Three of the world’s largest central banks took different approaches to interest rates this week as a long-awaited, but potentially short-lived, divergence in monetary policies deepens.

The Bank of Japan kicked off the action on Wednesday by unexpectedly hiking before the Federal Reserve decided to stay on hold while signaling a potential cut in September. On Thursday, the Bank of England lowered borrowing costs for the first time since the start of the pandemic.

Data out Friday showed US hiring slowed markedly in July and the unemployment rate rose to an almost three-year high, raising recession concerns and putting the Fed solidly on a path to cutting interest rates in September. It also spurred a deep selloff in the stock market.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy, markets and geopolitics:

World

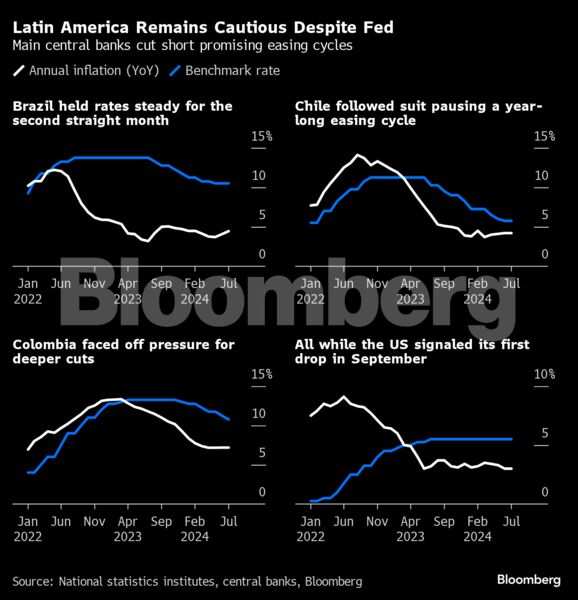

Coronavirus-era supply-chain shocks have now largely washed through global economies and inflation is at or approaching targets. Most leading central bankers, consequently, are shifting focus to preserving economic growth and employment while Japan again plays the outlier.Outside of the major central banks, Brazil, Chile and Georgia held rates steady. Colombia, Czech Republic, Pakistan and Armenia cut.

US

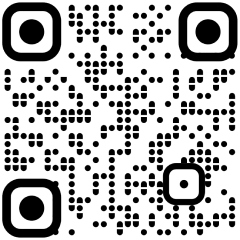

Nonfarm payrolls rose by 114,000 — one of the weakest prints since the pandemic — and job growth was revised lower in the prior two months. The unemployment rate unexpectedly climbed for a fourth month to 4.3%, triggering a closely watched recession indicator and hammering stocks. The weak report fueled fears the Fed has already waited too long to lower interest rates, but policymakers are unlikely to respond with a jumbo-sized cut in September that might signal alarm.

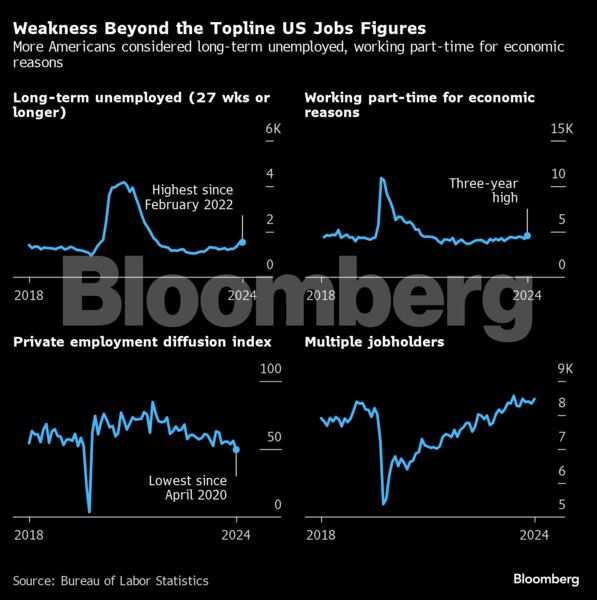

Kamala Harris has wiped out Donald Trump’s lead across seven battleground states, as the vice president rides a wave of enthusiasm among young, Black and Hispanic voters, according to the latest Bloomberg News/Morning Consult poll. When it comes to who voters trust more on the economy and handling inflation, Harris has narrowed the gap.

Undocumented immigrants pay more than a quarter, about 26%, of their income in taxes, in line with the median taxpayer, according to a report released Tuesday by the Institute on Taxation and Economic Policy, a left-leaning think tank. While their incomes are usually lower, they’re less likely to claim refunds or earn tax-preferred income.

Europe

The euro-area economy grew more in the second quarter than expected as resilient expansion in key countries allowed the region to shrug off Germany’s surprise contraction. Gross domestic product rose 0.3% for a second straight quarter as growth in both France and Spain beat estimates and Italy kept expanding.

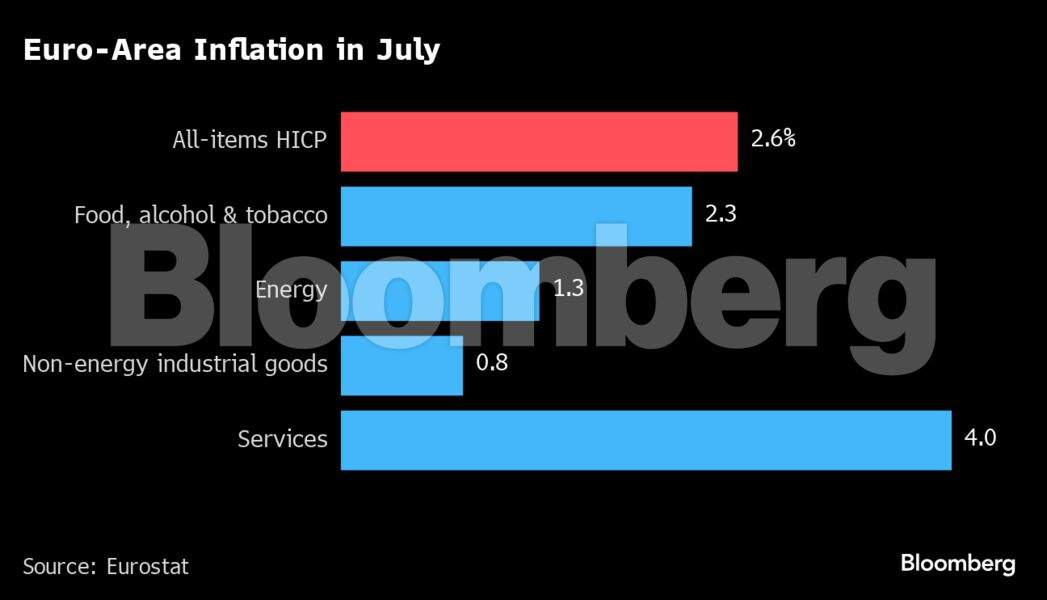

Euro-area inflation unexpectedly quickened, an outcome that may make the European Central Bank warier about cutting interest rates further. The report is one of two crucial monthly inflation readings that will inform ECB officials before their Sept. 11-12 meeting, when investors expect them to follow up their initial rate cut in June with a second move.

Asia

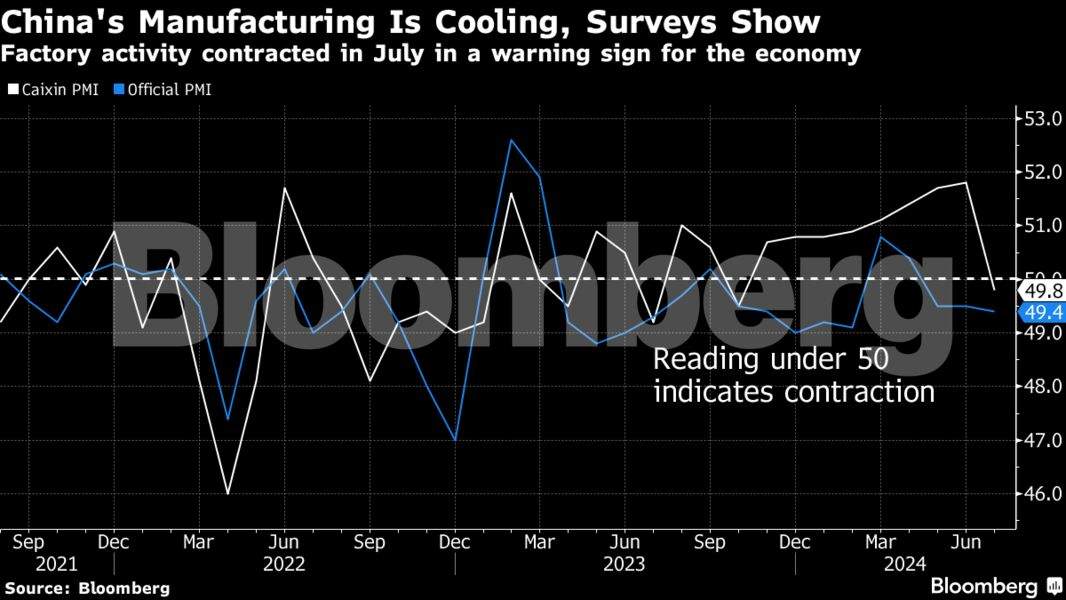

China’s manufacturing activity unexpectedly shrank for the first time in nine months in July, a private survey showed, a sign the country’s export machine might be cooling, darkening the economy’s outlook. The private measure likely reflects weakening momentum in overseas shipments as it focuses on small and export-oriented firms.

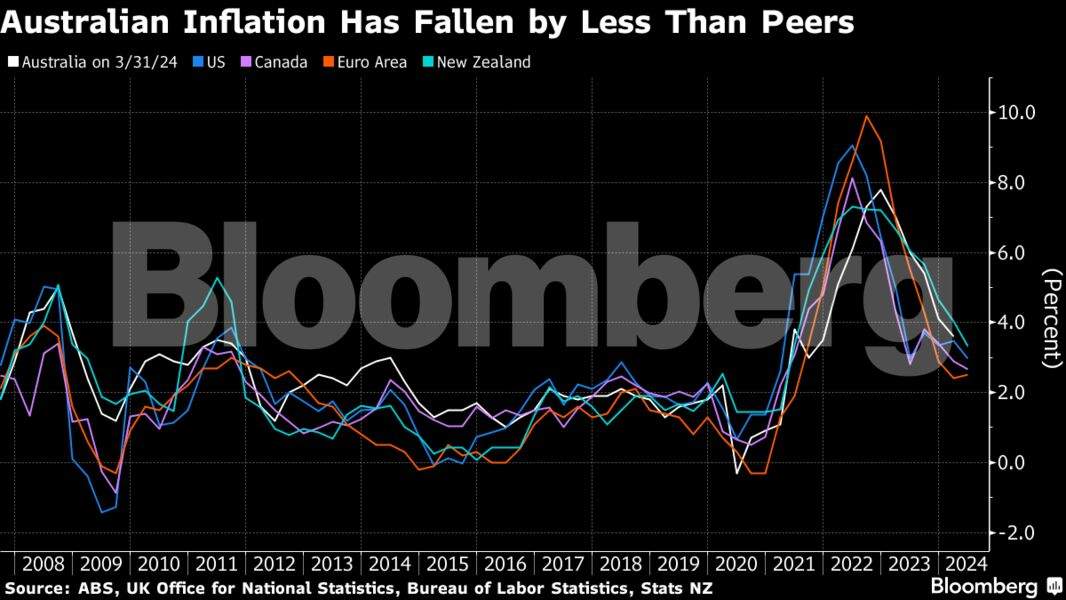

Australia’s core inflation unexpectedly decelerated last quarter, supporting the Reserve Bank’s view that prices will gradually ease and prompting money markets to boost bets on an interest-rate cut. The currency and bond yields dropped.

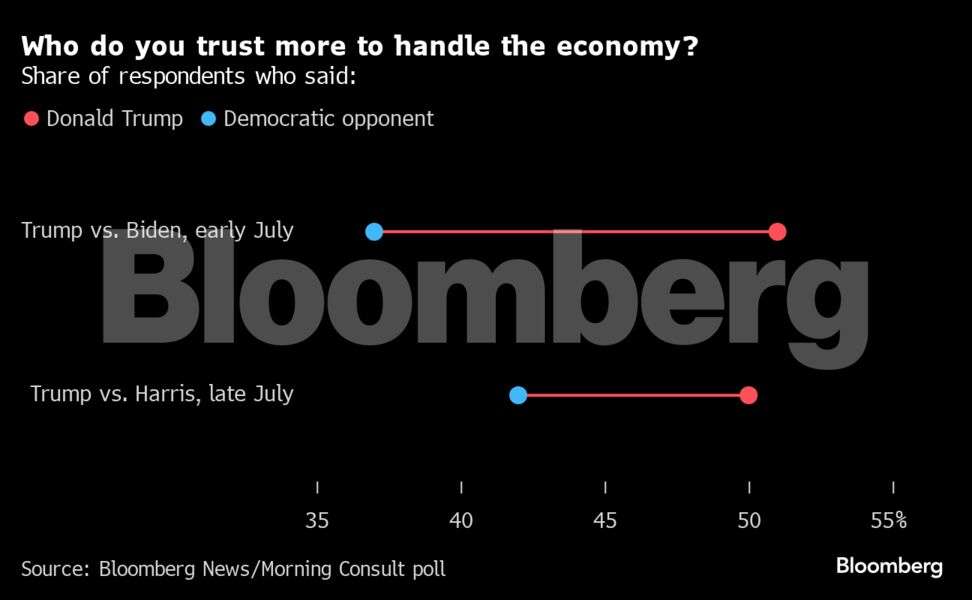

South Korea’s export growth slowed in July, suggesting global demand may be cooling a touch after a boom in the artificial intelligence and technology sectors drove gains earlier this year.

Emerging Markets

Three Latin American central banks signaled unease over inflation to justify their cautious stance on interest rates Wednesday, contrasting with the Fed’s growing confidence that the start of its easing cycle is near.

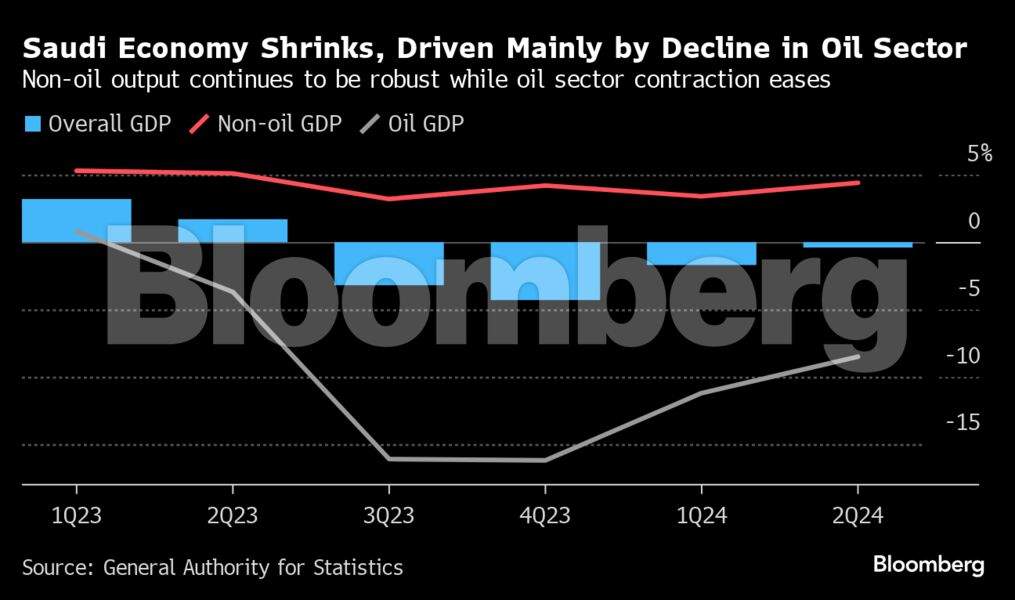

Saudi Arabia’s economy contracted at a slower pace before a likely turnaround starting this quarter ends a stretch of declines that began a year ago, as the effect of OPEC+ oil production cuts begins to wane. Gross domestic product shrank an annual 0.4% in the April-June period, an improvement from a drop of 1.7% in the previous three months.