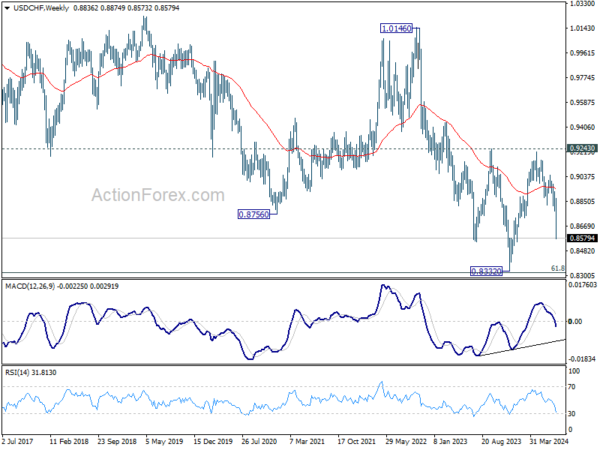

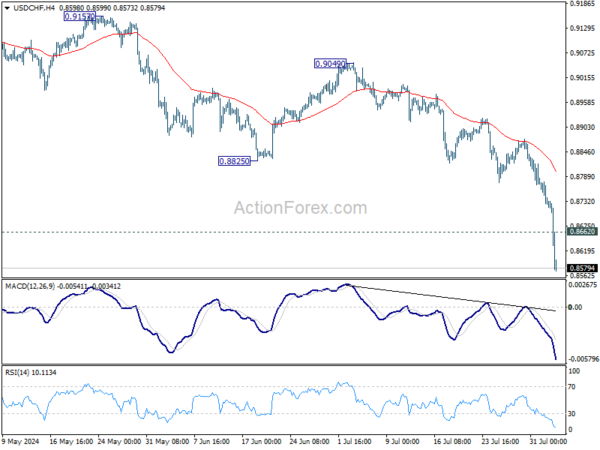

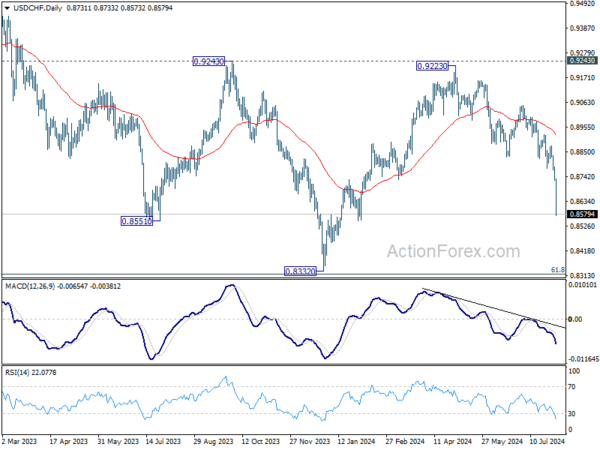

USD/CHF’s fall from 0.9223 accelerated lower last week and there is no sign of bottoming yet. Initial bias remains on the downside this week and deeper decline would be seen to retest 0.8332 low. On the upside, above 0.8662 minor resistance will turn intraday bias neutral and bring consolidations. But outlook will remain bearish as long as 0.8825 support turned resistance holds.

In the bigger picture, price actions from 0.8332 (2023 low) are currently seen as a medium term corrective pattern, with fall from 0.9223 as the second leg. Strong support could be seen from 0.8332 to bring rebound. Yet, overall outlook will continue to stay bearish as long as 0.9243 resistance holds. Firm break of 0.8332, however, will resume larger down trend from 1.0146 (2022 high).

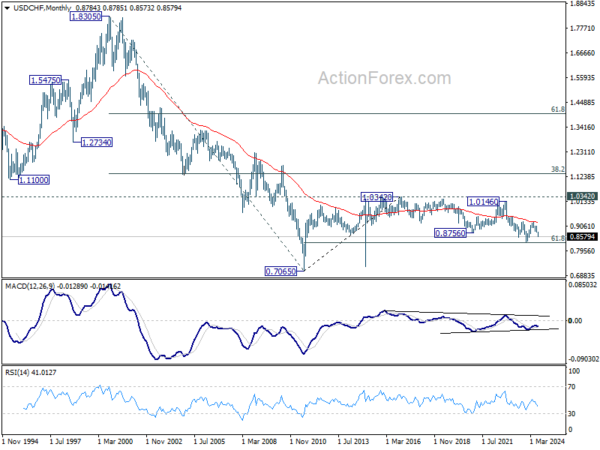

In the long term picture, price action from 0.7065 (2011 low ) are seen as a corrective pattern to the multi-decade down trend from 1.8305 (2000 high). Fall from 1.0342 (2016 high) is seen as the second leg. Rejection by 55 M EMA suggest that this fall is in progress. Break of 61.8% retracement of 0.7065 to 1.0342 at 0.8317 will pave the way back to 0.7065.