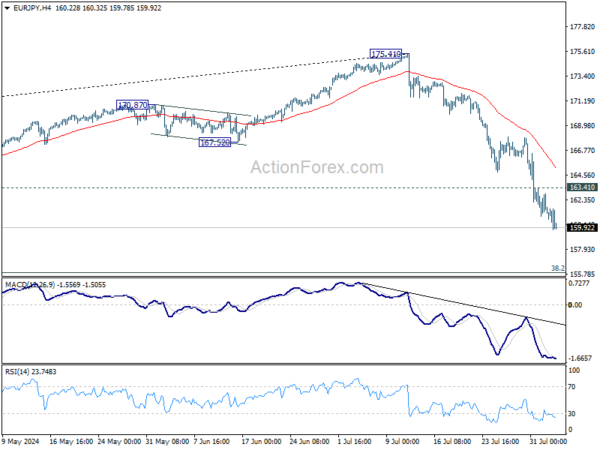

EUR/JPY’s fall from 175.41 continued last week accelerated further. This decline is now seen as a larger scale correction. Initial bias remains on the downside for 155.91 fibonacci level next. On the upside, above 163.41 minor resistance will turn intraday bias neutral and bring consolidations first, before staging another decline.

In the bigger picture, break of 164.29 resistance turned support indicates that fall from 175.41 medium term top is at least correcting the rise from 124.73, with risk of bearish trend reversal. Deeper decline would be seen to 38.2% retracement of 124.37 to 175.41 at 155.91. This will now remain the favored case as long as 55 D EMA (now at 168.81) holds, even in case of strong rebound.

In the long term picture, considering bearish divergence condition in W MACD, 175.41 is at least a medium term top. It’s still early to conclude that up trend from 94.11 (2012 low) has completed. But a medium term corrective phase is in progress with risk of deeper fall back to 55 M EMA (now at 145.46).