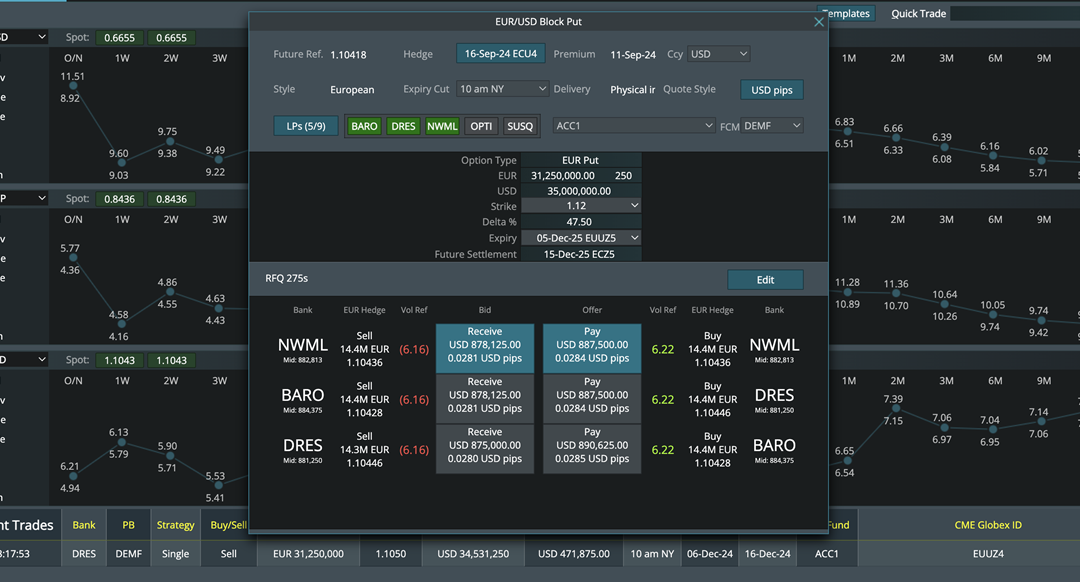

FX Options e-trading platform provider Digital Vega and derivatives marketplace operator CME Group have announced the launch of a new FX options block trading service. Currently available for client testing, buy-side firms will be able to use existing OTC workflows on Digital Vega’s multi-bank platform Medusa to request quotes and trade blocks of FX options on futures.

Market participants will be able to leverage Digital Vega’s established connectivity, GUI and workflow technology to request prices in CME Group’s centrally cleared FX options from multiple Liquidity Providers in competition. These options can be significantly more margin efficient versus traditional OTC options for those subject to Uncleared Margin Rules.

Chris Povey, Executive Director and Head of FX Options, CME Group said,

Chris Povey, Executive Director and Head of FX Options, CME Group said,

“Enabling customers to negotiate and trade risk-transfer blocks via Digital Vega’s Medusa platform is an exciting development in the electronification of the FX options market. This partnership lowers the barriers to entry for buy-side clients looking to gain the margin and operational benefits of our centrally cleared FX options by allowing them to use existing OTC workflows and lean on OTC relationships. In addition, clients could gain access to new liquidity given there is no requirement for bilateral credit relationships.”

Mark Suter, Executive Chairman and Co-Founder, Digital Vega added,

Mark Suter, Executive Chairman and Co-Founder, Digital Vega added,

“Trading CME Group’s FX blocks on Digital Vega’s multi-dealer platform, provides a seamless execution solution to both buy-side and sell-side participants. Pricing and execution is in a format familiar to OTC traders, with deep liquidity provided by a broad group of market makers, and booking to a single central counterparty. This mitigates counterparty credit risk and generates potentially significant capital, margin, and operational efficiencies. Transaction reporting to CME ClearPort is automated and immediate, with detailed post-trade reporting and analytics available.

“Our new service provides liquidity access for more clients and market makers to trade with each other without having to establish new bilateral credit agreements, which we expect will result in increased liquidity for the market as a whole. We are encouraging clients to onboard to this service now so that they can fully test the system before they begin trading.”

About Digital Vega

Digital Vega is an independent company operating the pioneering Medusa, Hydra and Vega FX Options trading platforms. Our client-driven focus and unparalleled liquidity has made us the market leader in the OTC FX options marketplace.

As more OTC and derivatives markets migrate to electronic trading models, driven by regulations and client demand, Digital Vega is at the forefront of these new developments. It continues to add new financial products, support new asset classes and bring new market innovations to its award-winning platform.

All major global FX banks and most of the FX Prime Brokers provide liquidity to Digital Vega. Clients are Institutional Investors, Hedge Funds, Asset Managers, Agency Brokers, and Regional and Private Banks.

Formed in 2010, Digital Vega is headquartered in London, and is backed by strategic institutional investors.

About CME Group

As the world’s leading derivatives marketplace, CME Group enables clients to trade futures, options, cash and OTC markets, optimize portfolios, and analyze data – empowering market participants worldwide to efficiently manage risk and capture opportunities. CME Group exchanges offer the widest range of global benchmark products across all major asset classes based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals.

The company offers futures and options on futures trading through the CME Globex platform, fixed income trading via BrokerTec and foreign exchange trading on the EBS platform. In addition, it operates one of the world’s leading central counterparty clearing providers, CME Clearing.