The BFSI (Banking, Financial Services, and Insurance) sector witnessed a significant increase in deal activity in the third quarter of CY24, marking the highest quarterly volumes and the second-highest quarterly values since Q2 CY22.

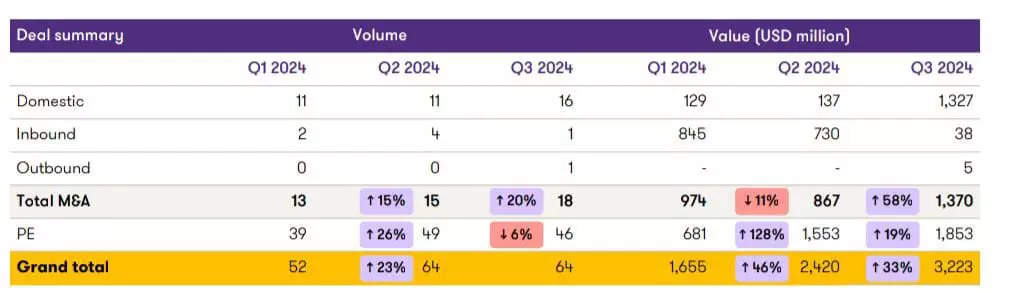

Q3 CY24 saw as many as 64 deals in the BFSI sector valued at USD 3.2 billion, reflecting a 16 per cent increase in volume and a 50 per cent increase in value compared to Q3 CY23, revealed a latest report by Grant Thornton Bharat.

This surge in deal activity was driven by heightened investor interest, with domestic deals dominating the landscape, accounting for 89 per cent of the total volume and 97 per cent of the total value.

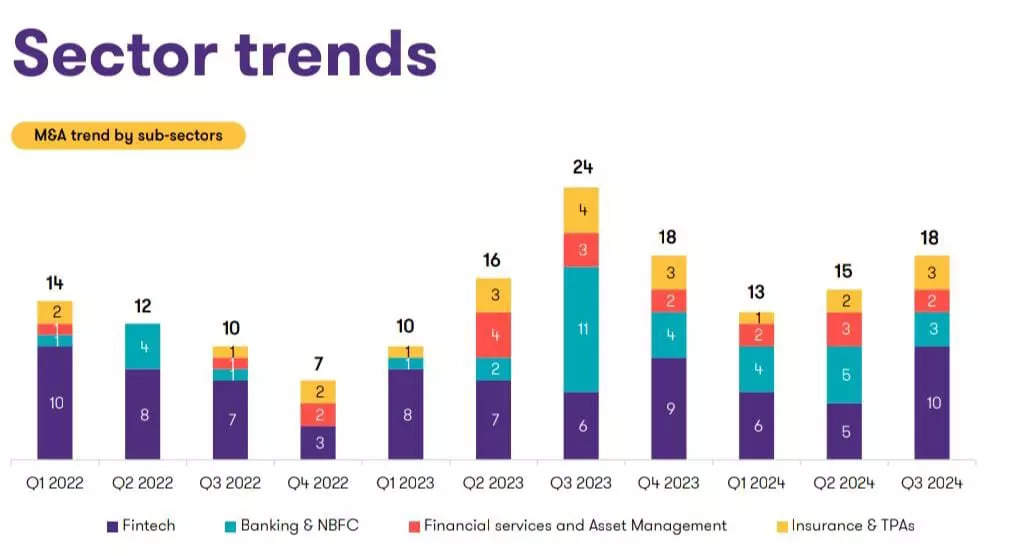

The fintech segment alone contributed 50 per cent of the deal volumes, while the banking, NBFC, financial services, and asset management sectors together accounted for 91 per cent of the total values, said the report.

M&A activity showed stable growth with 18 deals worth USD 1.4 billion, primarily driven by the sale of stressed assets of IDFC bank to Omkara AMC for USD 741 million, which accounted for 54 per cent of the deal values.

Private equity activity saw 46 deals worth USD 1.9 billion, marking a slight decline in volumes but a 19 per cent increase in values.

The quarter also saw 2 IPOs worth USD 884 million, compared to 3 issues worth USD 692 million in Q2 2024.

Notably, Bajaj finance’s USD 790 million issue is one of the largest and successful IPO’s that experienced significant gains upon listing, driven by strong retail investor participation, indicating a robust appetite for investment in the NBFC sector, the report added.

QIP activity recorded the second-highest quarterly volumes in the last five years and the highest quarterly deal values for the year 2024. Additionally, companies have been able to leverage favourable market conditions to raise capital efficiently and at competitive terms.

Sectoral Trends

The fintech segment continued to lead the sector in terms of volumes, with 39 deals worth USD 475 million, accounting for a substantial 61 per cent stake, the report highlighted.

In contrast, the banking and NBFC segment led in terms of values, with 13 deals valuing USD 1.8 billion, marking a 55 per cent share. The financial services and asset management segment saw a significant rise of 50 per cent in terms of deal volumes and a 42x increase in values over the previous quarter.

Insurance & TPAs space witnessed steady deal volumes, while a significant decline of 92 per cent in terms of values due to the absence of high-value deals in the segment over Q2 2024, said the report.

Notably, JM Financial Group made two acquisitions across NBFC, financial services, and asset management segments, contributing to two high-value deals (over USD 100 mn) adding up to USD 257 million.

Additionally, CVC Capital Partners acquired a 27 per cent stake in Aavas Financiers from Partners Group and Kedaara Capital for an estimated worth of USD 410 million, marking the largest buyout in the housing finance industry, the report added.

With interest rates likely to decrease in the near term, deal-making in the BFSI sector is expected to increase, driven by growing investor confidence and a focus on significant investments.