All eyes will be on Wednesday’s U.S. inflation print after a larger-than-expected increase in the unemployment rate and softening in the manufacturing sector a week ago heightened concerns that the Federal Reserve may need to respond with more aggressive interest rate cuts than previously thought.

Economic data since then have somewhat calmed concerns with the U.S. services purchasing managers index pointing to further expansion and initial jobless claims edging lower in the past week. Still, we expect further signs of easing inflation in July. We forecast headline price growth held at 3% on an annual basis but with a second straight small 0.1% monthly increase in core (excluding food and energy) prices. That should reassure the Fed that those annual rates will continue to move lower.

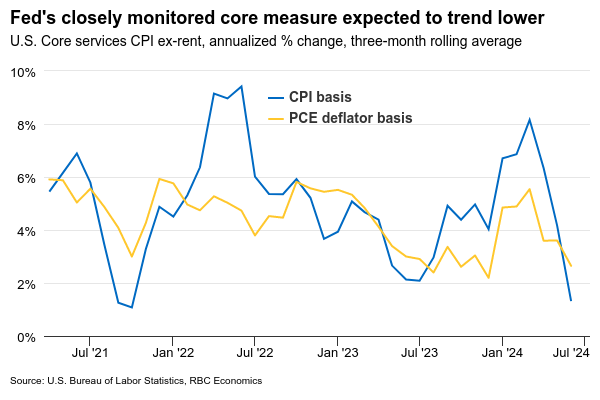

In June, the Fed’s “supercore” (core services ex-rent) measure posted its lowest reading on a three-month annualized basis since October 2021 at 1.3%. The breadth of inflationary pressures has narrowed in recent months and the share of products seeing inflation above 5% has returned to pre-pandemic levels. Home rents continue to account for a disproportionate share of the remaining annual price growth. But, it is slowing as the impact of earlier easing in market rent increases eventually passes through to lease agreements.

U.S. economic growth (or inflation) numbers haven’t hit a level yet that would push Fed officials to panic. But, it is becoming increasingly difficult to justify interest rates more than 200 basis points above the Fed’s own estimate of the long-run “neutral” rate. Evidence is building that broader economic conditions have already normalized and inflation is more likely to drift lower. Our base case assumption is that the Fed will cut the fed funds target range by 25 basis points in September and risks of a larger cut are contingent on further downside in economic growth or inflation surprises.

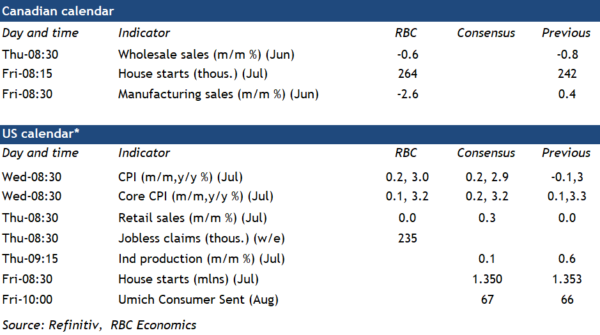

Week ahead data watch

According to StatCan’s early indicator, core wholesales sales were down 0.6% in June. Much of that weakness came from the sales decline in the motor vehicle and motor vehicle parts and accessories subsector, as well as the food, beverage, and tobacco subsector.

We expect manufacturing sales to drop by 2.6% in June, in line with StatCan’s prelim estimates, driven by lower sales in the chemical product and transportation equipment subsectors.

Canadian housing starts likely came in at 264K in July. That would be up 9.2% from June to reverse the 8.8% decline the prior month. Building permits trended higher during recent months, with the three-month rolling average value increased from 257K in March to 286K in May.

U.S. retail sales are likely little changed from last month. Higher auto sales and a price-related sales growth at gas stations were offsetting by the decline in control sales.