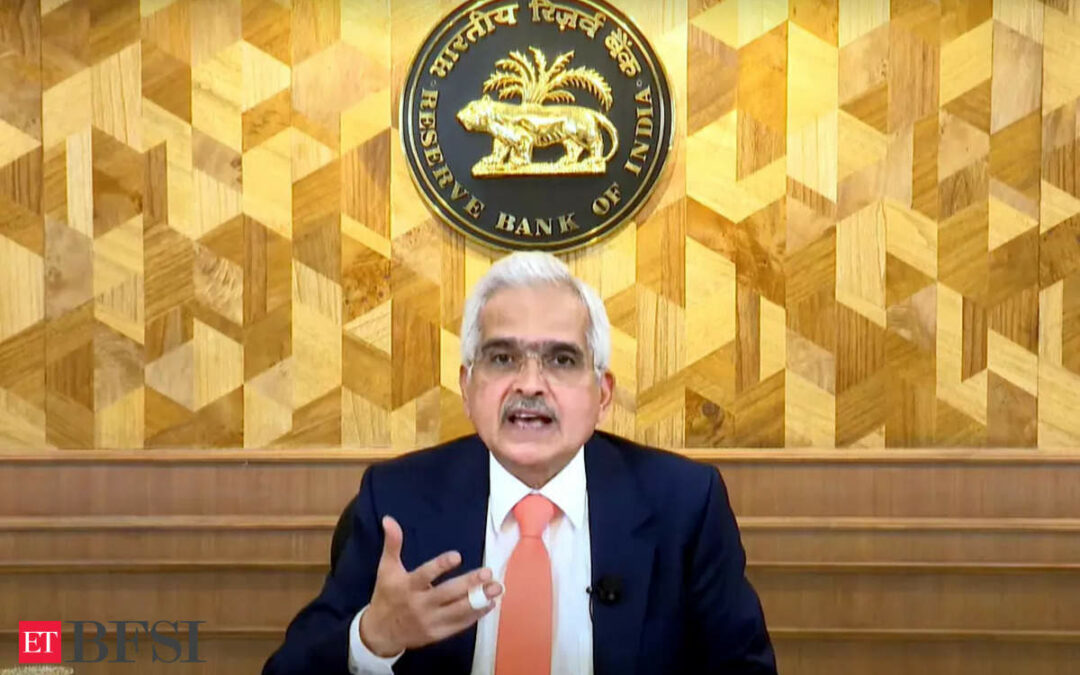

The Reserve Bank of India (RBI) has kept the policy rate unchanged for the tenth consecutive time, maintaining a steady approach to interest rates. However, the central bank has shifted its stance to “neutral” signalling potential changes in the months ahead. This adjustment leaves room for future rate cuts, depending on the evolving economic conditions. But what exactly does a “neutral stance” mean, and how might it impact interest rates? Here’s a detailed explainer.

What is a neutral stance in monetary policy?

A neutral stance in monetary policy means that the central bank, in this case, the RBI, is neither biased towards increasing nor decreasing interest rates in the immediate future. It reflects a balanced approach where the RBI will assess economic conditions like inflation, growth, and external factors before making a decision on the next move regarding interest rates.

This stance signals flexibility, meaning the RBI is open to either tightening (increasing rates) or easing (cutting rates) based on the evolving economic environment. It contrasts with other stances like “accommodative” (which favors rate cuts) or “hawkish” (which leans toward rate hikes).

What was the RBI’s stance before the shift to neutral?

Until this recent shift to a neutral stance, the Reserve Bank of India (RBI) had maintained an “accommodative stance” in its monetary policy. An accommodative stance means the central bank was focused on supporting economic growth by keeping interest rates low or signaling a bias towards reducing them further if necessary. This was largely in response to the economic challenges posed by the COVID-19 pandemic, with the goal of ensuring liquidity and encouraging borrowing to stimulate the economy.

By keeping the stance accommodative, the RBI aimed to balance economic recovery with inflation control, allowing for monetary easing when required to boost growth. However, inflationary pressures and improving economic conditions have led the RBI to reassess this approach, now shifting to a neutral stance to better respond to future developments.

How will the neutral stance impact interest rates?

A neutral stance opens the door for potential rate cuts in the near future if economic conditions, such as lower inflation or slowing growth, warrant it. In this case, since the RBI did not raise rates for the tenth consecutive time, it might be waiting for more data to justify a rate cut in upcoming policy meetings.

The RBI’s shift to neutral allows it to remain flexible in its policy decisions. While a cut could be on the horizon, the central bank will carefully monitor key economic indicators, such as inflation trends, GDP growth, global uncertainties, and currency movements, before making a definitive move. The neutral stance ensures that the RBI is not locked into any particular direction, giving it room to maneuver depending on the economic situation.

With a neutral stance, businesses and consumers can expect interest rates to remain stable in the short term. However, if inflation remains under control and growth slows, the neutral stance increases the chances of future rate cuts, which would lower borrowing costs for loans like mortgages, auto loans, and business credit.