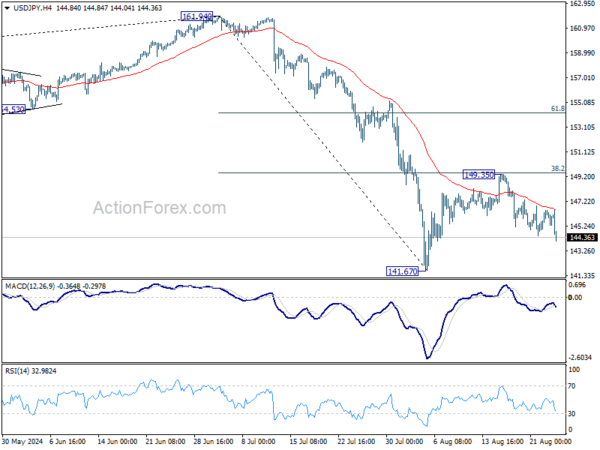

USD/JPY gyrated lower last week even though momentum is a bit unconvincing. Still, the development suggests that rebound from 141.67 has completed at 149.35, after rejection by 38.2% retracement of 161.94 to 141.67 at 149.41. Initial bias is on the downside this week for retesting 141.67 low. Firm break there will resume the whole fall from 161.94 to 140.25 support next. For now, risk will stay on the downside as long as 149.35 resistance holds, in case of recovery.

In the bigger picture, fall from 161.94 medium term top is seen as correcting whole up trend from 102.58 (2021 low). Deeper decline could be seen to 38.2% retracement of 102.58 to 161.94 at 139.26, which is close to 140.25 support. In any case, risk will stay on the downside as long as 55 W EMA (now at 149.59) holds. Nevertheless, firm break of 55 W EMA will suggest that the range for medium term corrective pattern is already set.

In the long term picture, it’s still early to conclude that up trend from 75.56 (2011 low) has completed. However, a medium term corrective phase should have commenced, with risk of deep correction towards 55 M EMA (now at 132.73).