Global stock markets are in crash mode today, beginning with the massive historic -12.4% decline in Nikkei. Major European indexes are also trading deeply in the red, with losses around -3%, though these are overshadowed by the severe drop in Japan. Concurrently, DOW futures are down over -1100 points, with S&P 500 futures down -4.4% and NASDAQ futures down -5.7%. US 10-year yield has continued its steep fall, diving below the 3.7% handle. Given the current panic mode in the markets, even a strong upside surprise in US ISM services data is unlikely to provide support.

In the currency markets, Yen and Swiss Franc are the clear runaway leaders, with Euro trailing in a distant third. Australian Dollar is the worst performer, looking ahead to RBA rate decision in the upcoming Asian session. Sterling is the second worst, followed by Kiwi. Dollar and Canadian Dollar are positioned in the middle.

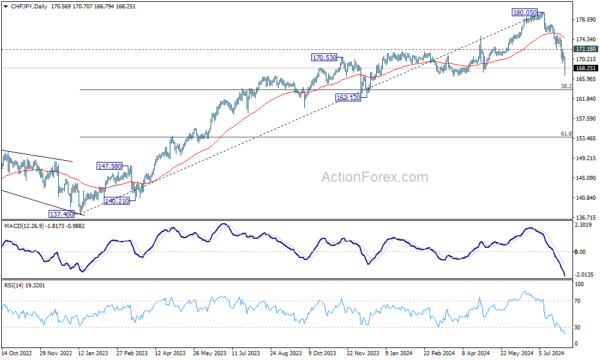

Technically, Yen is clearly overpowering Swiss Franc even though both are strong. CHF/JPY’s current fall from 180.05 is seen as correcting rise from 137.40 first. Deeper fall is expected as long as 172.18 resistance holds, to 38.2% retracement of 137.40 to 180.05 at 163.75. Strong support should be seen there to bring rebound, at least on first attempt. However, powerful break of 163.75 will argue that like other Yen crosses, CHF/JPY is also already in a larger scale correction.

In Europe, at the time of writing, FTSE is down -3.09%. DAX is down -3.51%. CAC is down -2.78%. UK 10 year yield is down -0.086 at 3.756. Germany 10-year yield is down -0.081 at 2.100. Earlier in Asia, Nikkei fell -12.4%. Hong Kong HSI fell -1.46%. China Shanghai SSE fell -1.54%. Singapore Strait Times fell -4.07%. Japan 10-year JGB yield fell -0.205 to 0.754.

Eurozone Sentix falls to -13.8, ECB under pressure to cut further and faster

Eurozone Sentix Investor Confidence fell sharply from -7.3 to -13.8 in August, marking its lowest level since January. Current Situation Index dropped from -15.8 to -19.0, the lowest since February, while Expectations Index declined from 1.5 to -8.8, the lowest since last December.

Globally, Sentix Investor Confidence Index also tumbled, falling from 5.9 to -1.5, its lowest level since December. Current Situation Index decreased from 6.0 to -0.6, the lowest since January, and Expectations Index dropped from 5.7 to -2.4, the lowest since November.

Sentix commented on the data, stating that “Following the severe setback of the ‘first mover’ in the previous month, there is now another, more pronounced economic slump in August. The global recovery comes to a halt.”

They added that the economic downturn in Eurozone should put ECB under pressure to “cut interest rates further and faster”. Investors are now expecting ECB to address the economic weakness more aggressively, even though the Sentix Inflation Barometer is not indicating any sustained easing in the inflation environment.

Eurozone PPI at 0.5% mom, -3.2% yoy in Jun

Eurozone PPI rose 0.5% mom in June, but down -3.2% yoy, comparing to expectation of 0.3% mom, -3.2% yoy. For the month. Industrial producer prices increased by 0.1% for intermediate goods,1.6% for energy, 0.1% for capital goods, and 0.1% for non-durable consumer goods. Prices remained stable for durable consumer goods

EU PPI was up 0.5% mom, down -3.1% yoy. The highest monthly increases in industrial producer prices were recorded in Estonia (+2.2%), Spain and Romania (both +1.9%) and Greece (+1.8%). The largest decreases were observed in Bulgaria (-1.0%), Czechia, France and Finland (each -0.3%).

Eurozone PMI composite finalized at 50.2, growing at snail’s pace

Eurozone PMI Services was finalized at 51.9 in July, down from June’s 52.8, a 4-month low. PMI Composite was finalized at 50.2, down from June’s 50.9, a 5-month low. These figures indicate a slowing economy as the services sector loses momentum and the industrial sector continues its decline.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, stated, “The eurozone’s economy is growing at a snail’s pace.” He noted that while the services sector isn’t picking up speed as it did earlier in the year, the industrial slump persists. The HCOB Composite Output PMI barely stays above the expansion line, signaling a weak start to H2 despite surprisingly strong economic growth in the second quarter. De la Rubia added, “Given this situation, our 0.7% growth forecast for the year is still conservative.”

Inflation remains a significant concern. Although sales prices are increasing at their slowest rate in 38 months and input costs are generally following suit, inflation is still high relative to the weak economy. Historically, when PMI activity index was at 52.0 or lower, selling prices typically stayed flat, and input prices rose much more slowly than they are now. De la Rubia attributes this to wage pressure caused by demographic shifts, which complicates ECB’s efforts to achieve its 2% inflation target.

UK PMI services finalized at 52.5, composite at 52.8

UK PMI Services was finalized at 52.5 in July, up from June’s 52.1. PMI Composite was finalized at 52.8, up from June’s 52.3.

Joe Hayes, Principal Economist at S&P Global Market Intelligence, noted that the UK service sector saw a “modest rebound” following a subdued end to Q2. Business Activity Index saw a slight uptick, but New Business Index jumped by over three points to its highest level in 14 months, reflecting an influx of new clients and contracts. Hayes pointed out that the accelerated expansion in sales activity indicates improved business and consumer confidence, suggesting a positive outlook for GDP growth in Q3.

Hayes highlighted ongoing issues with “sluggish progress on inflation.” While price pressures on input costs and output prices are at their lowest since early 2021, the respective PMIs remain above pre-pandemic levels. These benchmarks are critical for BoE to hit before it can declare success in combating inflation.

Japan’s PMI services finalized at 53.7, concerns on sustained inflationary pressure

Japan’s PMI Services was finalized at 53.7 in July, up from June’s 49.4. PMI Composite was finalized at 52.5, up from June’s 49.7.

Usamah Bhatti, Economist at S&P Global Market Intelligence, highlighted a “renewed upswing” in the services sector at the start of Q3, driven by “improved demand conditions and stronger customer numbers.” This growth was largely domestic, as new export business declined for the first time this year. The outlook for the service sector remains positive, with outstanding business levels increasing and strong confidence in the 12-month outlook.

While the combined output of the manufacturing and services sectors expanded at a “moderate pace,” the growth was primarily driven by the service sector, with manufacturing experiencing a slight contraction. Private sector companies reported that input price inflation remained “stubbornly high,” affecting total output. There are concerns that “sustained inflationary pressure” could pose a downside risk to the economy in the coming months.

China’s Caixin PMI services rises to 52.1, composite falls to 51.2

China’s Caixin PMI Services increased from 51.2 to 52.1 in July, surpassing the expected 51.4 and remaining in expansionary territory for the 19th consecutive month. Meanwhile, PMI Composite fell from 52.8 to 51.2, but still marking the ninth consecutive month of expansion.

Wang Zhe, Senior Economist at Caixin Insight Group, noted that while the services sector saw improvement, manufacturing faced greater pressure. “The former outperformed the latter in terms of supply, demand and employment,” Wang said. Despite this, composite prices remained weak, especially on the sales front, which further squeezed company profit margins. Market optimism improved, although it remained at a low level.

The latest data revealed that China’s real GDP growth in Q2 slowed to 4.7% yoy, significantly lower than market expectations. This slowdown suggests that it will be challenging for the country to meet its annual growth target of around 5%. Wang said the primary issues remain insufficient effective domestic demand and weak market optimism.

EUR/USD Mid-Day Outlook

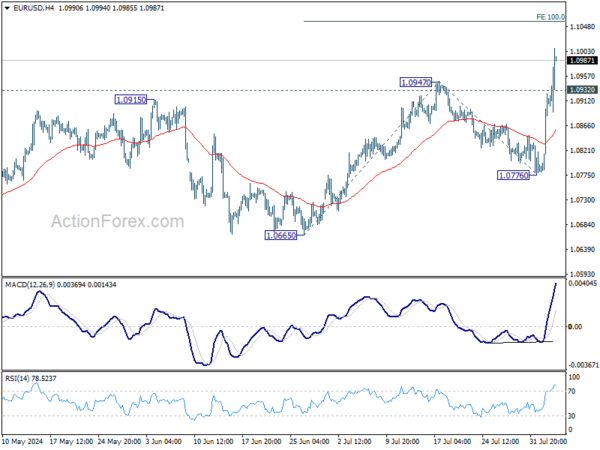

Daily Pivots: (S1) 1.0820; (P) 1.0873; (R1) 1.0965; More…..

EUR/USD’s strong break of 1.0947 resistance confirms resumption of the rise from 1.0665. Intraday bias remains on the upside for 100% projection of 1.0665 to 1.0947 from 1.0776 at 1.1056 next. On the downside, below 1.0932 minor support will turn intraday bias neutral and bring consolidations, before staging another rally.

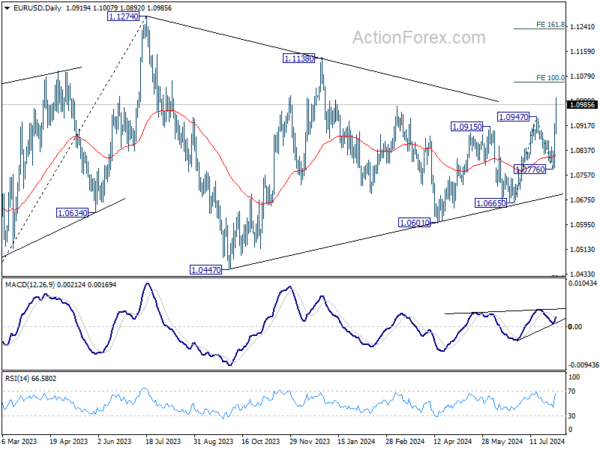

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern that’s still be in progress. Break of 1.1138 resistance will be the first signal that rise from 0.9534 (2022 low) is ready to resume through 1.1274 (2023 high). However, break of 1.0776 support will extend the correction with another falling leg back towards 1.0447 support.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Meeting Minutes | ||||

| 01:00 | AUD | TD Securities Inflation M/M Jul | 0.40% | 0.30% | ||

| 01:45 | CNY | Caixin Services PMI Jul | 52.1 | 51.4 | 51.2 | |

| 07:45 | EUR | Italy Services PMI Jul | 51.7 | 53 | 53.7 | |

| 07:50 | EUR | France Services PMI Jul F | 50.1 | 50.7 | 50.7 | |

| 07:55 | EUR | Germany Services PMI Jul F | 52.5 | 52 | 52 | |

| 08:00 | EUR | Eurozone Services PMI Jul F | 51.9 | 51.9 | 51.9 | |

| 08:30 | EUR | Eurozone Sentix Investor Confidence Aug | -13.9 | -5.5 | -7.3 | |

| 08:30 | GBP | Services PMI Jul F | 52.5 | 52.4 | 52.4 | |

| 09:00 | EUR | Eurozone PPI M/M Jun | 0.50% | 0.30% | -0.20% | |

| 09:00 | EUR | Eurozone PPI Y/Y Jun | -3.20% | -3.30% | -4.20% | -4.10% |

| 13:45 | USD | Services PMI Jul F | 56 | 56 | ||

| 14:00 | USD | ISM Services PMI Jul | 51.4 | 48.8 |