Regenerative Finance (ReFi) in blockchain is an emerging financial framework that aims to align economic activities with ecological and social regeneration for sustainable development. In contrast to traditional finance, which often prioritizes short-term profits over long-term sustainability, ReFi focuses on creating a more balanced and equitable economy that incentivizes social and environmental good.

At the core of ReFi are three key principles — environmental sustainability, social impact, and financial viability. ReFi seeks to promote initiatives that advance ecological renewal, such as investing in renewable energy projects, sustainable agriculture, and carbon capture technologies. Additionally, ReFi aims to reduce socioeconomic disparities and improve community well-being by funding projects that empower underprivileged populations and provide access to essential services.

The need for ReFi has become increasingly evident in recent years, as the world faces pressing challenges such as climate change, social inequality, and economic instability. Traditional financial systems have often been criticized for their role in exacerbating these problems, as they encourage the extraction and exploitation of natural resources and the unequal distribution of wealth. ReFi offers a potential solution by providing a framework for a more sustainable, inclusive, and resilient financial system that prioritizes the long-term well-being of people and the planet.

Understanding the ReFi Ecosystem

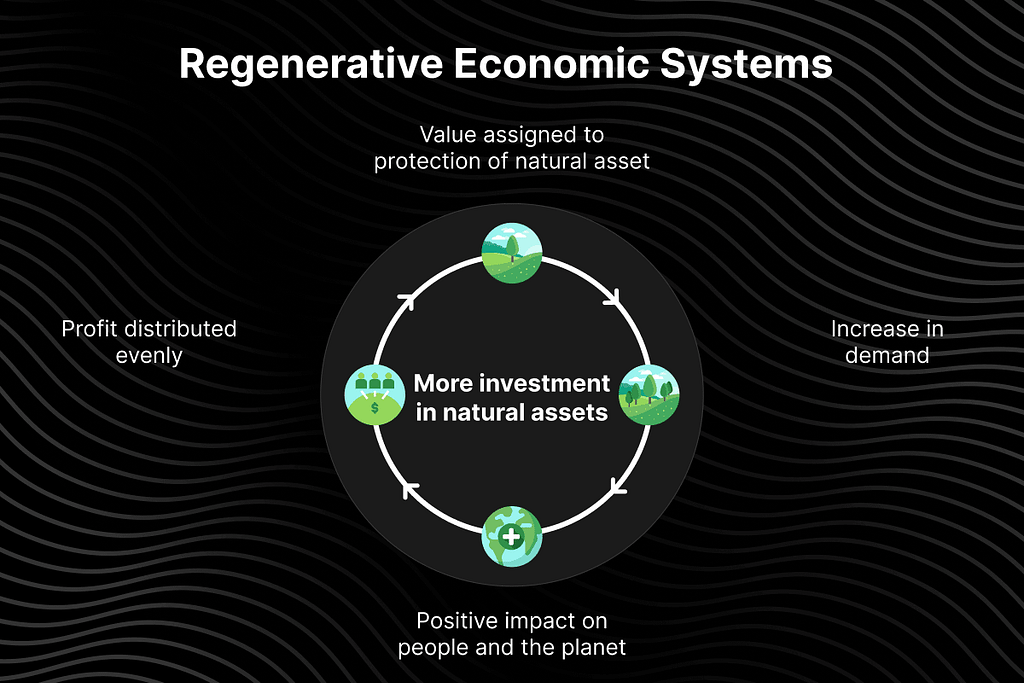

Regenerative Finance (ReFi) is grounded in a set of core principles that guide its operations. Central to ReFi is the concept of a circular economy, where resources are reused and recycled to minimize waste. This is often paired with regenerative agriculture, which focuses on restoring soil health and biodiversity. Additionally, ReFi focuses on social impact, aiming to create equitable and inclusive financial systems.

Blockchain technology is the foundation of ReFi, providing the infrastructure for transparent and secure transactions. By recording data immutably, blockchain offers the traceability of assets, from their origin to their end-use. This transparency builds trust and accountability within the ecosystem.

Decentralized Autonomous Organizations (DAOs) play a crucial role in ReFi governance. These community-led entities make decisions collectively through smart contracts, promoting a democratic approach to project management. DAOs allow stakeholders to participate actively in shaping the future of ReFi.

Tokenonomics or token economics is another essential component. By creating and distributing tokens, ReFi projects can incentivize positive environmental and social behaviors. These tokens can represent ownership, voting rights, or access to specific benefits, creating a dynamic system that rewards contributions to the ecosystem.

ReFi Projects and Use Cases

Carbon Markets and Offset Projects

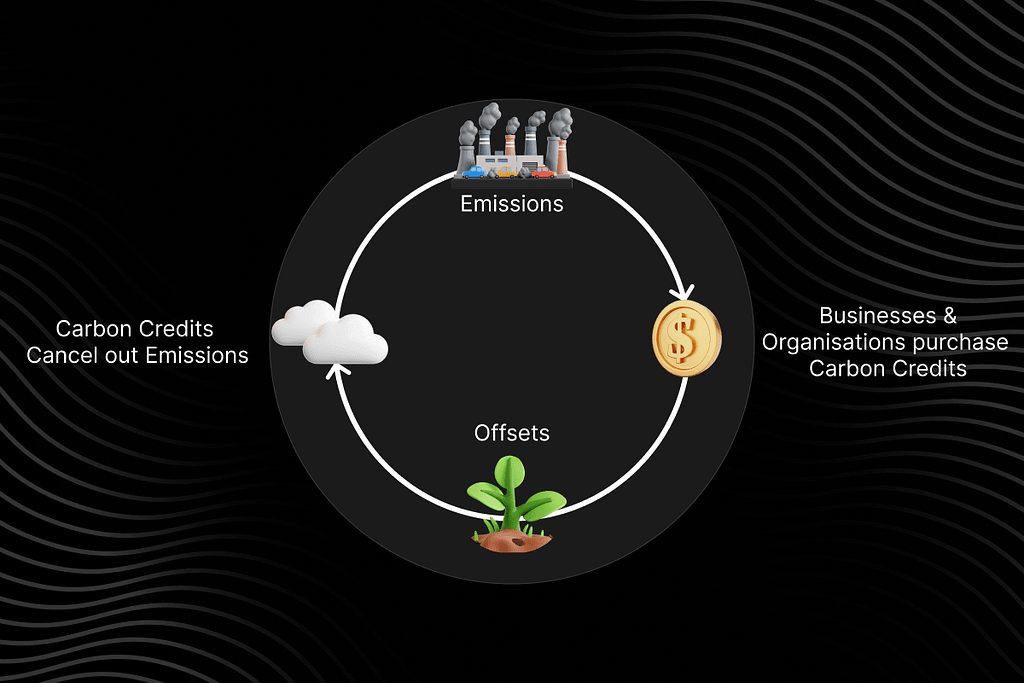

Carbon credits and offsets are essential components of the global effort to reduce greenhouse gas emissions. A carbon credit represents a permit to emit one ton of carbon dioxide or its equivalent in other greenhouse gases. Organizations can purchase these credits to offset their emissions, effectively supporting projects that reduce or remove carbon from the atmosphere.

ReFi platforms facilitate carbon market transactions by utilizing blockchain technology to ensure transparency and traceability. This technology allows stakeholders to verify carbon reductions and track the flow of funds, ensuring that investments are directed toward legitimate projects. Successful ReFi projects in carbon markets include initiatives like Moss, which tokenizes carbon credits from the Amazon rainforest, making them accessible to a broader audience while promoting conservation efforts. Another example is The Climate Trust, which invests in emission reduction projects and employs blockchain for authenticating and tracking carbon credits.

Renewable Energy Financing

Financing renewable energy projects often presents challenges, including high upfront costs and long payback periods. Traditional financing methods may not adequately address these hurdles, leaving many viable projects underfunded. ReFi platforms can offer innovative solutions, such as tokenized renewable energy assets and crowdfunding, to democratize access to capital.

For instance, projects like Triodos Bank utilize ReFi principles to finance renewable energy initiatives, providing impactful investments that yield both financial returns and positive environmental outcomes. By utilizing blockchain technology, these platforms can create a more efficient and transparent funding process, allowing a wider range of investors to participate in renewable energy projects.

Conservation and Biodiversity

Conserving biodiversity and ecosystems is critical for maintaining the planet’s health and resilience. ReFi projects focused on protecting and restoring ecosystems often employ nature-based solutions and ecosystem services tokenization to create financial incentives for conservation.

Successful projects in this area include initiatives that restore mangrove forests, which not only sequester carbon but also provide habitats for marine life and protect coastal communities from climate impacts. These projects generate both carbon credits and biodiversity credits, creating a dual benefit for investors and the environment. By integrating blockchain technology, these projects ensure that the benefits of conservation efforts are tracked and verified, encouraging greater accountability.

Social Impact Projects

ReFi has significant potential to address pressing social issues such as poverty, inequality, and access to finance. By focusing on social impact, ReFi projects can empower marginalized communities and create pathways for economic development.

Examples of successful ReFi projects in this domain include microfinance initiatives that provide small loans to environmentally sustainable businesses and impact investing funds that support social enterprises. These projects not only generate financial returns but also contribute to social equity and community well-being. By incorporating community participation and stakeholder governance, ReFi projects can distribute the benefits, leading to a more inclusive economy.

Challenges and Opportunities in ReFi

Regulatory Landscape

The nascent nature of ReFi presents both challenges and opportunities in the regulatory sphere. While many jurisdictions are still developing frameworks for digital assets and blockchain technology, there’s a growing recognition of the potential of ReFi. Regulatory clarity is essential for investor confidence and to ensure that ReFi projects adhere to environmental and social standards. However, overly restrictive regulations could discourage innovation. Regulators need to create a framework that allows ReFi projects to thrive while mitigating risks such as greenwashing and fraud. Opportunities lie in developing standardized definitions, reporting requirements, and impact measurement methodologies for ReFi projects.

Scalability and Adoption

Scaling ReFi projects can be challenging due to the complexity of integrating blockchain technology, tokenization, and regenerative principles. Strategies to increase adoption include raising awareness among investors about the potential benefits of ReFi, providing educational resources, and demonstrating the real-world impact of successful projects.

Collaborations between ReFi initiatives and traditional financial institutions can also help drive adoption by leveraging existing infrastructure and distribution channels. Governments can support ReFi adoption through incentives, such as tax credits or preferential treatment for sustainable investments.

Interoperability and Standardization

Interoperability between different ReFi platforms is crucial for creating a cohesive ecosystem and facilitating the flow of capital across projects. Standardized metrics and reporting frameworks are necessary for investors to compare and evaluate ReFi opportunities.

Initiatives like the Impact Management Project and the Sustainability Accounting Standards Board are working towards developing common impact measurement and reporting standards. Blockchain-based protocols that allow for cross-chain interoperability, such as Polkadot and Cosmos, can facilitate the exchange of assets and data between ReFi platforms.

The Future of ReFi

The future of ReFi is promising, with emerging technologies and evolving market dynamics shaping its trajectory. Advancements in DeFi, such as DeFi 2.0 and interchain protocols, can boost the efficiency and accessibility of ReFi platforms. The integration of artificial intelligence and machine learning can optimize impact measurement and risk assessment. As ReFi matures, it can redefine the relationship between finance and nature, creating a more sustainable and equitable world.

ReFi and Your Business

ReFi offers an effective framework for businesses to enhance their Corporate Social Responsibility (CSR) initiatives. By integrating ReFi principles, businesses can invest in projects that promote sustainability, such as renewable energy, carbon offset programs, and community development. This alignment not only strengthens a company’s commitment to CSR but also boosts its brand reputation and stakeholder trust.

Implementing ReFi strategies can lead to measurable outcomes that demonstrate a company’s dedication to positive change. For example, businesses can participate in carbon credit markets, supporting projects that reduce emissions while also achieving their sustainability targets. Such initiatives can create a competitive advantage, as consumers increasingly prefer brands that prioritize environmental and social responsibility.

Investment Opportunities

ReFi offers various investment opportunities for businesses looking to engage in sustainable finance. Companies can invest in projects that focus on renewable energy, sustainable agriculture, and community development, providing both financial returns and positive environmental impacts.

Opportunities in ReFi include investing in tokenized assets that represent renewable energy projects or participating in crowdfunding campaigns for social enterprises. These investments contribute to sustainable development as well as yield attractive returns, making them appealing to socially conscious investors. As the demand for sustainable investment options grows, businesses that engage in ReFi can position themselves as leaders in the transition to a more regenerative economy.

Partnerships and Collaborations

Collaboration with ReFi organizations presents significant opportunities for businesses to amplify their impact. By partnering with ReFi platforms, companies can access innovative funding mechanisms and participate in projects that align with their sustainability goals.

For instance, businesses can collaborate with NGOs focused on regenerative agriculture or conservation efforts, tapping into their resources and expertise to scale impactful initiatives. Additionally, forming alliances with other companies in the ReFi space can encourage knowledge sharing and drive collective action toward sustainability.

Furthermore, engaging in partnerships opens up new markets and customer bases for companies, as consumers increasingly seek out brands that are committed to environmental and social responsibility. By working together with ReFi organizations, businesses can contribute to a more sustainable future while also achieving their strategic objectives.

The Bottom Line

As we’ve explored, Regenerative Finance (ReFi) offers a promising path towards a more sustainable and equitable future. By aligning financial activities with environmental and social regeneration, ReFi can drive positive change on a global scale.

We encourage you to explore existing projects, learn about the technologies involved, and consider how you can contribute to this movement. Whether it’s through investment, partnerships, or adopting ReFi principles within your organization, your involvement can make a significant difference.

The future of ReFi is bright. With increasing awareness, technological advancements, and supportive policies, we can anticipate a world where finance is a force for good. By adopting ReFi principles, we can create a sustainable and prosperous future for generations to come.

Source — https://www.codezeros.com/regenerative-finance-refi-a-sustainable-approach-to-finance