Forex trading continues to be subdued today, with Dollar gaining slightly in the early US session after better-than-expected jobless claims data. This data is particularly crucial as market participants are closely monitoring employment figures following the triggering of the Sahm Rule, which signals potential rapid employment deterioration leading to a recession. However, so far, there are no signs of such a downturn in materializing.

In the broader currency market, the dynamics remain largely unchanged. Canadian Dollar is leading among commodity currencies, maintaining its position as the strongest performer this week. Conversely, British Pound is the worst performer, followed by Swiss Franc and Japanese Yen. Dollar and Euro are holding their positions in the middle of the pack. Notably, the strength of the commodity currency rebound is relatively weak, as is the pullback in Yen and Franc, indicating that the market is in a consolidation phase, likely awaiting a resurgence of risk-off sentiment.

Technically, while NZD/USD rebounded strongly this week, it struggled to break through falling 55 D EMA (now at 0.6030). Break of 0.5911 minor support would indicate rejection by the EMA and bring retest of 0.5849/51 support zone. Firm break there will resume the whole fall from 0.6368 to 0.5771 low. Nevertheless, firm break of the EMA would bring stronger rebound towards channel resistance (now at 0.6170).

In Europe, at the time of writing, FTSE is down -1.21%. DAX is down -0.67%. CAC is own -1.12%. UK 10-year yield is up 0.0230 at 3.977. Germany 10-year yield is down -0.006 at 2.265. Earlier in Asia, Nikkei fell -0.74%. Hong Kong HSI rose 0.08%. China Shanghai SSE rose 0.00%. Singapore Strait Times rose 0.37%. Japan 10-year JGB yield fell -0.0477 to 0.833.

US initial jobless claims fall to 233k, below exp 245k

US initial jobless claims fell -17k to 233k in the week ending August 3, lower than expectation of 245k. Four-week moving average of initial claims rose 2.5k to 241k.

Continuing claims rose 6k to 1875k in the week ending July 27, highest since November 21, 2021. Four-week moving average of continuing claims rose 7k to 1869k, highest since November 27, 2021 too.

One BoJ member suggests gradual rate hike to above 1% neutral rate

BoJ’s Summary of Opinions from the July 30-31 meeting reveals that board members discussed further rate hikes after implementing the second interest rate increase this year at the meeting.

One member’s opinion stood out, suggesting that, assuming the price stability target is achieved in the second half of fiscal 2025, BoJ should raise the policy interest rate to the level of the “neutral interest rate.” This neutral rate is estimated to be “at least around 1 percent.” To avoid rapid hikes, BoJ should increase the policy interest rate in a “timely and gradual manner.”

The consensus among members is that economic activity and prices have been developing generally “in line with the Bank’s outlook.” Consequently, it is deemed appropriate for to raise the policy interest rate and adjust the degree of monetary accommodation.

One opinion highlighted that raising interest rates at a “moderate pace” aligns the adjustment in monetary accommodation with underlying inflation. Such moves “will not have monetary tightening effects.”

RBA’s Bullock: Rate hikes still possible as inflation timeline extends

RBA Governor Michele Bullock revealed in a speech today that the board “explicitly considered” another rate hike during Tuesday’s meeting. Although they decided to hold rates steady, Bullock stressed that RBA “will not hesitate” to hike if necessary.

Bullock highlighted two main points from the meeting. First, despite weak economic growth, the gap between aggregate demand and supply is “larger than previously thought,” leading to “persistent inflation.” Second, demand growth is expected to “pick up over the next year,” though there is significant uncertainty about this outlook.

Due to these factors, the Board’s inflation target timeline has been “pushed out”. “We don’t expect to be back in the 2–3 percent target range until the end of 2025 – over a year away,” Bullock stated. This delay prompted the board to consider another rate hike to ensure inflation continues to decline.

Ultimately, RBA decided to keep interest rates unchanged, believing this would balance their inflation and employment objectives. However, Bullock emphasized that the Board remains vigilant regarding upside inflation risks and “will not hesitate to raise rates if it needs to.”

RBNZ inflation expectations drop across all horizons

RBNZ latest Survey of Expectations showed a notable decline in inflation expectations across all time horizons. One-year-ahead annual inflation expectations fell by 33 basis points, dropping from 2.73% to 2.40%. This marks the sixth consecutive quarterly decline since June 2023.

The two-year-ahead inflation expectations, a closely monitored indicator, also saw a decrease from 2.33% to 2.03%. These expectations are now below the average level observed since 2002, indicating a substantial shift in business outlook regarding future inflation.

Long-term expectations followed a similar trend. Five-year-ahead inflation expectations decreased to 2.07%, while ten-year-ahead expectations dropped to 2.03%.

Survey respondents also provided their outlook on the OCR. On average, they expect OCR to be 5.40% by the end of the September 2024 quarter, with a projected decrease to 4.24% by the end of June 2025. The current OCR stands at 5.50%.

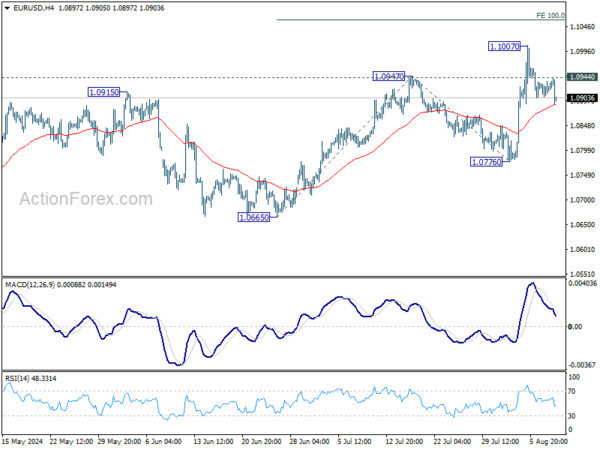

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0907; (P) 1.0922; (R1) 1.0938; More…..

EUR/USD dips mildly in early US session as consolidation from 1.1007 extends. Intraday bias remains neutral first. While deeper retreat cannot be ruled out, downside should be contained well above 1.0776 support. On the upside, above 1.0944 minor resistance will bring retest of 1.1007 first. Further break there will resume recent rally from 1.0665 to 100% projection of 1.0665 to 1.0947 from 1.0776 at 1.1056 next.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern that’s still be in progress. Break of 1.1138 resistance will be the first signal that rise from 0.9534 (2022 low) is ready to resume through 1.1274 (2023 high). However, break of 1.0776 support will extend the correction with another falling leg back towards 1.0447 support.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 23:50 | JPY | Bank Lending Y/Y Jul | 3.20% | 3.20% | 3.20% | |

| 23:50 | JPY | Current Account (JPY) Jun | 1.78T | 2.29T | 2.41T | |

| 03:00 | NZD | RBNZ Inflation Expectations Q/Q Q3 | 2.03% | 2.33% | ||

| 05:00 | JPY | Eco Watchers Survey: Current Jul | 47.5 | 47.8 | 47 | |

| 12:30 | USD | Initial Jobless Claims (Aug 2) | 233K | 245K | 249K | 250K |

| 14:00 | USD | Wholesale Inventories Jun F | 0.20% | 0.20% | ||

| 14:30 | USD | Natural Gas Storage | 22B | 18B |