FNG Exclusive… FNG has learned via regulatory filings that FCA regulated CFDs and financial spreadbetting brokerage Capital Index (UK) Limited saw a decline in revenues for the fourth consecutive year in 2023, leading to another senior management shakeup at the company.

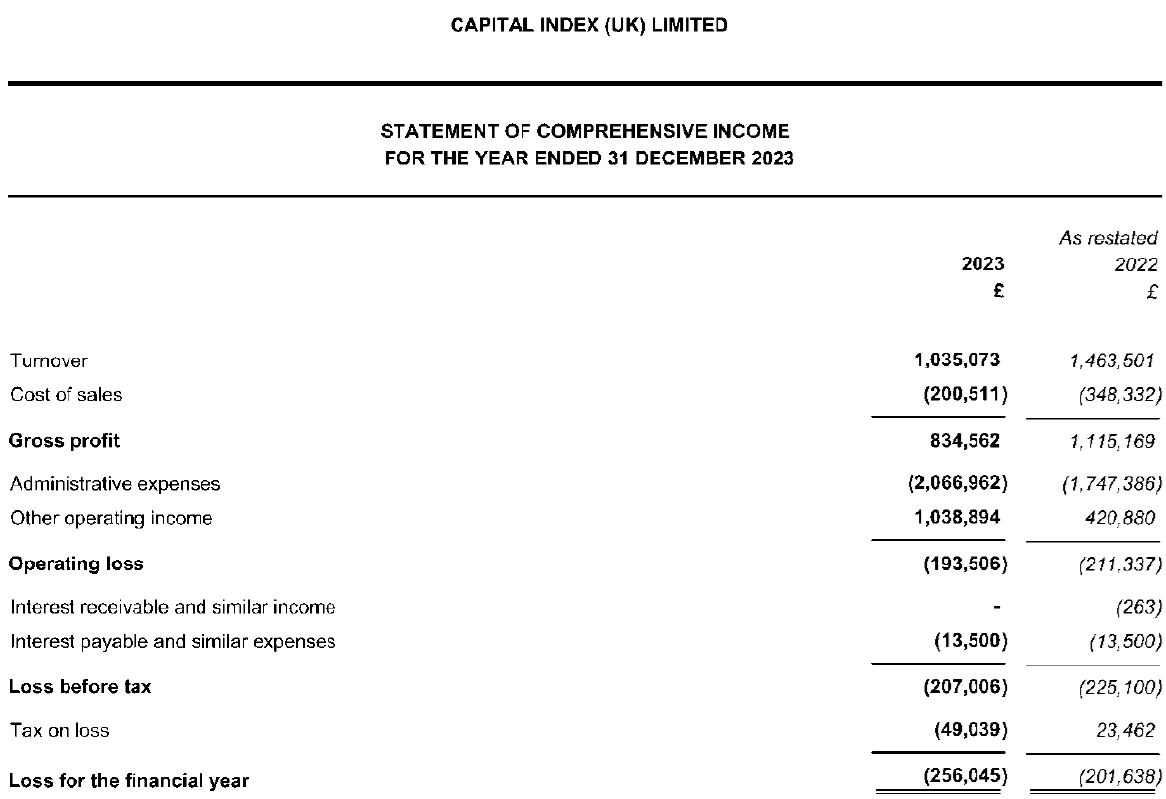

Capital Index brought in revenue of £1.04 million in 2023, down by 29% from £1.46 million in 2022. As recently as 2019 Capital Index did £2.74 million in revenue. The company posted a net loss of £256,000 in 2023, fairly similar to a £202,000 loss in 2022.

Client money held by Capital Index fell to £3.2 million as at year-end 2023, down from £3.6 million in 2022.

Capital Index (UK) Ltd is an online global financial services provider. The company provides execution only financial Contract For Differences (CFDs) and Spread Bets in a range of instruments including Foreign Exchange, Indices, Commodities and Bonds. The company currently offers the MT4 online trading platform through which appropriately assessed customers can invest. Customers are majority retail clients, and Client Money is segregated and held in a trust account with a Tier 1 A-rated bank.

The revenue of the company mainly derives from the transactional spread generated from client trading.

Capital Index management noted that the UK business continued to suffer due to the cost of living crisis, both in terms of client numbers and trades. However, the Directors are hopeful that revenues will increase in 2024 and, together with a reduction in overhead costs, a return to profit will be possible.

Soon after the close of the year Capital Index CEO Trevor Barwell resigned, as was exclusively reported at the time here at FNG. Trevor Barwell was promoted to the position of CEO (or more formally, Managing Director) of Capital Index in 2021, following the departure earlier that year of Matthew Wright, who had been CEO of the company since 2018. (Matthew Wright is now Group COO at Exinity.)

Capital Index (UK) Limited is controlled by forex trading coach Greg Secker, who bought into the company in 2016. The group also operates the brand offshore via Bahamas domiciled Capital Index (Global) Limited. The company’s 2023 income statement and balance sheet follow below.