By RoboForex Analytical Department

The USD/JPY pair has found a stable footing around 143.22 as investors carefully analyse the recent comments from Bank of Japan Governor Kazuo Ueda. His remarks suggest that the BoJ is taking a measured approach to monetary policy adjustments, signalling a possible delay in interest rate hikes.

Governor Ueda emphasised the need to thoroughly analyse market and economic conditions before making policy decisions, indicating that immediate rate hikes are unlikely. He also highlighted external risks, including financial market volatility and uncertainties surrounding the US economy, which are critical considerations for Japan’s monetary policy.

At its September meeting, the BoJ maintained the interest rate at 0.25% per annum, aligning with market expectations. Speculation suggests that the October meeting may not change the Monetary Policy Committee’s structure. Still, by December, the BoJ might gather sufficient evidence to justify a rate increase.

The recent dip in the US dollar, spurred by weak consumer confidence figures in the US, has incidentally strengthened the yen. This shift has heightened expectations for further rate cuts by the Federal Reserve.

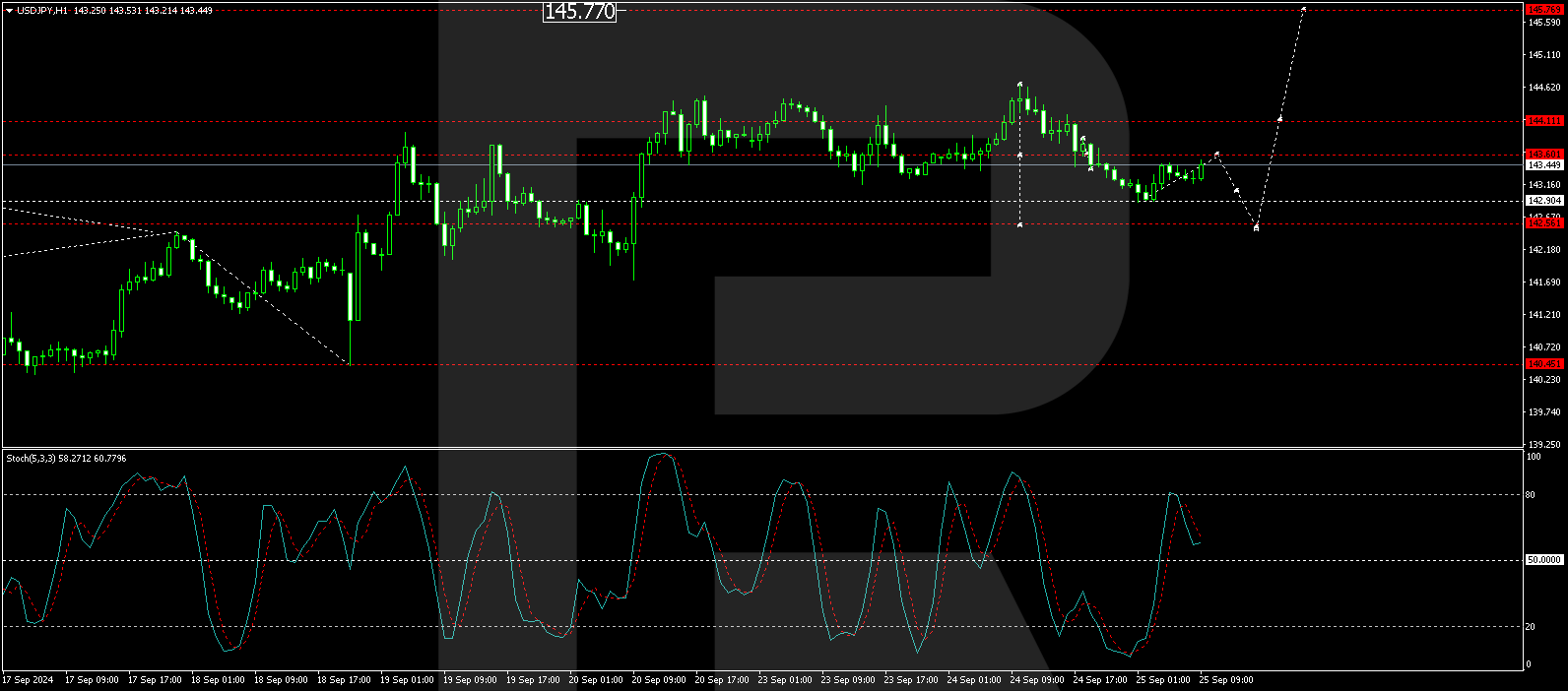

Technical Analysis of USD/JPY

The USD/JPY is currently in a broad consolidation range centred around 143.43, extending to 144.66. The market has initiated a downward movement towards 142.55, testing this level from above. Subsequently, we anticipate a rebound to the upper boundary of this range. A breach above 144.70 could pave the way for a rise to 145.77, potentially extending to 146.66. Conversely, a decline to 142.00 and a subsequent breakdown could signal a trend continuation towards 137.77. The MACD indicator supports this bullish scenario, with its signal line positioned above zero and pointing upwards.

On the H1 chart, USD/JPY has crafted a consolidation range around 143.60, achieving the 142.90 local downside target. The pair is now moving upward towards 143.60, testing this level from below. The current setup suggests a retest of 143.60 could be followed by a new decline towards 142.55. The Stochastic oscillator, with its signal line above 50 and pointing upwards, corroborates this potential for a brief uptick followed by a continued downward trajectory.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- USD/JPY Stabilises Amid Bank of Japan’s Cautious Signals Sep 25, 2024

- Chinese indices rise on PBoC stimulus. In Australia, inflationary pressures are easing Sep 25, 2024

- Markets rally on China stimulus cheer Sep 24, 2024

- AUD/USD Reaches Yearly High Amid Positive Stimulus News from China Sep 24, 2024

- China announced a broad stimulus for the economy. The RBA kept the rate at 4.35% Sep 24, 2024

- Gold Reaches New Record as Investors Eye Further Rate Cuts Sep 23, 2024

- Bitcoin has reached the $64000 mark. Oil rises amid escalating conflict in the Middle East Sep 23, 2024

- COT Metals Charts: Speculator Bets led by Gold, Silver & Platinum Sep 21, 2024

- COT Bonds Charts: Speculator Bets led by Fed Funds & 5-Year Bonds Sep 21, 2024

- COT Stock Market Charts: Speculator Bets led by VIX & DowJones-Mini Sep 21, 2024