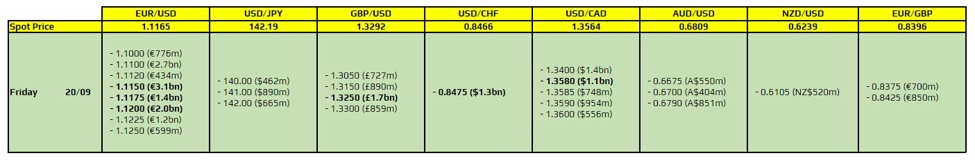

There are a couple to take note of on the day, as highlighted in bold.

The first ones are for EUR/USD and layered between 1.1150 and 1.1200. Given the more muted action so far, the expiries could keep price action in check before rolling off later in the day. If the dollar does weaken further, the ones at 1.1200 might help to keep a lid on things alongside resistance from the August highs.

Then, there is one for GBP/USD at the 1.3250 level. It isn’t one that bears any technical significance though, but may just help to limit any downside extensions to price action during the session ahead. Otherwise, it might not factor much into play whatsoever.

As for the one for USD/CHF at 0.8475, it could just act as a bit of a draw for price action before rolling off later. The pair is caught in a bit of a consolidative phase, with the SNB also not wanting the franc to strengthen too much at this stage. So, there’s that to consider too in the bigger picture besides just the prevailing dollar sentiment.

And lastly, there is one for USD/CAD at the 1.3580 level. It sits near the 200-day moving average as well as the confluence of the 100 and 200-hour moving averages currently. As such, the expiries could help to provide a bit of a ceiling alongside those key technical levels to price action before we get to North America trading later. We do have Canadian retail sales on the agenda and then having to work through another round of dollar musings before the weekend.

For more information on how to use this data, you may refer to this post here.