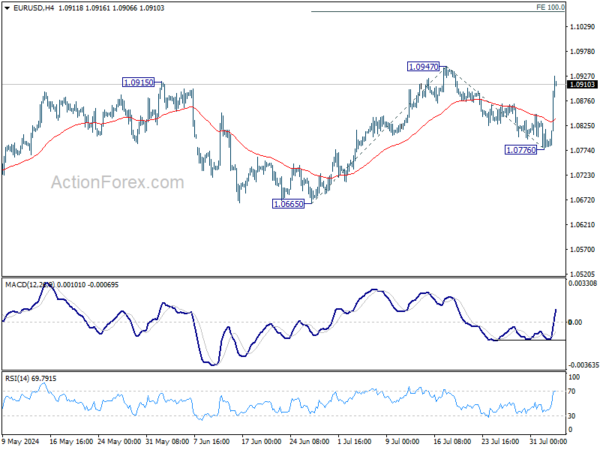

While the dip to 1.0776 was deeper than expected, EUR/USD’s subsequent strong rebound suggests that pullback from 1.0947 has completed already. Initial bias stays on the upside for retesting 1.0947 first. Firm break there will target 100% projection of 1.0665 to 1.0947 from 1.0776 at 1.1056. For now, risk will stay on the upside as long as 55 4H EMA (now at 1.0839) holds, in case of retreat.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern that’s still be in progress. Break of 1.1138 resistance will be the first signal that rise from 0.9534 (2022 low) is ready to resume through 1.1274 (2023 high). However, break of 1.0665 support will extend the correction with another falling leg back towards 1.0447 support.

In the long term picture, a long term bottom is in place at 0.9534 (2022 low). Sustained break of 55 M EMA (now at 1.1011) will raise the chance of long term reversal. But even in this case, firm break of 1.2348 structural resistance is needed to confirm. Rejection by 55 M EMA will maintain bearishness for extend the down trend from 1.6039 (2008 high) through 0.9534 at a later stage.