FNG Exclusive… FNG has learned via regulatory filings that Trive Financial Services UK Limited, which operates the Trivepro institutional brokerage brand, posted an 18% decline in Revenues in 2023, and halving of its profits, ahead of a decision made earlier this year to apply to cancel the company’s FCA license.

Revenues at Trivepro came in at £8.85 million (USD $11.6 million) in 2023, down from £10.79 million the previous year. Net Profit at Trivepro for 2023 was £1.33 million, versus £2.68 million in 2022.

During the year the company also made a significant capital reduction, actively reducing its Share Capital to £27.0 million by returning £17.2 million of shares to its immediate parent.

As was also exclusively reported here at FNG back in July, the Trive Financial group has applied to cancel its UK FCA license, as the group apparently prepares to depart the UK market. The application to cancel is still pending with the FCA. Trivepro had held its FCA license since 2010. The move came after Trivepro saw the departure earlier this year of its CEO Adam Dougall, as well as institutional sales head David Papier who joined CPT Markets.

Shravan Joshi MBE, an elected member of the Court of Common Council for Bishopsgate Ward, in the City of London Corporation, has also stepped off the board of directors of Trive Financial Services UK Limited.

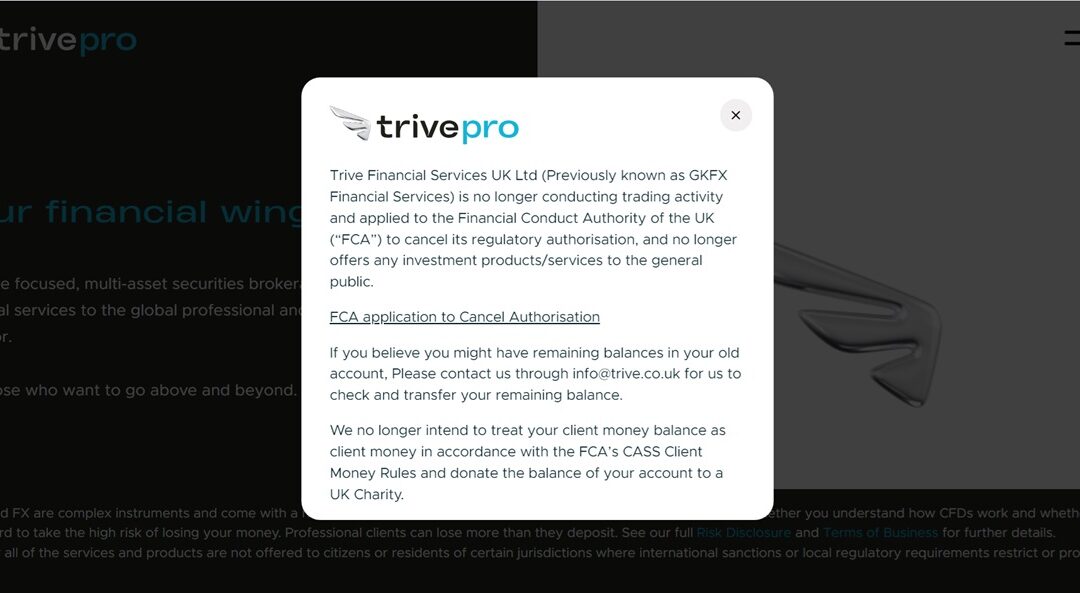

A message pop-up on the Trivepro website (trivepro.co.uk) now reads:

Trive Financial Services UK Ltd (Previously known as GKFX Financial Services) is no longer conducting trading activity and applied to the Financial Conduct Authority of the UK (“FCA”) to cancel its regulatory authorisation, and no longer offers any investment products/services to the general public.

If you believe you might have remaining balances in your old account, Please contact us through info@trive.co.uk for us to check and transfer your remaining balance.

We no longer intend to treat your client money balance as client money in accordance with the FCA’s CASS Client Money Rules and donate the balance of your account to a UK Charity.

Trivepro is a multi-asset securities brokerage offering online financial services to financial professional and institutional investors, acting as the institutional brokerage arm of the Trive brokerage brand. We had exclusively reported in early 2023 that Retail FX and CFDs broker GKFX (and its institutional brokerage sister arm in the UK, GKPro) were both rebranding to Trive. That followed a 2022 restructuring at parent company Global Kapital Group in Turkey, which saw Global Kapital Group transfer ownership of its retail (GKFX) and institutional (GKPro) brokerage arms to Amsterdam based Trive, in which Global Kapital Group controlling shareholder Kasim Garipoğlu also has a controlling interest, via his Trive Investments B.V. holding company.

The company’s Malta-licensed operation runs the Retail FX part of the business. That operation was renamed from AKFX Financial Services Ltd to Trive Financial Services Malta Limited as part of the aforementioned restructuring. The retail brand was then changed from GKFX to just Trive, and the institutional brand to Trivepro, operated out of the UK.