The world economy’s tectonic plates will shift this week when a US easing cycle begins, just as officials from Europe to Asia set policy against a backdrop of brittle markets.

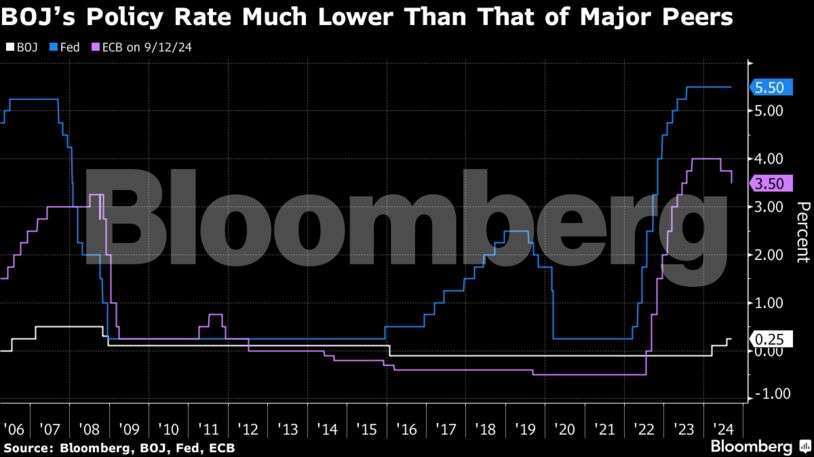

A 36-hour monetary rollercoaster will start with the Federal Reserve’s probable decision to cut interest rates on Wednesday, and finish on Friday with the outcome of the Bank of Japan’s first meeting since it raised borrowing costs and helped sow the seeds of a global selloff.

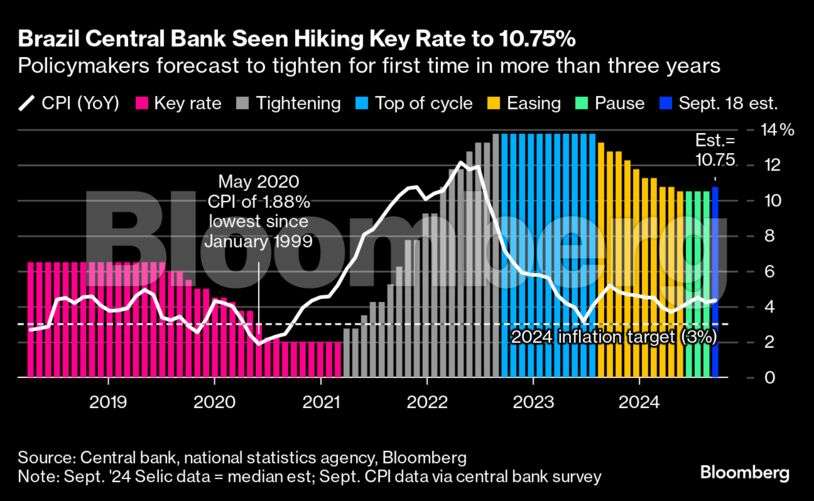

Along the way, central banking peers in the Group of 20 and beyond that are poised to adjust their own policy levers include Brazil, where officials may tighten for the first time in 3 1/2 years, and the Bank of England. The UK central bank faces a delicate judgment on the pace of its balance-sheet unwind, and may also signal how ready it is to ease further.

South African policymakers are anticipated to cut borrowing costs for the first time since 2020, while counterparts in Norway and Turkey may keep them unchanged.

The Fed decision will take center stage, with jittery traders debating whether officials will judge a quarter-point cut to be adequate medicine for an economy showing signs of losing momentum, or whether they’ll opt for a half-point move instead. Clues on the Fed’s future intentions will also be pivotal.

But for all the end to suspense that the US announcement will bring, investors are likely to stay on edge at least until the BOJ is done, in a decision that’s bound to be scrutinized for clues on its next hike.

What Bloomberg Economics Says:

“We think Fed Chair Jerome Powell supports a 50-basis point cut. However, the lack of a clear signal from New York Fed President John Williams before the pre-meeting blackout period makes us think Powell doesn’t have the full committee’s support.”

—Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou and Chris G. Collins, economists.

Focusing minds will be memories of market ructions a few weeks ago amid the unwind of yen-centered carry trades after its rate increase in July.

And that’s not all: China could be in the limelight too, with a monetary announcement by officials there anticipated at some point — days after data showed that the world’s second-biggest economy is suffering signs of spiraling deflation.

US and Canada

When Fed policymakers sit down Tuesday for the start of their two-day meeting, they’ll have fresh figures on the state of consumer demand. While overall retail sales in August were likely held back by slower activity at auto dealers, receipts at other merchants probably posted a healthy advance.

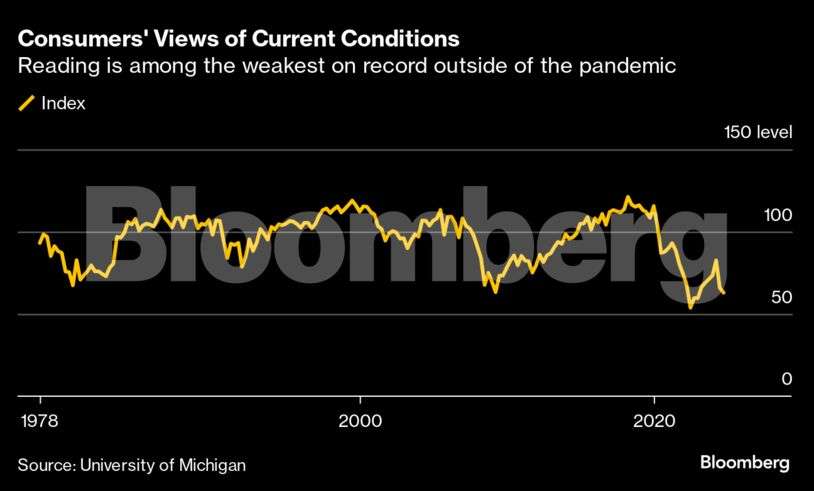

Despite signs of consumer resilience, a Fed report out the same day is expected to show lingering malaise in factory output. Looming November elections and still-high borrowing costs are restraining capital spending.

On Wednesday, government figures are seen showing that housing starts firmed up last month after sliding in July to the lowest level since May 2020.

National Association of Realtors data on Thursday will probably show contract closings on previously owned home sales remained weak, though.

Canada’s inflation reading for August is likely to show continued deceleration in both headline and core measures. A slight uptick wouldn’t knock the Bank of Canada off its easing path, however, while cooler-than-expected data may boost calls for deeper rate cuts.

Asia

BOJ chief Kazuo Ueda is bound to get a lot of attention after the board sets policy on Friday.

While economists are unanimous in predicting no change to borrowing costs, how the governor characterizes the trajectory could jolt Japan’s currency, which has already spooked yen-carry traders by outperforming its peers so far this month.

Elsewhere, 1-year medium-term lending and loan prime rates in China are expected to be kept unchanged, and Indonesia’s central bank is tipped to hold its policy rate steady for a fifth month. Authorities in Taiwan decide the discount rate on Thursday.

On the data front, Japan’s key consumer inflation gauge is seen ticking higher a tad in August, backing the case for the BOJ to eye a rate hike in coming months.

Japan, Singapore, Indonesia and Malaysia will release trade figures, while New Zealand is set to report second-quarter data that may show the economy contracted a smidgeon versus the prior quarter.

Europe, Middle East, Africa

Several central bank decisions are scheduled in the wake of the Fed’s likely easing. Given their dependence on dollar-denominated energy exports, Gulf states may follow the US lead automatically with rate cuts of their own.

Here’s a quick roundup of other announcements due in Europe, the Middle East and Africa, mainly on Thursday:

While no rate change is expected from the BOE, investors await a crucial judgment on whether it will accelerate the wind-down of its bond portfolio to keep gilt sales steady before a year when an unusually high amount of debt matures. Hints on the pace of future rate cuts will also be eagerly awaited, amid speculation that officials will soon ramp up easing to aid the economy.

Norges Bank is seen keeping its deposit rate at 4.5%, with analysts focusing on any adjustments to projections for easing early next year. While slowing inflation has increased bets on a first cut in December, Norwegian officials may stick to their hawkish stance with the labor market robust and the krone near multi-year lows.

Central banks in Ukraine and Moldova are also scheduled for decisions.

Turning south, Turkey’s central bank is set to keep its key rate at 50% for a sixth straight meeting as it waits for inflation to slow further. The pace of annual price growth has dropped from 75% in May, but remains as high as 52%. Officials hope to get it close to 40% by year-end.

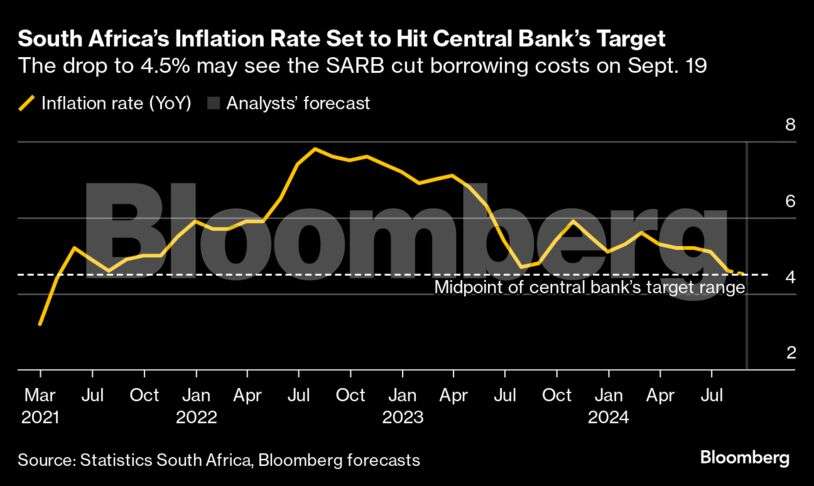

With data on Wednesday predicted to show South Africa’s inflation slowed to 4.5% in August, the central bank may cut borrowing costs for the first time since 2020 a day later. Governor Lesetja Kganyago has said the institution will adjust rates once price growth is firmly at the 4.5% midpoint of its target range, where it prefers to anchor expectations. Forward-rate agreements, used to speculate on borrowing costs, are fully pricing in a chance of a 25-basis-point rate cut.

Angola’s decision may be a close call between a hike and a hold. While inflation is easing, the currency has weakened almost 7% since August against the dollar.

On Friday, Eswatini, whose currency is pegged to South Africa’s rand, is expected to follow its neighbor and lower rates.

Elsewhere, comments from European Central Bank officials may be scrutinized for any hints on the path of future easing after a second cut to borrowing costs. Several governors are scheduled to appear, and President Christine Lagarde will deliver a speech in Washington on Friday.

Other things to watch include euro-area consumer confidence on Friday, and outside the currency zone, Swiss government forecasts on Thursday.

Turning south, data on Sunday are expected to show Israel’s inflation remained steady at 3.2% in August, still above the government’s target of 1% to 3%.

The economy is weakening, but the war in Gaza is causing supply-side constraints and government spending is soaring, keeping inflationary pressures high.

In Nigeria on Monday, data will likely show inflation slowed for a second straight month in August, to 32.3%. That’s as the impact on prices of a currency devaluation and temporary removal of fuel subsidies last year continue to wane.

The measures were part of reforms introduced by President Bola Tinubu after he took office in May 2023.

Latin America

Brazil’s central bank meets against the backdrop of an overheating economy, above-target inflation, unmoored CPI expectations and government fiscal largesse.

Putting it all together, investors and analysts expect to see tighter monetary policy for first time in 3 1/2 years on Wednesday. The consensus is for a 25 basis-point hike to 10.75%, with another 75 basis points of tightening to follow by year-end, taking the key rate to 11.5%.

Six July economic reports from Colombia should underscore the resilience of domestic demand that has analysts marking up their third- and fourth-quarter growth forecasts.

The pace of retail sales may build on June’s positive print, which snapped a 16-month slide, while the early consensus has GDP-proxy data showing a rebound in activity after June’s mild slump.

Paraguay’s rate setters meet with inflation running slightly above the 4% target. Analysts surveyed by the central bank see a 25 basis-point cut by year-end.

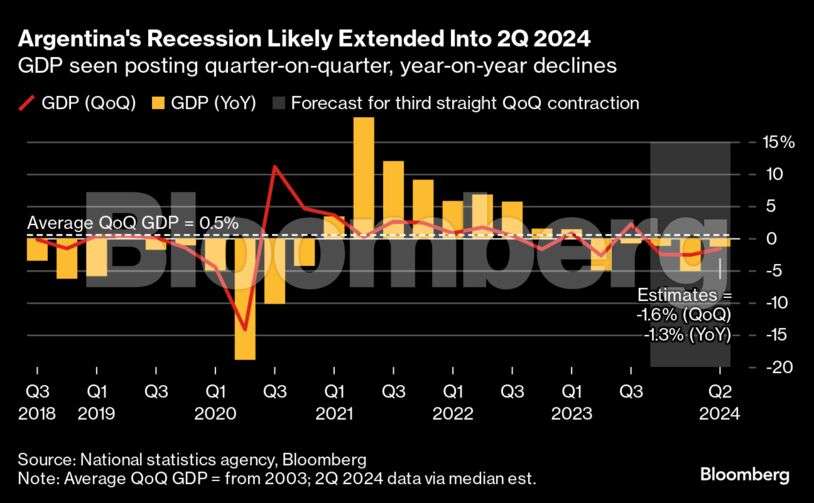

After roughly 10 months of President Javier Milei’s so-called shock therapy, this week is set to offer some telling data on the state of Argentina’s economy.

Budget data may show the government posted an eighth straight monthly budget surplus in August, while that same scorched-earth austerity contributed to a third straight quarterly contraction in output.