Investing platform Public announces the launch of a Bond Account, a convenient way to invest in multiple bonds.

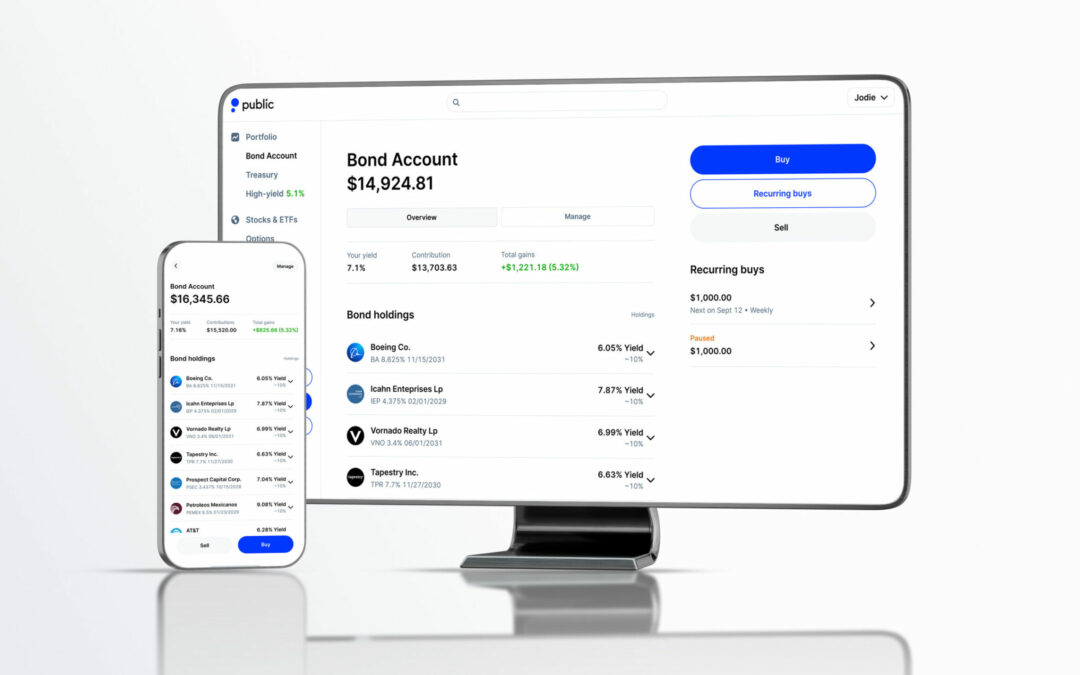

The new Bond Account will allow members to invest in a diverse set of ten corporate bonds issued by companies across various industries, including well-known names.

By investing in a Public Bond Account, members can easily purchase ten corporate bonds issued by companies like Boeing, Tapestry, Warner Media LLC, Main Street Capital Corp, and Vornado Realty LP. Interest earned is automatically reinvested once it reaches ~$1,000.

Members also have the option to set up recurring investments in their Bond Account. The ten bonds may change over time to address changing market conditions.

“Last year, we introduced the concept of the Treasury Account: an automated investing feature that made buying T-bills an easy experience for retail investors. Due to the simple user experience and high yield of short-dated treasuries, it became the most invested-in asset throughout the year. Now we’re doing the same, but for corporate bonds, where yields are higher, and the underlying investments are more diversified,” said Jannick Malling, Co-CEO and Co-Founder of Public. “As rates potentially come down later this year and into next year, we are hearing from investors who want to lock in a higher yield now, and our Bond Account allows you to invest in the bond market in just a few clicks.”

Members can track their accrued and projected income from the Bond Account through Public’s income hub, a new way to see all interest payments on the platform. In the coming weeks, members will also be able to track dividend payments, individual treasury and corporate bonds, music royalties, and the Bond Account to visualize their past and future income.

To make the bond market more accessible, the minimum investment Public requires for the Bond Account is $1,000, ten times less than single bond minimums on other platforms, which are often $10,000 or more.