- US nonfarm payrolls to be released on Friday, 12:30 GMT

- Analysts estimate softer employment conditions in July

- Gold might push for an uptrend resumption if jobs data disappoint

Will July’s NFP report be a game-changer?

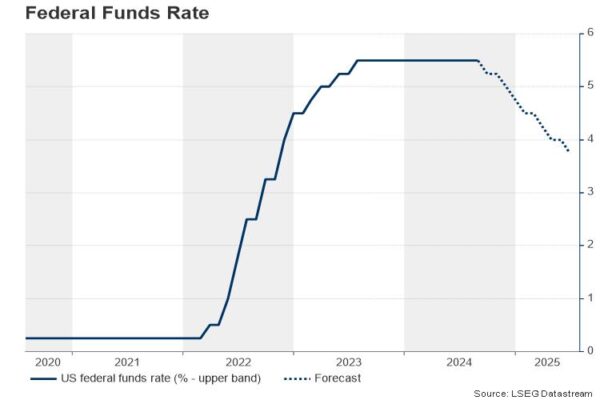

Friday’s nonfarm payrolls report will not be the last before September’s FOMC policy meeting, but it will be the first release of the third quarter and the first of the second half of the year. Therefore, the figures might be symbolic, especially after the Fed decided to put a September rate cut on the table but provided little insight about whether there will be more reductions after November’s presidential election.

Forecasts are discouraging, but will the data surprise again?

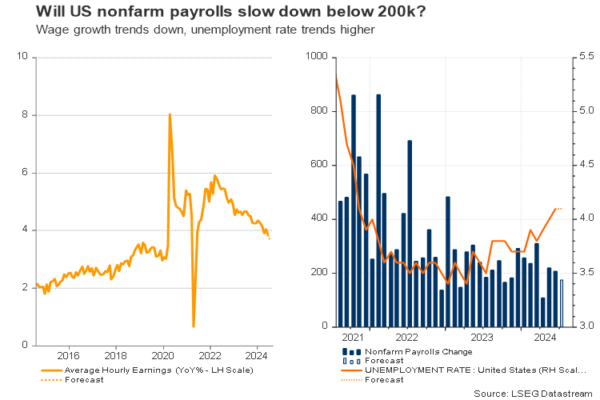

Despite their past error in judging employment growth, investors continue to expect fewer than 200k new jobs, with estimates of 175k for July. Additionally, they anticipate a drop in average hourly earnings to 3.7% year-on-year, the lowest in 12 months, from the previous 3.9%, along with an unchanged unemployment rate of 4.1%.

Excluding the 2020-2022 period of lockdowns, the creation of jobs in the US economy tended to slow down during the month of July since 2015, but it was stronger than analysts expected most of the time. Hence, another upside surprise might be technically possible.

From recent evidence, the flash S&P Global business PMI survey for July indicated a moderate increase in employment, though what was more striking is that input costs headed higher on the back of rising raw material prices, shipping and labor costs, increasing fears that businesses might transfer some of the increased costs to consumers or accept lower margins.

On the other hand, the latest private ADP employment report displayed a softer pay increase of 4.8% for those who stayed in the same job – the lowest since 2021 but still comfortably higher than the 3.7% estimate for Friday’s average hourly earnings.

In any case, the negative relation between wage growth and unemployment rate have been markedly noticeable since the start of the year, with unemployment benefits trending up partially on the back of increased migration and average hourly earnings losing steam.

September rate cut is a done deal, what’s next?

All in all, a quarter percentage point rate cut in September is a done deal and there is a small group of investors who foresee a more aggressive 50bps rate reduction. Perhaps the case for a bold double rate reduction might stay unfavorable unless there is a sharp deterioration in the employment data and inflation sinks towards the Fed’s 2.0% target.

In the meantime, a worse-than-expected NFP report, including a milder wage growth and/or another soft increase in the unemployment rate, could boost prospects for a second-rate cut in the coming months. Futures markets suggest a 60% probability for a 25bps rate cut in November and investors are certain that another one could follow in December.

Gold

As regards the market reaction, the greenback could lose more ground in the wake of disappointing employment numbers, boosting gold closer to its all-time high of $2,483 or even towards the $2,500 psychological mark. The $2,550 constraining zone could be the next destination.

In the opposite case where nonfarm payrolls come in above 200k once again and wage growth shows some strength, investors might scale back their expectations for a 50bps rate cut in September and perhaps become less confident for a second reduction in the coming months. Consequently, the US dollar might attract fresh buying interest, pressing gold towards the $2,385 – $2,410. A step lower and beneath the 50-day simple moving average (SMA) at 2,366 could raise concerns for a bearish trend reversal, triggering a faster decline towards the $2,320 zone.