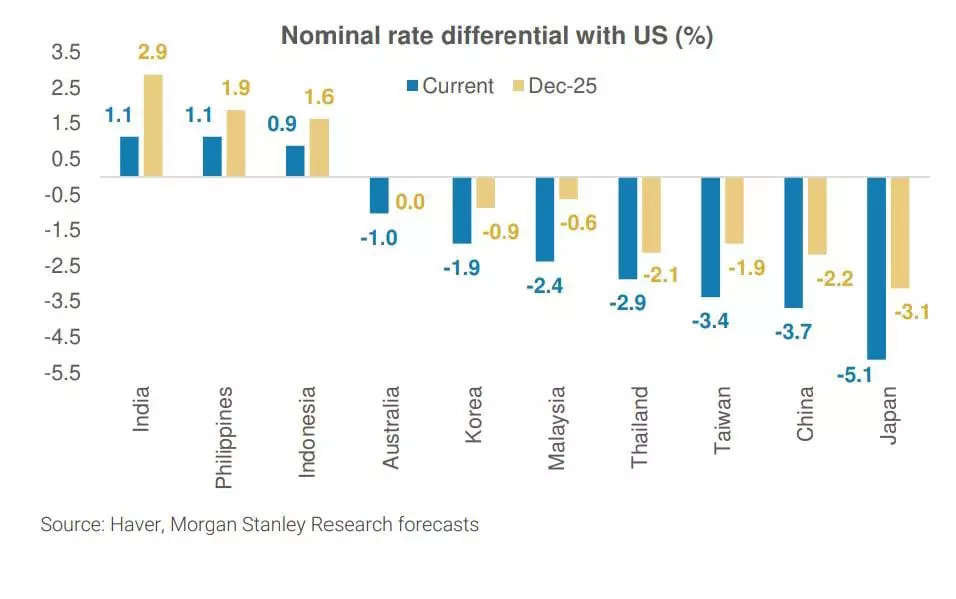

The backdrop of less-favourable rate differentials and relatively weak Asian currencies means that central banks will likely move only after the Fed. Asia’s rate cut cycle will also be shallower as compared to the Fed, with the weighted average rate in Asia, for example Japan falling by 30 basis points compared to 175 basis points in the US, revealed a latest report by Morgan Stanley.

At the outset, inflation for large parts of Asia have come within the central banks’ comfort zone and for some time now. While the backdrop for inflation is benign, central banks across Asia are having to contend with an external backdrop that has been less than conducive to reduce rates.

Policy rates in seven out of 10 Asian economies are lower than the US currently. Similarly, real rates are also lower in many Asian economies as compared to the US, which makes it tougher for the central banks in Asia to cut when the Fed has not yet embarked on rate cuts, highlighted the report.

The upshot of this backdrop is that Asian central banks are expected to still follow the Fed. If the Fed does cut rates in September as expected, then central banks in the region will be able to progressively cut rates.

However, the US elections in November and the outcome may influence the timing and pace of subsequent rate cuts even as the cumulative rate cuts may be the same as expected, it added.

Dollar to stay supported

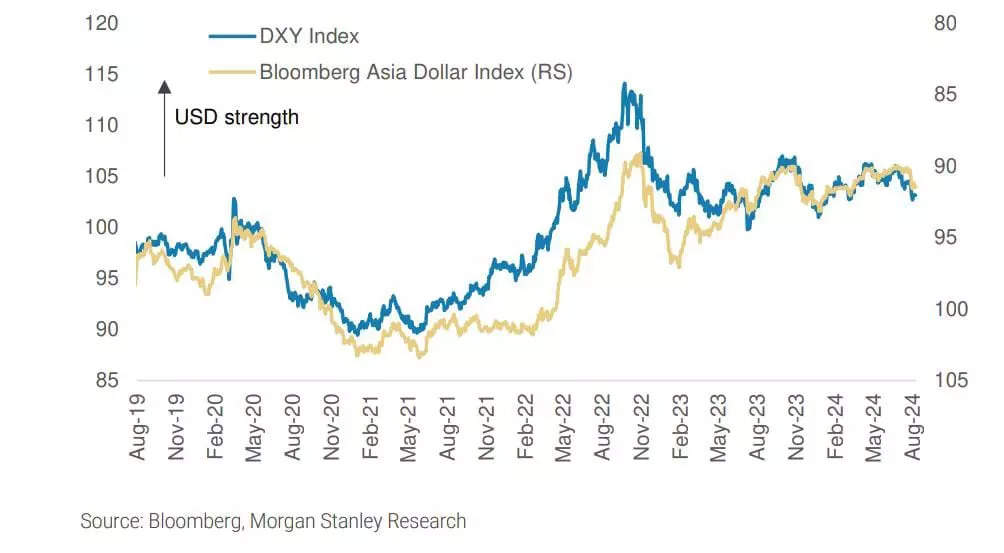

The US dollar has been strong in the current cycle, having appreciated by 8 per cent since 2021 and 5 per cent since the Fed embarked on its rate hike cycle.

It is to be noted that there are a number of USD-supportive developments such as growth, inflation dynamics as well as the market pricing of shallower rate cuts elsewhere as compared to the US, said the report.

Central banks in Asia have been cautious, highlighting that the strong dollar (and hence weak Asian currencies) could yet impose upside risks to the inflation outlook and therefore holding them back from cutting rates.

Moreover, in the run up to US elections in November, it is to be noted that policies proposed by the Republican Presidential campaign would likely provide a boost to the USD, the report added.

ALSO READ| When will RBI cut rates next?

What will prompt RBI to cut rates?

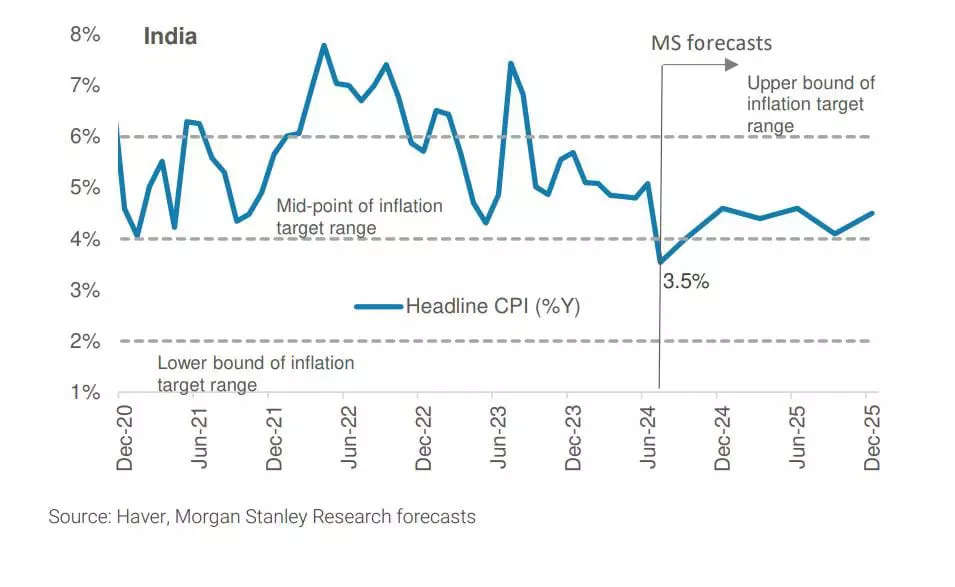

Contrary to market pricing, RBI is expected to remain on hold through 2025. A combination of robust growth, inflation continuing to track above 4 per cent, and the need for RBI to lean against leverage trends are the key reasons. Additionally, durable disinflation to 4 per cent or growth slowdown could enable rate cuts, highlighted the report.

RBI stands out as one of the central banks in Asia that will not cut rates. A robust growth cycle with a healthy productivity dynamic driven by capex is expected to remain underway, implying a higher neutral rate.

Recent RBI research indicated that the neutral rate has shifted up to an estimated 1.4-1.9 per cent as of end-Q1 2024 (compared to 0.8-1 per cent in Q4 2021).

RBI has also continued to reiterate “its commitment to aligning inflation to the 4 per cent target on a durable basis”, and that “resilient and steady growth in GDP enables monetary policy to focus unambiguously on inflation”.

The leverage cycle is strong and the banking system is stretched. In this environment, the RBI should stay put to lean against these leverage trends, the report stated.

However, durable inflation deceleration or growth moderation would open the door for rate.

Headline inflation will have to moderate to 4 per cent or below on a sustained basis. Importantly, Governor Das has stated that food inflation pressures cannot be ignored given food’s high CPI weighting.

ALSO READ| RBI MPC: Tone of the policy hawkish, pause to continue till Q4, says Economists

There is a chance that favourable weather conditions – as indicated by cumulative monsoon rainfall running above the long period average – help slow food inflation meaningfully over the next few months. Any implementation could only come in Jan 2026, which is beyond the expected rate cuts horizon, it added.

Policy space for rate cuts could also open up if GDP growth slows unexpectedly in a significant way either due to domestic or global factors and brings with it a moderation in credit growth.