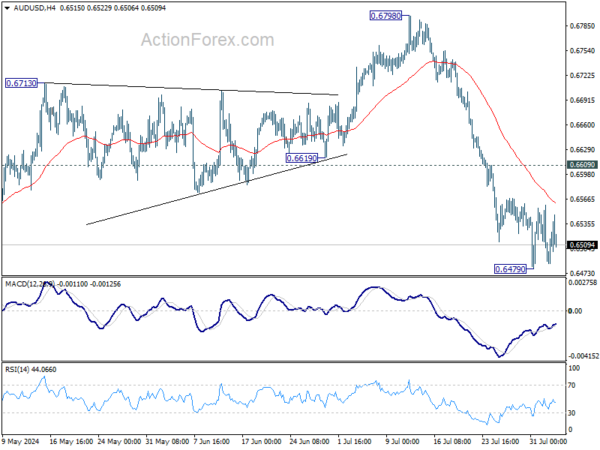

AUD/USD edged lower to 0.6479 last week but turned sideway since then. Initial bias stays neutral this week for some more consolidations. But further decline is expected as long as 0.6609 minor resistance holds. Break of 0.6479 will resume the fall from 0.6798 to 0.6361 support next.

In the bigger picture, overall, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern, with fall from 0.6798 as another falling leg. Deeper fall could be seen to the lower side of the range between 0.6169/6361. But strong support should be seen there to contain downside. For now, risk will stay on the downside as long as 55 D EMA (now at 0.6633) holds, in case of rebound.

In the long term picture, the down trend from 1.1079 (2011 high) should have completed at 0.5506 (2020 low) already. It’s unsure yet whether price actions from 0.5506 are developing into a corrective pattern, or trend reversal. But in either case, fall from 0.8006 is seen as the second leg of the pattern. Hence, in case of deeper decline, strong support should emerge above 0.5506 to bring reversal.