Following a set of record results in Q1, Poland based Retail FX and CFDs broker XTB has reported its preliminary results for Q2 2024 indicating a major decrease in activity, leading to lower Revenues and Profit at the company.

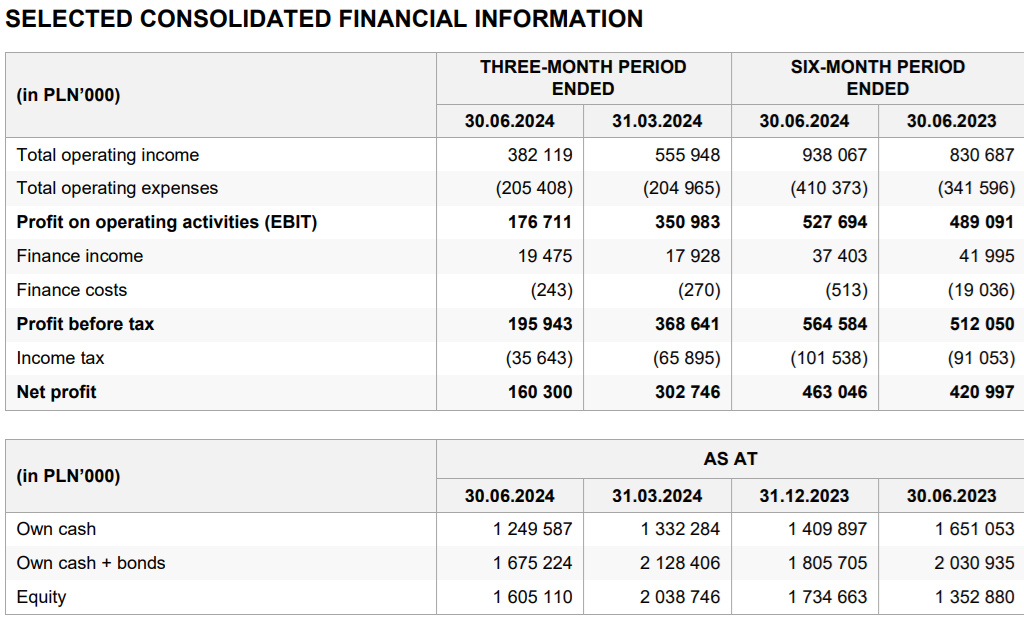

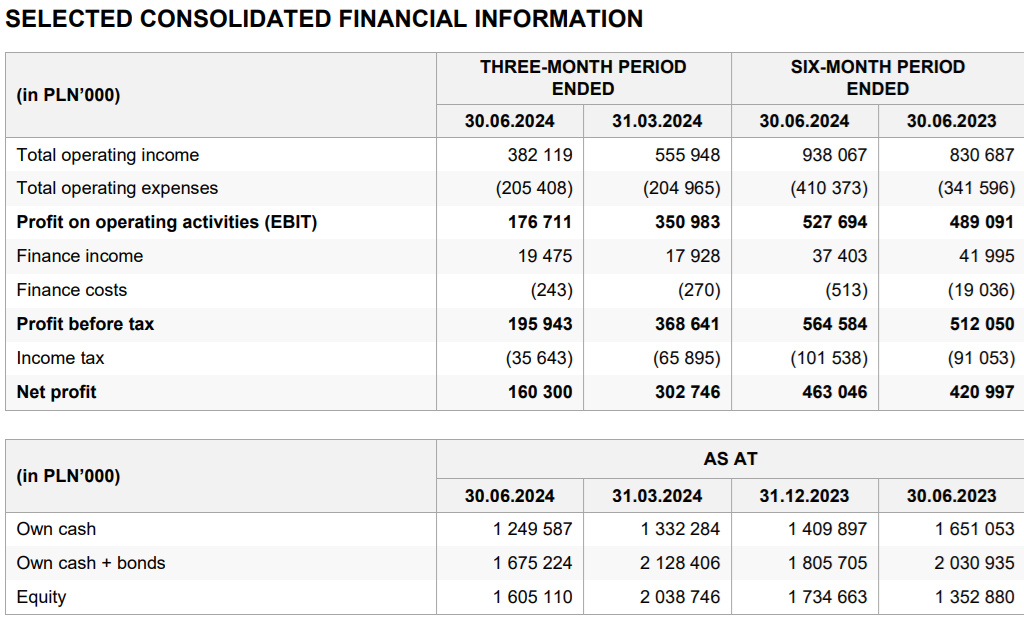

Revenues at XTB for the second quarter of 2024 came in at PLN 382 million (USD $96 million), down by 31% from Q1’s record $139 million. Net Profit fell by almost half (47%), to PLN 160 million ($40 million), versus $76 million in Q1.

The results were released after the company’s shares (WSE:XTB) closed for trading on Friday, so it will be very interesting to see how they trade come Monday. After trading near an all time high earlier this year, XTB shares dropped by about 12% last month after the company confirmed that it was cutting activity in the Spain CFDs market, which accounts for more than 10% of company Revenue.

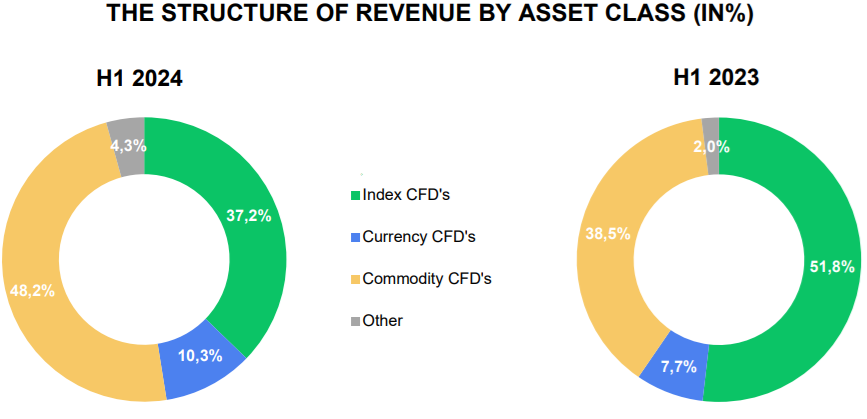

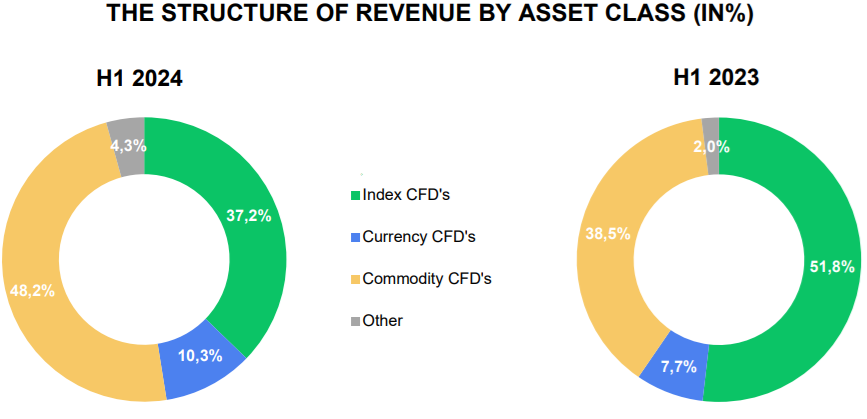

Trading volumes at XTB averaged $207 million monthly in Q2-2024 – that’s actually up from $194 billion monthly in Q1, however the company’s profitability per 1 million USD transaction volume in Q2 fell precipitously to 154, from 239 in Q1.

Regarding clients and client acquisition, XTB said it has a solid foundation in the form of constantly growing client base and the number of active clients. In the first half of 2024 the Group reported another record in this area, acquiring 232,316 new clients compared to 167,200 a year earlier, an increase of 38.9%. Similarly to the number of new clients, the number of active clients was also at a record high, increasing from 307,511 to 462,771, i.e. by 50.5% y/y. In Q2 however XTB brought in 102,569 new clients, down from 129,747 in Q1.

More highlights from XTB’s first Q2 and first half 2024 results follow below.