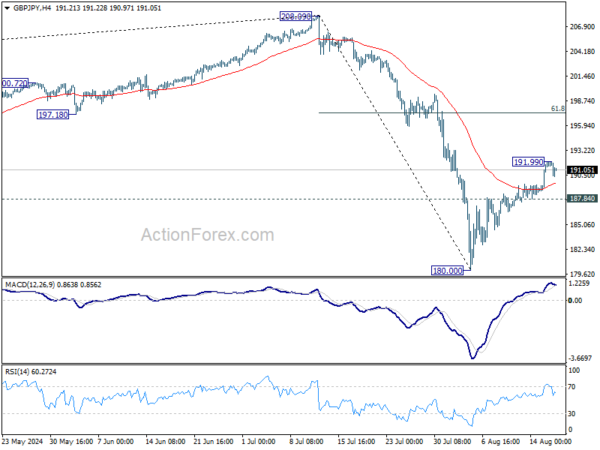

GBP/JPY’s rebound from 180.00 extended to 191.99 last week before forming a temporary top there. Initial bias this week is turned neutral for consolidations first. Above 191.99 will target 61.8% retracement of 208.09 to 180.00 at 197.35, as the second leg of the corrective pattern from 208.09. On the downside, however, break of 187.84 minor support will turn bias back to the downside for retesting 180.00 instead.

In the bigger picture, price actions from 208.09 are seen as a correction to whole rally from 123.94 (2020 low). Current development suggests that the first leg has completed and the range of medium term consolidation should be set between 38.2% retracement of 123.94 to 208.09 at 175.94 and 208.09.

In the longer term picture, considering bearish divergence condition in W MACD, 208.09 is at least a medium term top. It’s still early to conclude that the up trend from 122.75 (2016 low) has completed. But it’s at least in a medium term corrective phase, with risk of correction to 55 M EMA (now at 169.35).