New Zealand Dollar surged strongly today following much better than expected Q2 employment data.. Speculations of an early rate cut by RBNZ next week now seem exaggerated. Major banks still expect RBNZ to start easing monetary policy this year, with consensus pointing to the November meeting. However, there’s still a possibility that RBNZ could signal a shift towards an easing bias in its upcoming meeting.

In contrast, Yen plummeted broadly after comments from BoJ Deputy Governor Shinichi Uchida. Uchida highlighted significant concerns over recent extreme volatility in global financial markets and acknowledged the strong rebound in Yen’s exchange rate. These factors are affecting economic and price developments, leading Uchida to rule out another rate hike in the near term.

For today, Kiwi is the strongest performer, followed by Aussie and Sterling. Yen is the weakest, trailed by Swiss Franc and Euro. Dollar and Loonie are in the middle.

As for the week so far, Kiwi also leads as the strongest currency, followed by Loonie and Aussie. Sterling is the weakest, followed by Yen and Swiss Franc. Dollar and Euro position in the middle of the pack.

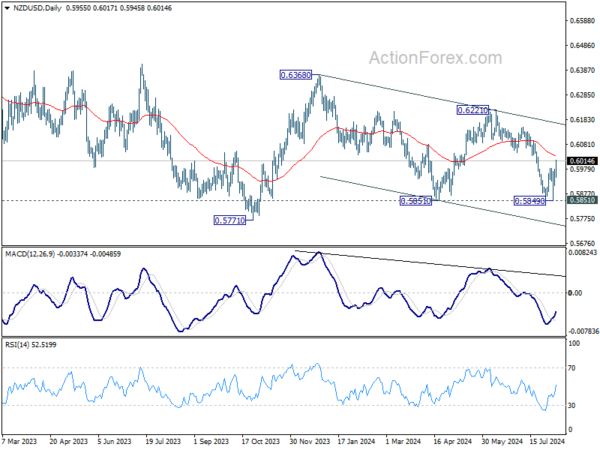

Technically, NZD/USD’s extended rebound today confirms short term bottoming at 0.5849, after hitting 0.5851 support. Stronger rise could be seen to 55 D EMA (now at 0.6032) and possibly above. However, firm break of channel resistance (now at 0.6174) is needed to confirm completion of the decline from 0.6368. Otherwise, risk will stay on the downside for another fall through 0.5849/51 to 0.5771 at a later stage.

In Asia, at the time of writing, Nikkei is up 2.74%. Hong Kong HSI is up 1.31%. China Shanghai SSE is up 0.31%. Singapore Strait Times is up 1.26%. Japan 10-year JGB yield is down -0.0229 at 0.864. Overnight, DOW rose 0.76%. S&P 500 rose 1.04%. NASDAQ rose 1.03%. 10-year yield rose 0.103 to 3.888.

BoJ’s Uchida: To keep interest rate for the time being due to extreme global market volatility

In a speech today, BoJ Deputy Governor Shinichi Uchida emphasized the necessity of maintaining monetary easing with the current policy interest rate “for the time being”, citing “extremely volatile” recent developments in both Japanese and global financial and capital markets. Uchida assured that BoJ is monitoring these developments with “utmost vigilance” and will adjust monetary policy as appropriate.

Uchida reiterated that if the outlook for economic activity and prices is realized, BoJ would “continue to raise the policy interest rate.” Howeer, he noted that “significant movements in stock prices and foreign exchange rates since last week” are particularly relevant in shaping this outlook.

Furthermore, Uchida pointed out that the recent correction in Yen’s depreciation has reduced the “upside risk to prices arising from higher import prices.” This adjustment in Yen’s value “affects the conduct of monetary policy.”

New Zealand employment grows 0.4% in Q2, above expectations

New Zealand’s employment data for Q2 showed unexpected strength, with employment growing by 0.4%, defying expectations of a -0.3% contraction. However, the unemployment rate increased from 4.4% to 4.6%, which was still better than the anticipated 4.7%. The labor force participation rate also saw a modest rise of 0.2% to 71.7%, while the employment rate remained steady at 68.4%.

All sector wage inflation was recorded at 1.2% qoq and 4.3% yoy. Private sector wage inflation stood at 0.9% qoq and 3.6% yoy. The public sector saw higher wage inflation at 1.8% qoq and 6.9% yoy, with the annual rate hitting a series high.

China’s exports grow 7.0% yoy in Jul, imports rises 7.2% yoy

China’s export growth for July came in at 7.0% yoy, falling short of the expected 9.7% yoy increase. Exports to the US and EU each grew by about 8% yoy, while exports to ASEAN countries surged by 12% yoy.

Imports, on the other hand, rose by 7.2% yoy, exceeding the expected 3.5% growth. Notably, imports from the US surged by 24% yoy, imports from ASEAN countries increased by 11% yoy, and imports from the EU climbed by 7% yoy.

As a result, China’s trade surplus narrowed from USD 99.1B to USD 84.6B, which was smaller than the expected USD 99.2B.

Looking ahead

Germany industiral production and trade balnace, France trade balance and Swiss foreign currency reserves will be released in European session. Later in the day, Canada will release Ivey PMI and BoC summery of deliberations.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 156.66; (P) 158.45; (R1) 159.60; More…

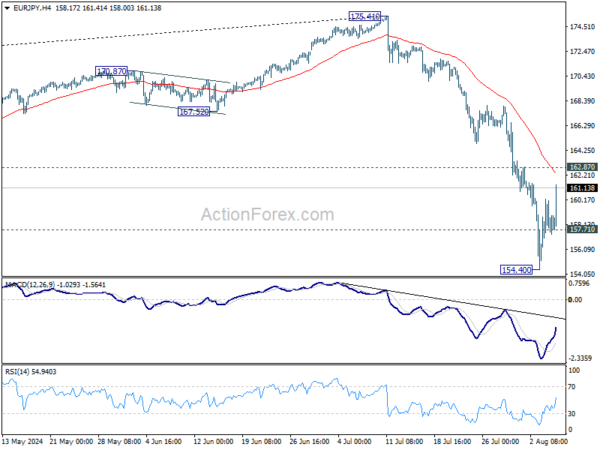

EUR/JPY’s recovery from 154.40 extends higher today but stays below 162.87 resistance. Intraday bias remains neutral at this point, and further fall is expected. On the downside, below 157.71 minor support will turn bias back to the downside. Break of 154.40 will resume the fall from 175.41 to 153.15 support next. However, decisive break of 162.87 will confirm short term bottoming, and turn bias back to the upside for stronger rebound.

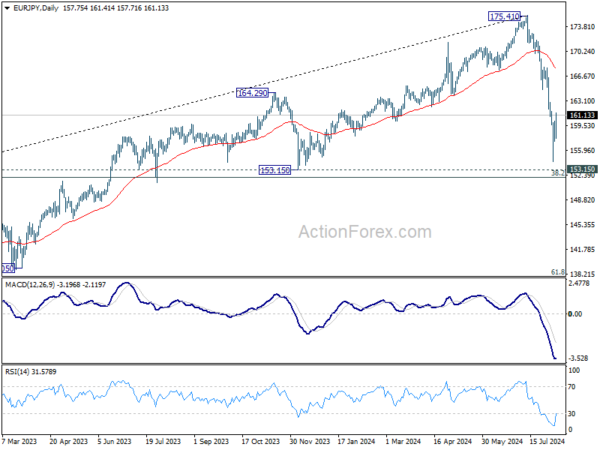

In the bigger picture, fall from 175.41 medium term top should be correcting the whole rise from 114.42 (2020 low). Deeper fall could be seen as long as 55 W EMA (now at 161.79) holds. But strong support should emerge between 153.15 and 38.2% retracement of 114.42 to 175.41 at 152.11 to bring rebound (at least on first attempt). Meanwhile, sustained trading above 55 W EMA will argue that the range of the medium term corrective pattern has already been set.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Employment Change Q2 | 0.40% | -0.30% | -0.20% | -0.30% |

| 22:45 | NZD | Unemployment Rate Q2 | 4.60% | 4.70% | 4.30% | 4.40% |

| 22:45 | NZD | Labour Cost Index Q/Q Q2 | 0.90% | 0.80% | 0.80% | |

| 03:00 | CNY | Trade Balance (USD) Jul | 84.7B | 99.2B | 99.1B | |

| 05:00 | JPY | Leading Economic Index Jun P | 109.3 | 111.2 | ||

| 06:00 | EUR | Germany Industrial Production M/M Jun | 1.00% | -2.50% | ||

| 06:00 | EUR | Germany Trade Balance Jun | 21.5B | 24.9B | ||

| 06:45 | EUR | France Trade Balance (EUR) Jun | -7.5B | -8.0B | ||

| 07:00 | CHF | Foreign Currency Reserves (CHF) Jul | 711B | |||

| 14:00 | CAD | Ivey PMI Jul | 62 | 62.5 | ||

| 14:30 | USD | Crude Oil Inventories | -1.6M | -3.4M | ||

| 17:30 | CAD | BoC Summary of Deliberations |