By RoboForex Analytical Department

Gold prices recovered, reaching 2,644.00 USD per troy ounce on Friday, as investors navigated mixed signals from recent US economic data. The resilience in September’s employment market introduced some hesitations regarding the Federal Reserve’s pace of monetary easing, as the robust job data might warrant a less aggressive approach to rate cuts.

Recent inflation reports further complicated the market. While the overall consumer price index slowed, it was less than anticipated, and core inflation, which excludes volatile food and energy prices, actually increased. These developments have hindered progress in easing price pressures, leading to adjustments in expectations for US monetary policy.

Initially, there was speculation of a significant 50-basis-point rate cut; however, given the current economic landscape, a more conservative rate cut of 25 basis points is now deemed more likely at the Fed’s November meeting. This scenario holds an 86% probability, according to market forecasts. For gold, which does not yield coupon income, the prospect of easing by the US Federal Open Market Committee (FOMC) remains a positive catalyst, particularly in a lower interest rate environment where bonds and other interest-bearing assets become less competitive.

Despite the recent uptick, gold is on track to register its second consecutive weekly decline.

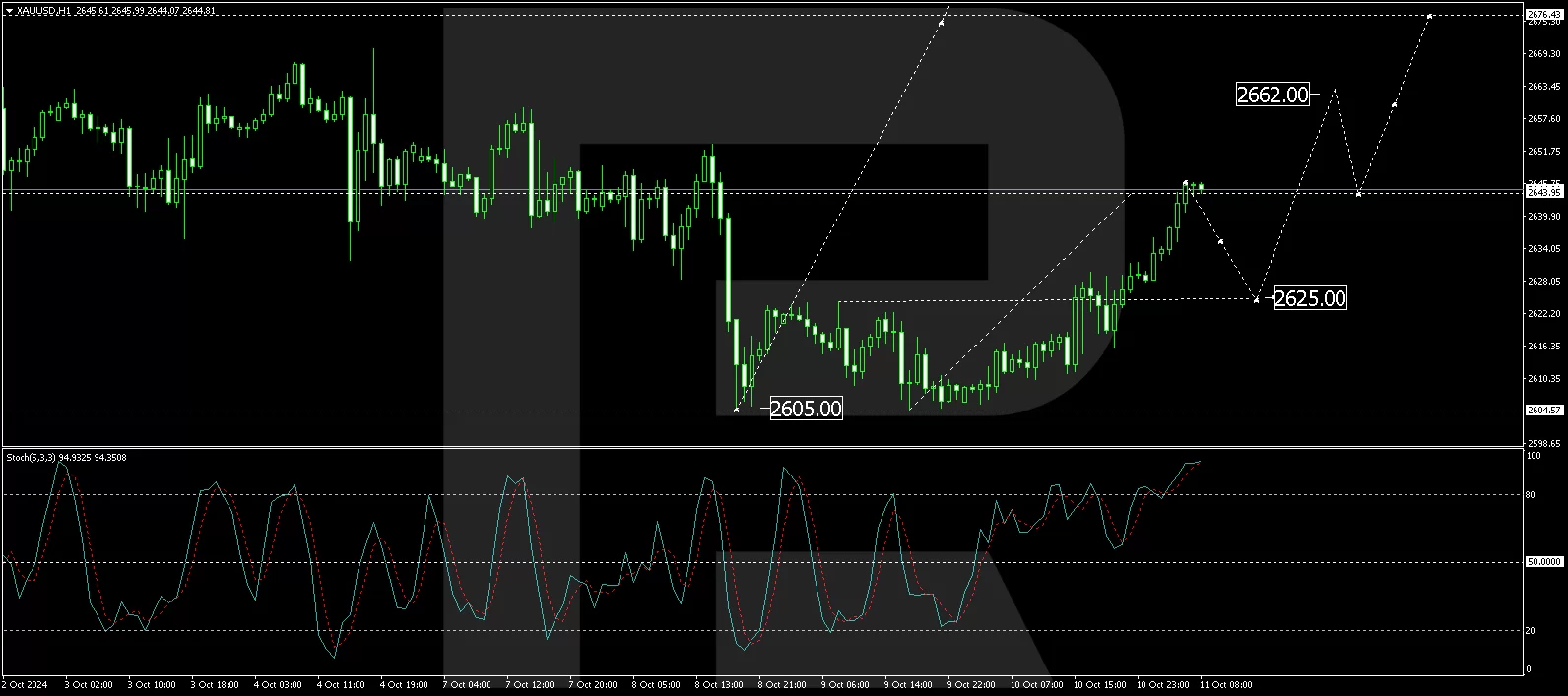

Technical analysis of gold (XAU/USD)

The gold market experienced a correction down to 2,605.00 but has since shown signs of resurgence. The current technical setup suggests a potential continuation towards 2,676.50, which would mark the next target in this upward trend. Following the achievement of this level, a correction back to 2,645.00 may occur. This bullish scenario is supported by the MACD indicator, which, although below zero, is gearing up for a potential rise, indicating strengthening momentum.

On the hourly chart, gold has formed a consolidation range above 2,605.00 and has broken upwards. It nearly reached the target of 2,644.00. Today, we might see the formation of a narrow consolidation range, and if a downward exit occurs, a corrective move to 2,625.00 could be expected. Following this correction, the market may gear up for another rise towards 2,662.00. This forecast is technically backed by the Stochastic oscillator, with its signal line currently above 80 but poised to start a decline, suggesting a short-term pullback before further gains.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Gold Recovers Amid Mixed US Economic Indicators Oct 11, 2024

- Hurricane Milton is putting downward pressure on natural gas and upward pressure on oil Oct 11, 2024

- Investors expect inflationary pressures to ease in the US. The People’s Bank of China launched a mechanism to support the stock market Oct 10, 2024

- AUD/USD Stabilises Near Monthly Low Amid Mixed Signals Oct 10, 2024

- USDInd: Eyes 100-day SMA ahead of US CPI data Oct 10, 2024

- RBNZ cut the rate by 0.5%. RBI kept the rate at 6.5% for the tenth consecutive meeting Oct 9, 2024

- NZD/USD Hits Seven-Week Low Amid Ongoing Sell-off and RBNZ Rate Cuts Oct 9, 2024

- Is This Copper Co. Extremely Undervalued? Oct 8, 2024

- RBA plans to hold rates until the end of the year. The US stock market is under pressure from rising bond yields. Oct 8, 2024

- Oil rises amid escalating conflict in the Middle East. Inflationary pressures are easing in Vietnam Oct 7, 2024