Dollar continued its decline overnight as risk-on sentiment prevailed, with S&P 500 and NASDAQ notching their eighth consecutive positive session. Investor optimism has been buoyed by recent economic data suggesting that the US economy is on track for a soft landing, sidestepping a recession. However, it’s important to remember that despite the recent gains, major indices remain capped well below their July highs. The markets are still vulnerable to any negative economic surprises, which could quickly shift sentiment. In addition, the looming uncertainty of the presidential elections later this year would limit enthusiasm for bold bets. In the immediate term, all eyes are on Fed Chair Jerome Powell’s upcoming speech at the Jackson Hole Symposium, which is expected to e a significant market mover.

In Asian session today, Australian Dollar remained stable but struggled to build on this week’s gains. RBA released minutes from its August meeting, which offered little in the way of new information. RBA reiterated its vigilance on upside inflation risks, emphasizing that a rate cut is not on the horizon in the near term, while also keeping all policy options open. Meanwhile, China’s PBoC left its 1-year and 5-year loan prime rates unchanged at 3.35% and 3.85%, respectively. This move was widely anticipated and had minimal impact on the markets.

For the week so far, New Zealand Dollar is currently the strongest performer, followed by Australian Dollar and Japanese Yen. On the other hand, Dollar is the weakest, with British Pound and Canadian Dollar also underperforming. Euro and Swiss Franc are trading in a middle positions.

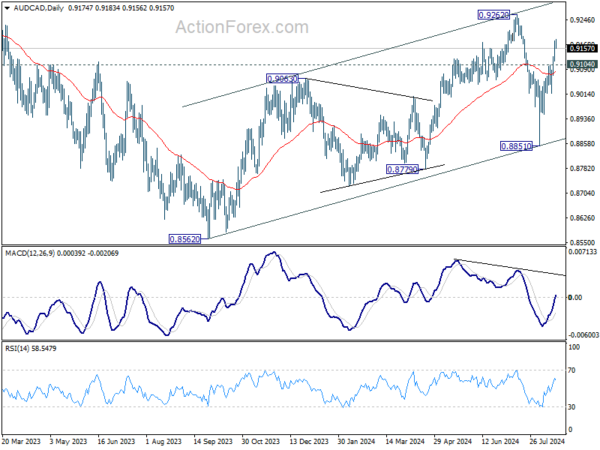

Looking ahead today, the market’s attention will shift to Canada’s consumer inflation data. Further slowdown in inflation, particularly in core measures, would provide BoC with the flexibility to cut interest rates again at its upcoming meeting in September. Technically, AUD/CAD is extending the rebound from 0.8851 this week. The strong support from near term rising channel is keeping the whole rise from 0.8562 alive. Further rally is now in favor as long as 0.9104 resistance turned support holds, for retesting 0.9262 resistance next.

In Asia, at the time of writing, Nikkei is up 1.68%. Hong Kong HSI is down -0.28%. China Shanghai SSE is down -0.90%. Singapore Strait Times is up 0.66%. Japan 10-year JGB yield is down -0.0051 at 0.885. Overnight, DOW rose 0.58%. S&P 500 rose 0.97%. NASDAQ rose 1.39%. 10-year yield fell -0.025 to 3.867.

RBA Minutes: No near-term rate cut expected, nothing ruled in or out

RBA’s August meeting minutes revealed a thorough discussion on the merits of both a rate hike and a rate hold, ultimately leading to the decision to keep interest rates unchanged at 4.35%. The minutes reiterated that it is “unlikely that the cash rate target would be reduced in the short term.” The minutes also noted that it is “not possible to either rule in or rule out” future changes in the cash rate

The decision to hold rates steady was seen as the best way to “balance the risks” to both inflation and the labor market, especially given the “prevailing uncertainties, market volatility, and market expectations.”

RBA members emphasized the importance of placing “greater-than-usual weight on the flow of data” rather than relying solely on forecasts, due to the uncertainties surrounding the persistence of supply shocks. They noted that the data since the previous meeting had “not been sufficient to warrant a change in the stance of monetary policy.”

Additionally, the minutes suggested that holding the cash rate target steady for a “longer period” than currently implied by market expectations could be enough to bring inflation back to target within a reasonable timeframe. However, the Board acknowledged that this approach would need to be reassessed at future meetings based on incoming data and evolving economic conditions.

New Zealand’s goods export rises 14% yoy in Jul, imports up 8.5% yoy

New Zealand’s goods exports saw a robust increase of 14% yoy in July, reaching NZD 6.1B. Goods imports also rose by 8.5% yoy to NZD 7.1B, leading to a trade deficit of NZD -963m, a stark contrast to the expected surplus of NZD 331m.

Breaking down the export data, the strongest growth came from Australia, with total exports up by 19% (NZD 135m), followed by the EU, where exports surged by 30% (NZD 114m). Exports to China increased by 8.5% (NZD 107m), while exports to the US and Japan rose by 4.7% (NZD 35m) and 5.3% (NZD 17m), respectively.

On the import side, the largest increase was from South Korea, where imports more than doubled, rising by 103% (NZD 480m). Imports from China also saw significant growth, up 18% (NZD 233m). In contrast, imports from the US and the EU declined sharply, with drops of -30% (NZD -255m) and -14% (NZD -147m), respectively. Imports from Australia showed a modest increase of 0.82% (NZD 6.3m).

ECB’s Rehn flags September rate cut amid growing growth risks

ECB Governing Council member Olli Rehn highlighted growing concerns about Eurozone’s economic outlook, stating that the “recent increase in negative growth risks” has strengthened the case for a rate cut at the next monetary policy meeting in September, assuming disinflation remains on course.

Rehn acknowledged that while inflation is expected to continue its path towards the 2% target, the journey is likely to be “bumpy” throughout the year. The real challenge, however, lies in the growth outlook.

He pointed out that there are still “no clear signs of a pick-up in the manufacturing sector,” despite the fading impact of high energy costs that had previously weighed on the sector.

Rehn further cautioned that if investments in the manufacturing sector fail to recover and growth continues to rely heavily on the services sector, the “projected pick-up in productivity growth may be jeopardized.”

He also warned that the slowdown in industrial production “may not be as temporary as assumed,” suggesting that Eurozone could face prolonged economic challenges if the manufacturing sector does not regain momentum.

Looking ahead

Swiss Trade balance, Germany PPI, Eurozone CPI final and current account will be released in European session. Later in the day, Canada CPI will take center stage.

EUR/USD Daily Outlook

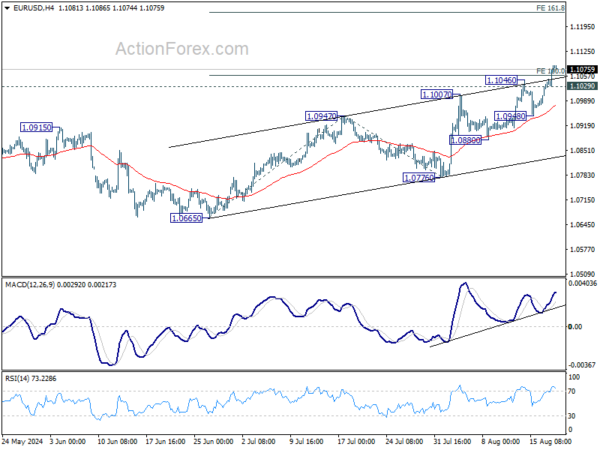

Daily Pivots: (S1) 1.1043; (P) 1.1064; (R1) 1.1107; More…..

EUR/USD’s rally is still in progress and breaks through 100% projection of 1.0665 to 1.0947 from 1.0776 at 1.1058. The break of near term channel resistance argues that EUR/USD might be accelerating. Intraday bias remains on the upside for 1.1138 resistance, and then 161.8% projection at 1.1232. On the downside, below 1.1029 minor support will turn intraday bias neutral and bring consolidations first. But outlook will now remain bullish as long as 1.0948 support holds.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern that’s could still extend. Break of 1.1138 resistance will be the first signal that rise from 0.9534 (2022 low) is ready to resume through 1.1274 (2023 high). However, break of 1.0776 support will extend the correction with another falling leg back towards 1.0447 support.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) Jul | -963M | 331M | 699M | 585M |

| 01:15 | CNY | 1-Y Loan Prime Rate | 3.35% | 3.35% | 3.35% | |

| 01:15 | CNY | 5-Y Loan Prime Rate | 3.85% | 3.85% | 3.85% | |

| 01:30 | AUD | RBA Meeting Minutes | ||||

| 06:00 | CHF | Trade Balance (CHF) Jul | 5.44B | 6.18B | ||

| 06:00 | EUR | Germany PPI M/M Jul | 0.30% | 0.20% | ||

| 06:00 | EUR | Germany PPI Y/Y Jul | -0.80% | -1.60% | ||

| 08:00 | EUR | Eurozone Current Account (EUR) Jun | 37.0B | 36.7B | ||

| 09:00 | EUR | Eurozone CPI Y/Y Jul F | 2.60% | 2.60% | ||

| 09:00 | EUR | Eurozone CPI Core Y/Y Jul F | 2.90% | 2.90% | ||

| 12:30 | CAD | New Housing Price Index M/M Jul | 0.00% | -0.20% | ||

| 12:30 | CAD | CPI M/M Jul | 0.30% | -0.10% | ||

| 12:30 | CAD | CPI Y/Y Jul | 2.50% | 2.70% | ||

| 12:30 | CAD | CPI Median Y/Y Jul | 2.50% | 2.60% | ||

| 12:30 | CAD | CPI Trimmed Y/Y Jul | 2.70% | 2.90% | ||

| 12:30 | CAD | CPI Common Y/Y Jul | 2.20% | 2.30% |