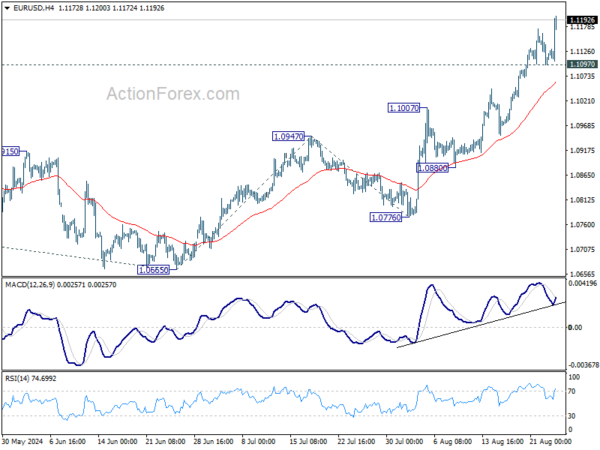

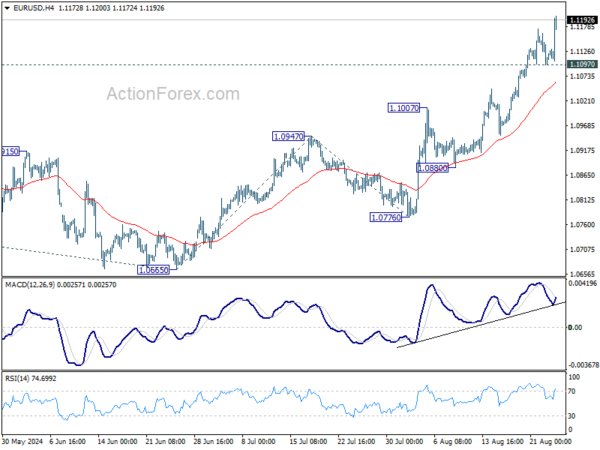

EUR/USD’s rally continued last week and the strong break of 1.1138 resistance argues that larger up trend may be resuming. Initial bias is on the upside this week for t 161.8% projection of 1.0665 to 1.0947 from 1.0776 at 1.1232, and then 1.1274 high. On the downside, below 1.1097 minor support will turn intraday bias neutral and bring consolidations first.

In the bigger picture, break of 1.1138 resistance indicates that corrective pattern from 1.1274 has completed at 1.0665 already. Decisive break of 1.1274 (2023 high) will confirm whole up trend from 0.9534 (2022 low). Next target will be 61.8% projection of 0.9534 to 1.1274 from 1.0665 at 1.1740. This will now be the favored case as long as 1.0947 resistance turned support holds.

In the long term picture, a long term bottom is in place at 0.9534 (2022 low). The strong break of 55 M EMA (now at 1.1018) is taken as the first sign of bullish trend reversal. But still, firm break of 1.2348 structural resistance is needed to confirm. Otherwise, price actions from 0.9534 could still develop into a consolidation pattern.