Lithuania based RegTech solutions provider iDenfy has announced the launch of a new Face Authentication service. iDenfy, best known for its variety of KYC tools, said that the new cutting-edge technology is designed to detect fraudulent biometrics and add extra protection without unnecessary friction to the end user. Face Authentication enables online platforms to create a more secure network by flagging suspicious activities in real-time, helping to prevent fraud at every stage of the customer journey.

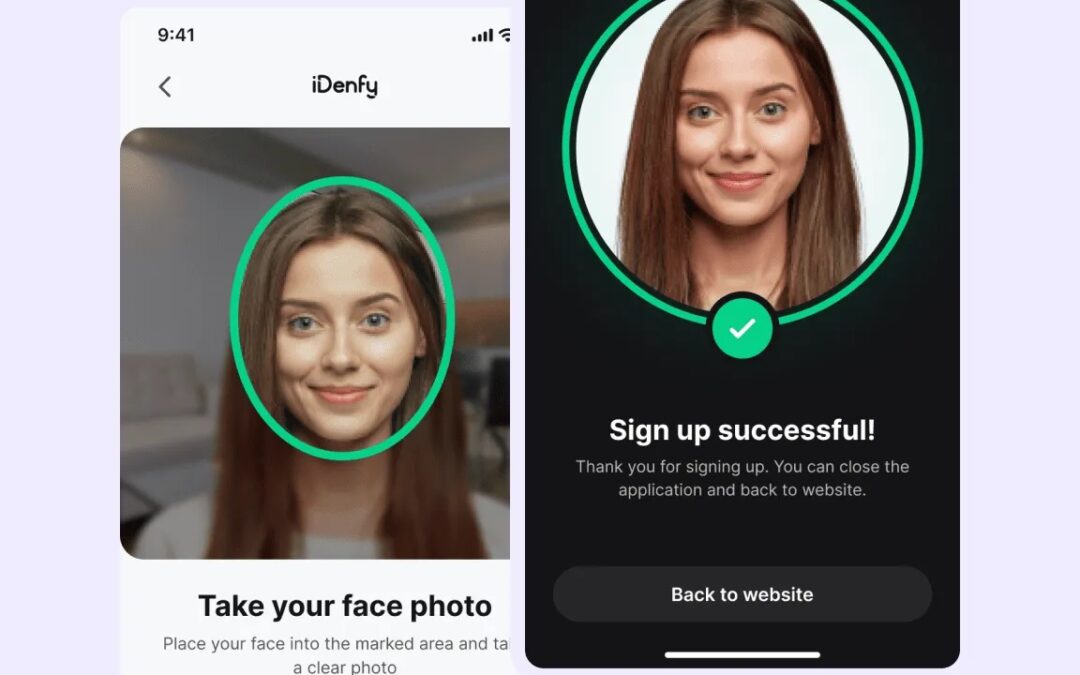

iDenfy’s Face Authentication service offers a seamless user experience by verifying identities in a matter of seconds. This innovative solution is set to transform the onboarding process, enabling businesses to onboard new customers quickly and securely. With verification times of up to 15 seconds, this service is not only efficient but also ensures a high level of security, making it an essential tool for businesses that prioritize compliance and user experience.

The fully automated solution works by comparing the customer’s live face with a reference image. This process involves AI-driven information extraction by reading the data from the customer’s ID document. The extracted information then verifies the authenticity of the face. Using iDenfy’s advanced facial recognition technology, the customer’s live face is automatically analyzed and matched to the photo on their ID document, authenticating and confirming they are indeed the person they claim to be.

Domantas Ciulde, the CEO of iDenfy, explained,

Domantas Ciulde, the CEO of iDenfy, explained,

“The Face Authentication process, in general, relies on biometric technology and offers a more efficient, simple, and user-friendly way to confirm a user’s identity compared to traditional methods. If the user can’t pass their authentication, the company can instantly take the necessary steps to avoid dealing with a potentially fraudulent customer. This way, this tool can help online platforms boost efficiency in their internal risk management processes.”

According to iDenfy, one of the key features of iDenfy’s Face Authentication is its face-matching capability. After successfully onboarding a new customer, businesses can use this feature to re-verify the customer’s identity at any point in the customer lifecycle. This ongoing due diligence process is crucial to ensure that businesses continue to meet Know Your Customer (KYC) regulatory requirements. The Face Authentication solution also helps companies keep records of up-to-date customer data, especially when it comes to high-risk customers who need to undergo Enhanced Due Diligence (EDD). According to iDenfy, its new solution accurately assesses the potential risks associated with the customer’s activities.

More importantly, the new Face Authentication tool has built-in active liveness checks to ensure that the person who’s being verified is real, and not a fraudster trying to trick the system. Through a swift integration process, companies can see a positive impact immediately, which, according to iDenfy, results in better user conversion rates. This streamlined authentication approach helps retain customers and supports faster scaling, especially for online platforms in fintech or crypto, which have strict requirements but aim to avoid adding unnecessary hassle for their users.

According to Domantas Ciulde, the new service is not just about verifying identities:

“Face Authentication also provides businesses with the insights they need to make informed decisions. Our updated dashboard now offers details like match ratio, failure reasons, passive liveness probability, and more.”

This comprehensive data allows compliance officers to see all results in one place, monitor and analyze ongoing verification sessions, and ensure that all security measures are as effective as possible. Moreover, businesses can initiate new verification sessions directly from the onboarded users’ section of the dashboard.

As regulations evolve and the need for secure, efficient identity verification grows, iDenfy’s face authentication service is positioned to be an indispensable tool for businesses across various industries. Whether for onboarding new customers, verifying users during account access, or maintaining ongoing compliance, this service offers a comprehensive solution that meets the demands of today’s fast-paced digital environment.

“With the launch of our Face Authentication service, we’re committed to providing our clients with simple and fully automated RegTech tools to enhance security, streamline operations, and meet regulatory requirements. Our goal is to make the onboarding process as seamless as possible while ensuring that businesses can trust the identities of their platform users,” added Domantas Ciulde.

About iDenfy

iDenfy, a platform of identity verification services and fraud prevention tools, ensures AML, KYC, and KYB compliance for every company — from large-scale businesses to small organizations. The rapidly growing business was named the best Fintech Startup in 2020. Recently, iDenfy was featured in G2’s Summer 2024 report as the leading identity verification software.