By RoboForex Analytical Department

The oil market remains under pressure. A barrel of Brent oil declined to 71.80 USD by Tuesday. The commodity erased all early-week gains as fears of slowing demand in China outweighed the risk of energy shortages due to the storm in the Persian Gulf.

In recent weeks, market participants have been paying close attention and analysing the whole range of news related to China. The sluggish economic growth rate combined with the global strategy of transition to low-carbon raw materials is reducing China’s need for oil. This negatively impacts Chinese oil imports and naturally affects market prices as China is considered the world’s largest raw material consumer.

Investors are also confident that oil consumption in Europe and the US will reduce following the active driving season. Additionally, some oil refineries are going into maintenance mode, meaning they will not need as many raw materials as before. OPEC+ had previously postponed the planned increase in oil output for a couple of months. Yes, the market now has a respite but the likelihood of an imminent commodity oversupply is still looming over prices

Storm Francine is expected to intensify near Texas, US and could become a Category 2 storm, which means a hurricane threat. Some production facilities in Texas may be shut down until weather conditions improve.

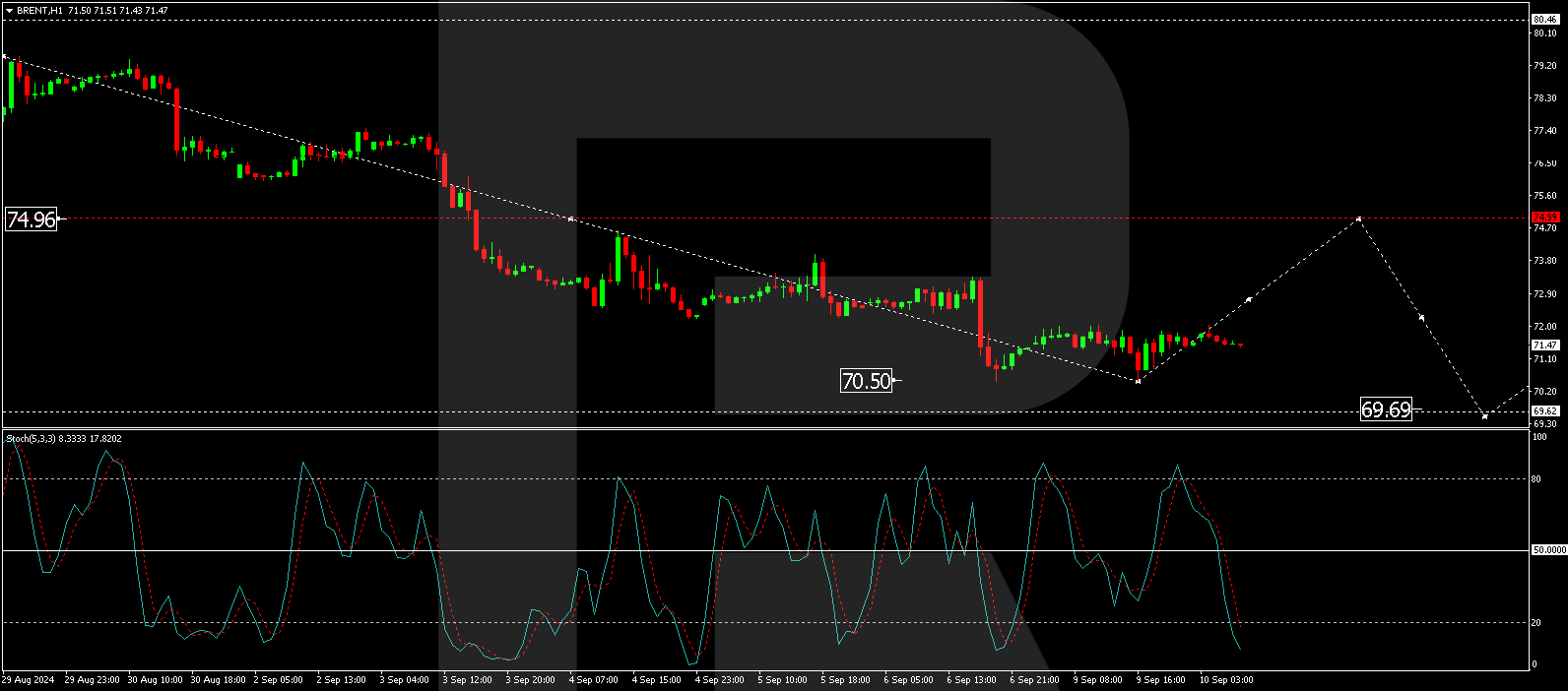

Brent technical analysis

The BRENT H4 chart shows that the market has broken below the 74.96 level and completed a downward wave, reaching 70.50. A consolidation range could form at the current lows today. An upward breakout will open the potential for growth to 75.00 (testing from below). With a downward breakout, the range could expand to the local target of 69.69. This scenario is technically supported by the MACD indicator, with its signal line below the zero level at the lows and poised for growth.

The BRENT H1 chart shows that the market has reached the downward wave’s local target of 70.50. Today, the market is forming a consolidation range above this level. The range expanded up to 71.90 and down to 70.46. A breakout above the 71.90 level will open the potential for a corrective wave towards 75.00. With a breakout below 70.46, the range could expand downwards, with the wave continuing to 69.69. This scenario is technically supported by the Stochastic oscillator, whose signal line is below 20 and poised for growth.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Brent remains under pressure: China and rapid growth in OPEC+ production to blame Sep 10, 2024

- The Analytical Overview of the Main Currency Pairs on Natural gas prices fell by 4%. Oil also remains under pressure from weak demand Sep 10, 2024

- The Analytical Overview of the Main Currency Pairs on The Bank of Canada is likely to continue cutting rates amid a weak labor market. OPEC+ postponed the planned production increase Sep 9, 2024

- USDJPY pauses, but this is temporary Sep 9, 2024

- COT Metals Charts: Speculator Bets led by Steel & Palladium Sep 7, 2024

- COT Bonds Charts: Speculators raised their Fed Funds and SOFR 3-Months bets this week Sep 7, 2024

- COT Soft Commodities Charts: Speculator Bets led higher by Corn & Sugar Sep 7, 2024

- COT Stock Market Charts: Speculator Bets led by S&P500 & Russell Minis Sep 7, 2024

- Week Ahead: USDInd faces triple risk cocktail Sep 6, 2024

- Gold rallies as market bets on rapid Fed monetary easing Sep 6, 2024