The following guest post is courtesy of Krzysztof Kapliński, Dealing Team Leader at broker platform provider Match-Trade Technologies.

Proprietary trading firms have emerged as a compelling alternative to traditional forex brokers. These firms provide traders with access to significant capital and high leverage in exchange for passing a trading challenge—a relatively small investment compared to standard forex trading.

While it’s debatable whether prop trading’s rise is due to its accessibility to traders with smaller capital, savvy social media marketing, or the flexibility of operating in a less regulated space, one thing is clear: from a trading technology perspective, the exclusive use of demo accounts in the evaluation process presents unique challenges. Traditional demo execution often fails to mirror real market conditions, which can compromise the fairness and effectiveness of the evaluation process.

In this article, I’ll explain how our newly introduced “Demo Execution Mode” in the Match-Trader platform addresses this issue delivering a more realistic trading experience.

The Execution Dilemma in Prop Trading

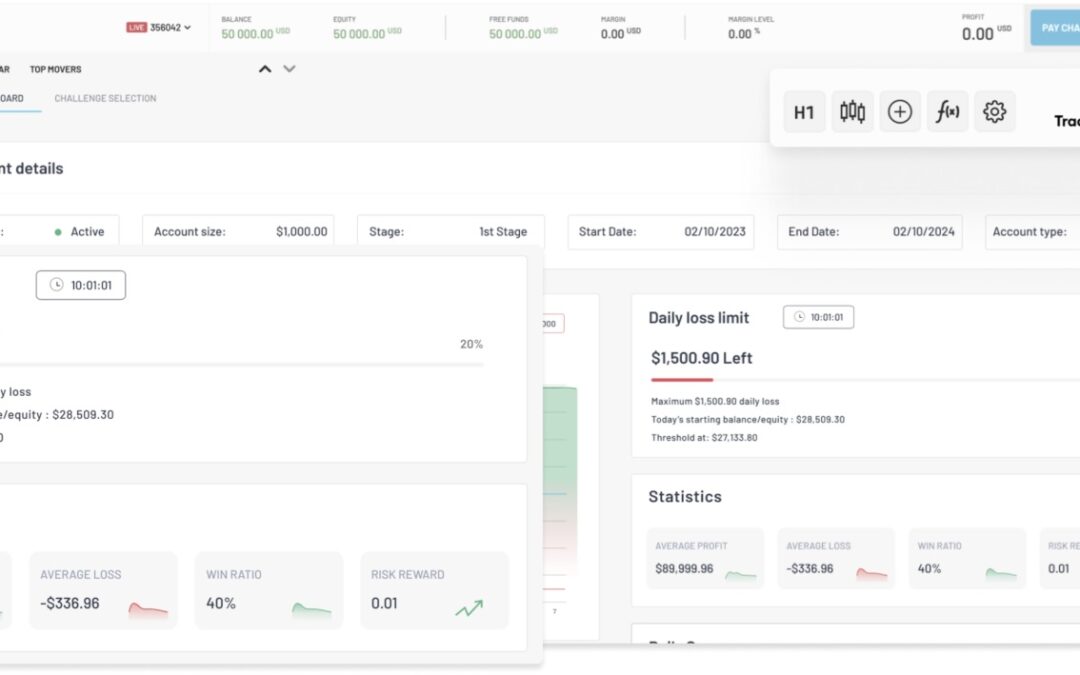

Prop trading firms heavily rely on demo accounts to evaluate prospective traders’ skills in an environment that should mirror real market conditions as closely as possible. For a few hundred dollars, traders can gain access to an account simulating a $100,000 deposit. Some even find offers to upgrade their accounts to a million dollars or more. With leverage as high as 1:100, traders can control notional volumes in the hundreds of millions in FX base currency. This raises a critical question: how should these trades be executed?

The problem with traditional demo account execution is that it often diverges from real market conditions, leading to a distorted trading experience. This happens because most demo platforms don’t impact the actual order book, allowing trades to be executed without considering market depth. This lack of realism can lead to skewed results, with traders experiencing execution conditions they would never encounter in a live market.

Introducing “Demo Execution Mode” on the Match-Trader Platform

Recognising this issue, we at Match-Trade Technologies developed and integrated the “Demo Execution Mode” into our Match-Trader platform. This innovative feature ensures that all orders on demo accounts are executed at market prices, closely replicating real trading conditions without affecting the actual order book. The result is a more authentic trading environment where demo trades don’t influence market depth, liquidity, or the trading experience of other market participants.

For prop trading firms, this is a game-changer. By enabling “Demo Execution Mode,” firms can provide their traders with a realistic simulation of market conditions, allowing them to practice and refine their strategies without the distortions typically associated with demo trading. This not only improves the quality of the evaluation process but also better prepares traders for the transition to live trading.

The Power of VWAP Execution

When implementing execution strategies, a prop trading company must decide whether order execution should be managed internally by the platform’s trading engine or externally through another tool. At Match-Trade Technologies, we believe that all solutions provided externally should also be fully accessible internally within the server. Therefore, we focus on providing seamless internal execution capabilities that prop firms can rely on.

At the core of this innovation is the use of Volume-Weighted Average Price (VWAP) execution, a method traditionally reserved for live trading environments. VWAP ensures that the execution price of a trade is based on multiple levels of liquidity, reflecting true market depth. Each level of liquidity has a specific price and available volume. The execution begins at the best possible price, and if the requested order volume exceeds the capacity of the first level, it is partially filled. The remaining volume is then executed at the next available level, continuing in this manner until the order is fully filled. The final execution price is an average weighted by the volume filled at each level. This approach is crucial for prop firms because it allows them to simulate real market conditions more accurately during the demo phase.

Unlike other platforms such as DXtrade, cTrader, or Tradelocker, which often require external bridges for VWAP execution—adding extra costs and complexity—Match-Trader offers this capability natively. Moreover, our high-quality, low-latency market feeds complement this execution model, allowing firms to customise market depth for their clients and further enhance the realism of the trading environment. This combination of features can be particularly beneficial in achieving a genuine pass ratio for traders, as it mitigates potential abuses that could arise in standard demo environments.

A Competitive Edge for Prop Trading Firms

By adopting Match-Trader’s “Demo Execution Mode,” prop trading firms can significantly elevate the quality of their trading environment. Offering a realistic demo trading experience not only improves the training and evaluation of traders but also helps mitigate potential abuses that can occur in less sophisticated demo environments.

In today’s competitive landscape, where attracting and retaining top trading talent is crucial, providing a superior trading platform can make all the difference. Match-Trader’s new features equip prop firms with the tools they need to stay ahead of the curve, ensuring their traders have the best possible resources to succeed.

Introducing “Demo Execution Mode” in the Match-Trader platform represents a significant leap forward for prop trading firms. By enhancing the realism of demo trading through VWAP execution and eliminating the distortions of traditional demo environments, Match-Trader is setting a new standard in trading technology. Prop firms that adopt this platform can look forward to a more robust, realistic, and ultimately successful trading environment for their traders.