By RoboForex Analytical Department

The EUR/USD pair has found some stability at around 1.0921 this Friday, following a week marked by high volatility. Market participants have been adjusting their positions in response to speculations concerning the US economy’s potential rapid recession and subsequent expectations about the Federal Reserve’s response.

The broader market sentiment has increasingly leaned towards anticipating a significant rate cut by the Fed in September, possibly by 50 basis points. However, the validity of these expectations remains to be seen as the situation evolves.

Austan Goolsbee, President of the Federal Reserve Bank of Chicago, recently emphasised that the Federal Reserve’s mandate is not to respond to stock market fluctuations but to focus on its dual objectives of maximising employment and achieving price stability. He also reiterated that the Fed has set specific economic criteria to justify a rate reduction. Goolsbee’s remarks seem to have calmed some of the more erratic market movements.

With no significant economic data released this week, traders have been left to navigate the market based on speculative movements and minor indicators.

Technical analysis of EUR/USD

The H4 EUR/USD chart shows that the pair has completed an initial downward movement targeting the 1.0880 level, followed by a corrective phase towards 1.0944. Should this correction complete, a further decline to 1.0888 is anticipated. Breaking below this level could extend the downward trajectory towards 1.0830. The bearish outlook is supported by the MACD indicator, whose signal line is positioned above zero but trending downwards, indicating a potential continuation of the decline.

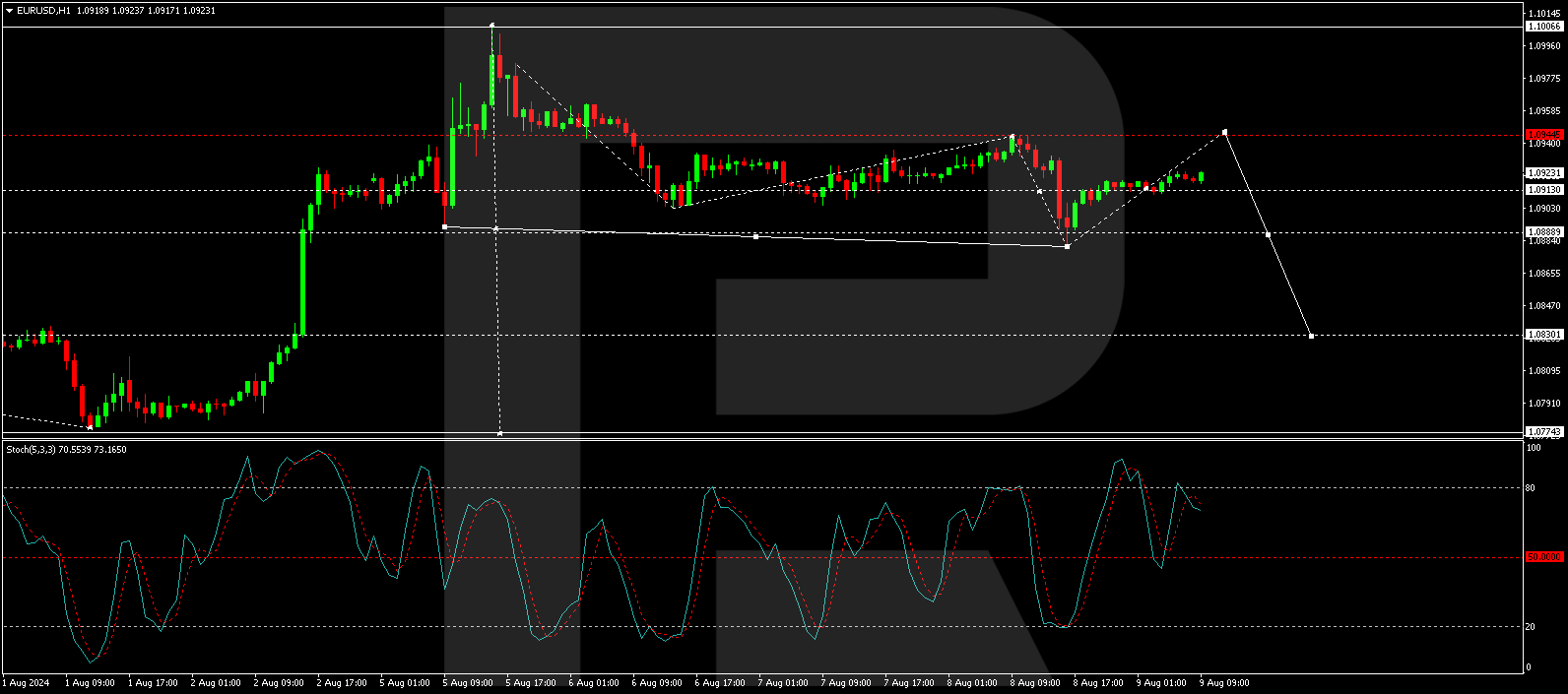

On the H1 chart, EUR/USD has formed a consolidation pattern around the 1.0913 mark. An upward breakout is expected, potentially driving the pair towards 1.0944, which is seen as a corrective move against the previous downtrend. Upon completion of this correction, the focus will shift to a new declining phase targeting 1.0888. This technical perspective is corroborated by the Stochastic oscillator, with its signal line poised to move from below the 80 level to around 20, suggesting an impending downward momentum.

Overall, the EUR/USD pair shows signs of temporary equilibrium as it navigates through speculative currents and awaits clearer directional cues from upcoming economic data or Federal Reserve communications.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- EUR/USD Stabilises Amid Fed Speculation and Absence of Major Economic Data Aug 9, 2024

- RBI kept rates at 6.5%. The Canadian dollar is strengthening due to foreign currency inflows and rising oil prices Aug 8, 2024

- Gold (XAU/USD) Recovers Amid Rate Cut Expectations Aug 8, 2024

- This Trend Will Likely Soon Rock the U.S. Financial System Aug 7, 2024

- Brent Oil Price Analysis: Anticipating a Correction Aug 7, 2024

- Panic selling of indices is over. New Zealand’s rising unemployment brings the RBNZ easing cycle closer Aug 7, 2024

- NZD/USD Sees Recovery After Hitting Nine-Month Low Aug 6, 2024

- Forced closures of carry-trade positions led to a crash in indices on Monday. The RBA maintained its policy settings Aug 6, 2024

- The US dollar fell to a 12-year low. Bitcoin lost 10% of its value during the day Aug 5, 2024

- Why are Stock, FX, Crypto markets falling? Aug 5, 2024