red Sea crisis and related freight issues are driving up prices. Selling prices also increased at the fastest rate since mid-2023. BoE is likely to remain cautious about loosening monetary policy due to these inflationary pressures “pivoting away from services and towards manufacturing.”

Eurozone PMI manufacturing finalized at 45.8, recovering taking a hit

Eurozone’s PMI Manufacturing was finalized at 45.8 in July, unchanged from June, indicating ongoing contraction. PMI Manufacturing Output fell from 46.1 to 45.6, a 7-month low. Input costs increased at the fastest rate in a year and a half.

Among countries, Greece led with a PMI of 53.2, a 7-month low. Spain recorded 51.0, a 6-month low. Ireland reached a 5-month high at 50.1, but the Netherlands fell to 49.2, a 6-month low. Italy showed a 4-month high at 47.4, France hit a 6-month low at 44.0, Germany a 3-month low at 43.2, and Austria a 4-month low at 43.1.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, noted that the belief in the Eurozone’s recovery “is taking a hit.” He emphasized that the decline in production has “intensified” doubts, prompting a likely downgrade in GDP growth forecast from 0.8%. Industrial activity weakened broadly, with only Greece and Spain seeing meaningful growth, though momentum there also slowed. Austria and Germany displayed the greatest weakness.

Japan’s PMI manufacturing finalized at 49.1 in Jul, back in contraction

Japan’s PMI Manufacturing was finalized at 49.1 in July, down from June’s 50.0, indicating that the sector is back in contraction streak since early 2023.

Usamah Bhatti of S&P Global Market Intelligence described the sector’s performance as “downbeat” at the start of Q3. The decline was driven by a stronger reduction in new orders, leading to a renewed fall in production levels.

Inflationary pressures remained high, with input price inflation reaching a 15-month peak. Despite this, firms raised their selling prices more cautiously to stay competitive.

The near-term outlook appears “muted” due to the lack of new order inflows, allowing firms to clear outstanding business at the fastest rate since March. However, firms are optimistic that this period will pass within the coming year, expecting business expansion and new product launches to coincide with a broader economic recovery.

China’s Caixin PMI manufacturing drops to 49.8, below expectations

China’s Caixin PMI Manufacturing dropped from 51.8 to 49.8 in July, falling below the expected 51.6. S&P Global noted that output expanded at the slowest pace in nine months, average selling prices declined, and input cost inflation eased. However, business confidence showed improvement.

Wang Zhe, Senior Economist at Caixin Insight Group, commented, “Overall, the manufacturing sector largely stabilized in July. Supply expanded slightly, while domestic demand declined and external demand was steady. The reduction in business purchases was coupled with decreases in raw material stocks. The job market contraction was steady. Price levels faced pressure while market optimism improved slightly.”

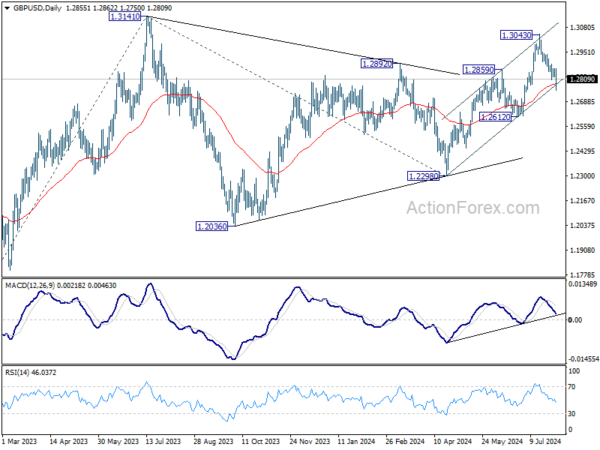

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2830; (P) 1.2847; (R1) 1.2873; More…

Intraday bias in GBP/USD remains on the downside for the moment. Fall from 1.3043 is in progress. Decisive break of 55 D EMA (now at 1.2782) will suggest that rise from 1.2298 has completed with three waves up to 1.3043. Deeper fall would be seen to 1.2612 support and below. On the upside, above 1.2887 minor resistance will turn intraday bias back to the upside for stronger rebound.

In the bigger picture, corrective pattern from 1.3141 medium term top (2023 high) could have completed with three waves to 1.2298 already. This will now remain the favored case as long as 1.2612 support holds. Firm break of 1.3141 will target 61.8% projection of 1.0351 (2022 low) to 1.3141 from 1.2298 at 1.4022. However, break of 1.2612 support argue that this corrective pattern is extending with another falling leg.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | JPY | Manufacturing PMI Jul F | 49.1 | 49.2 | 49.2 | |

| 01:30 | AUD | Trade Balance (AUD) Jun | 5.59B | 4.95B | 5.77B | 5.05B |

| 01:30 | AUD | Import Price Index Q/Q Q2 | 1.00% | -0.70% | -1.80% | |

| 01:45 | CNY | Caixin Manufacturing PMI Jul | 49.8 | 51.6 | 51.8 | |

| 07:45 | EUR | Italy Manufacturing PMI Jul | 47.4 | 46.2 | 45.7 | |

| 07:50 | EUR | France Manufacturing PMI Jul F | 44 | 44.1 | 44.1 | |

| 07:55 | EUR | Germany Manufacturing PMI Jul F | 43.2 | 42.6 | 42.6 | |

| 08:00 | EUR | Italy Unemployment Jun | 7.00% | 6.80% | 6.80% | 6.90% |

| 08:00 | EUR | ECB Economic Bulletin | ||||

| 08:00 | EUR | Eurozone Manufacturing PMI Jul F | 45.8 | 45.6 | 45.6 | |

| 08:30 | GBP | Manufacturing PMI Jul F | 52.1 | 51.8 | 51.8 | |

| 09:00 | EUR | Eurozone Unemployment Rate Jun | 6.50% | 6.40% | 6.40% | |

| 11:00 | GBP | BoE Interest Rate Decision | 5.00% | 5.00% | 5.25% | |

| 11:00 | GBP | MPC Official Bank Rate Votes | 0–5–4 | 0–6–3 | 0–2–7 | |

| 11:30 | USD | Challenger Job Cuts Y/Y Jul | 9.20% | 19.80% | ||

| 12:30 | USD | Initial Jobless Claims (Jul 26) | 249K | 239K | 235K | |

| 12:30 | USD | Nonfarm Productivity Q2 P | 2.30% | 1.50% | 0.20% | |

| 12:30 | USD | Unit Labor Costs Q2 P | 0.90% | 1.60% | 4.00% | |

| 13:30 | CAD | Manufacturing PMI Jul | 49.3 | |||

| 13:45 | USD | Manufacturing PMI Jul F | 49.5 | 49.5 | ||

| 14:00 | USD | ISM Manufacturing PMI Jul | 48.8 | 48.5 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Jul | 52.5 | 52.1 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Jul | 49.3 | |||

| 14:00 | USD | Construction Spending M/M Jun | 0.20% | -0.10% | ||

| 14:30 | USD | Natural Gas Storage | 22B |