By InvestMacro

Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday October 8th and shows a quick view of how large market participants (for-profit speculators and commercial traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the euro will decline versus the dollar.

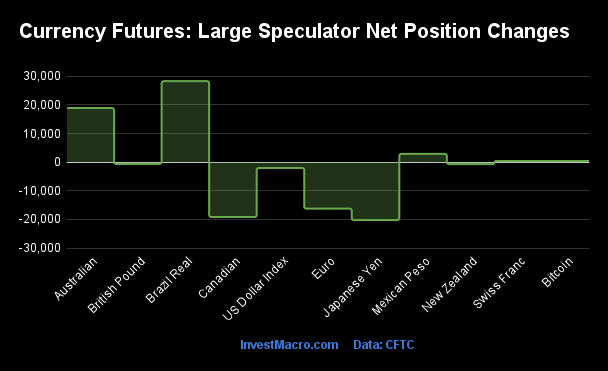

Weekly Speculator Changes led by Brazilian Real & Australian Dollar

The COT currency market speculator bets were slightly lower overall this week as five out of the eleven currency markets we cover had higher positioning while the other six markets had lower speculator contracts.

Leading the gains for the currency markets was the Brazilian Real (28,276 contracts) with the Australian Dollar (18,894 contracts), the Mexican Peso (2,894 contracts), Bitcoin (402 contracts) and the Swiss Franc (395 contracts) also showing positive weeks.

The currencies seeing declines in speculator bets on the week were the Japanese Yen (-20,244 contracts), the Canadian Dollar (-19,148 contracts), the EuroFX (-16,229 contracts), the US Dollar Index (-2,043 contracts), the New Zealand Dollar (-689 contracts) and the British Pound (-630 contracts) also registering lower bets on the week.

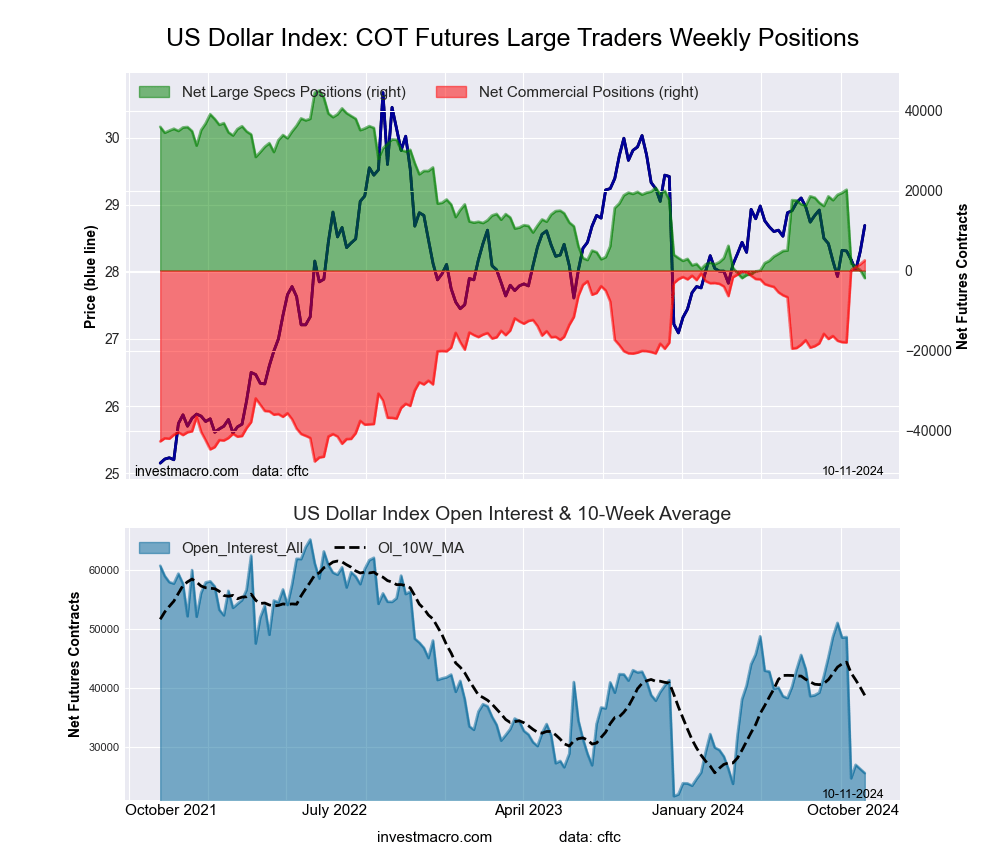

US Dollar Index Speculator bets fall for 4th straight week to 6-month low

Highlighting the COT currency’s data this week is the decrease in the speculator’s positioning in the US Dollar Index. The large speculative US Dollar Index positions declined for a fourth straight week and have now dipped by a total of -22,099 net contracts over this 4-week period. This recent weakness has pushed the US Dollar Index speculator net position into an overall bearish position at a total of -1,889 contracts. The current speculator standing now resides at the lowest level since April 2nd, a span of 27 weeks.

The Dollar Index sentiment has been feeling the pressure over the past few months with US inflation steadily coming down since the highs of 2022 and with the government interest rates already in a cutting cycle. The US Federal Reserve reduced the benchmark interest rate by 50 basis points at the last central bank meeting and brought the current rate down to a range of 4.75-5.00 percent.

There was an expectation of another jumbo rate cut coming up but a recent strong jobs report combined with a recent sticky inflation report puts a higher probability now for a smaller rate cut or even the possibility of a Fed hold. The CME Fedwatch tool shows at the current time, there is a 89.5 percent probability outlook that the Fed will cut the rate by another 25 basis points at the November 7th meeting while there is also 10.5 percent probability outlook that the Fed will hold the rate steady next month.

Despite the recent sentiment deficit, the US Dollar Index price has had a strong couple of weeks after falling to and rebounding off the 100.15 level on September 27th. Including September 30th, the Dollar Index has risen in nine out of the past ten days and closed this week right below 103.00 at a close of 102.91. We will see if this strength in the USD continues and whether the Dollar Index can get over the 103.00 support/resistance barrier or perhaps, head back lower toward 100.

Currencies Net Speculators Leaderboard

Legend: Weekly Speculators Change | Speculators Current Net Position | Speculators Strength Score compared to last 3-Years (0-100 range)

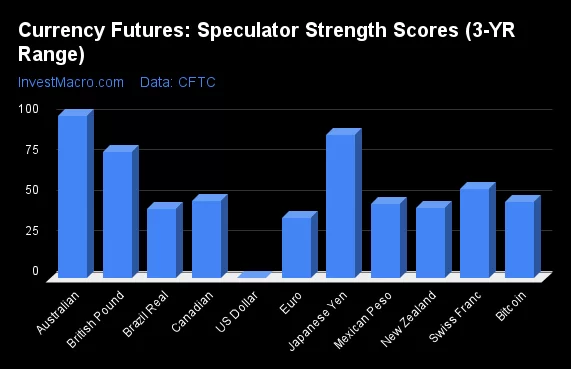

Strength Scores led by Australian Dollar & Japanese Yen

COT Strength Scores (a normalized measure of Speculator positions over a 3-Year range, from 0 to 100 where above 80 is Extreme-Bullish and below 20 is Extreme-Bearish) showed that the Australian Dollar (100 percent) and the Japanese Yen (88 percent) lead the currency markets this week. The British Pound (78 percent) and the Swiss Franc (55 percent) come in as the next highest in the weekly strength scores.

On the downside, the US Dollar Index (0 percent) comes in at the lowest strength levels currently and is in Extreme-Bearish territory (below 20 percent). The next lowest strength scores are the EuroFX (37 percent), the Brazilian Real (43 percent) and the New Zealand Dollar (43 percent).

3-Year Strength Statistics:

US Dollar Index (0.0 percent) vs US Dollar Index previous week (4.4 percent)

EuroFX (37.0 percent) vs EuroFX previous week (43.9 percent)

British Pound Sterling (78.0 percent) vs British Pound Sterling previous week (78.2 percent)

Japanese Yen (88.2 percent) vs Japanese Yen previous week (96.3 percent)

Swiss Franc (55.4 percent) vs Swiss Franc previous week (54.6 percent)

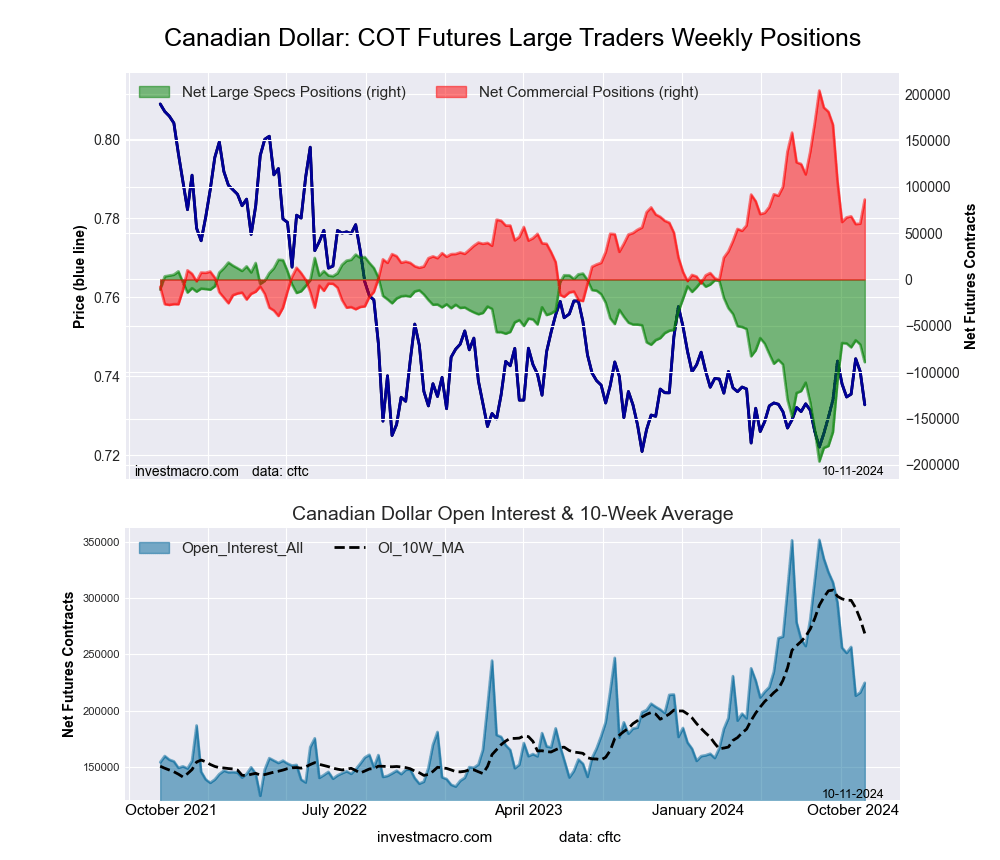

Canadian Dollar (48.0 percent) vs Canadian Dollar previous week (56.6 percent)

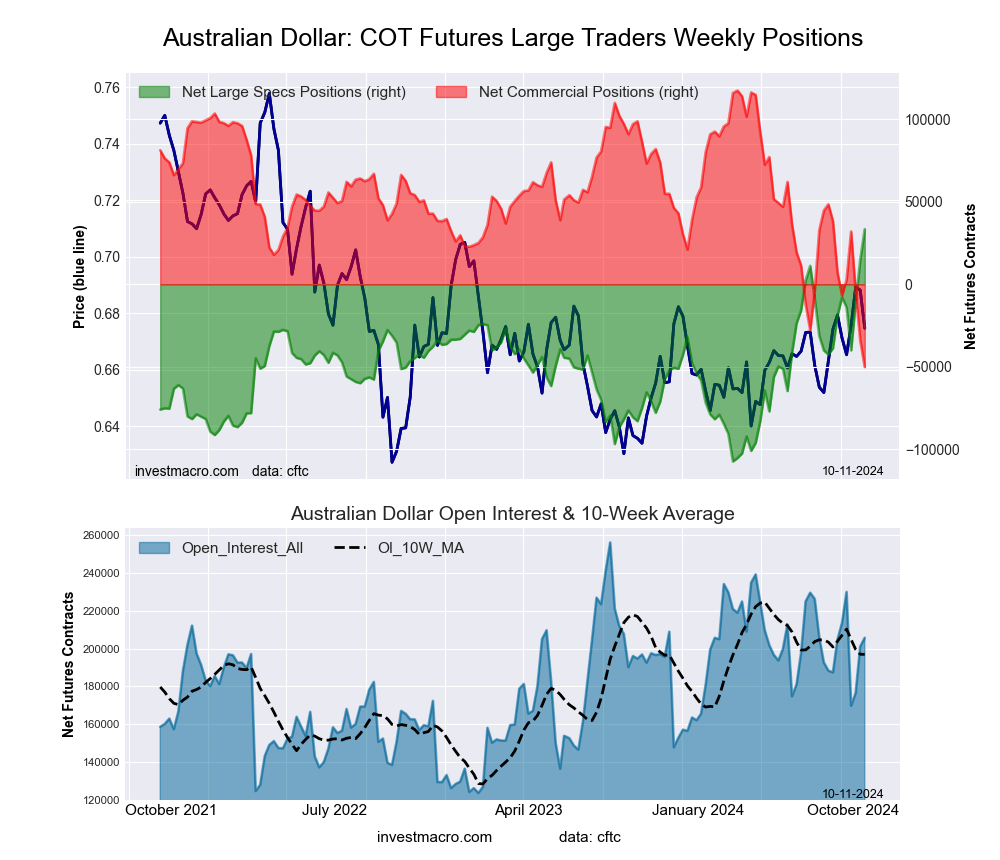

Australian Dollar (100.0 percent) vs Australian Dollar previous week (86.6 percent)

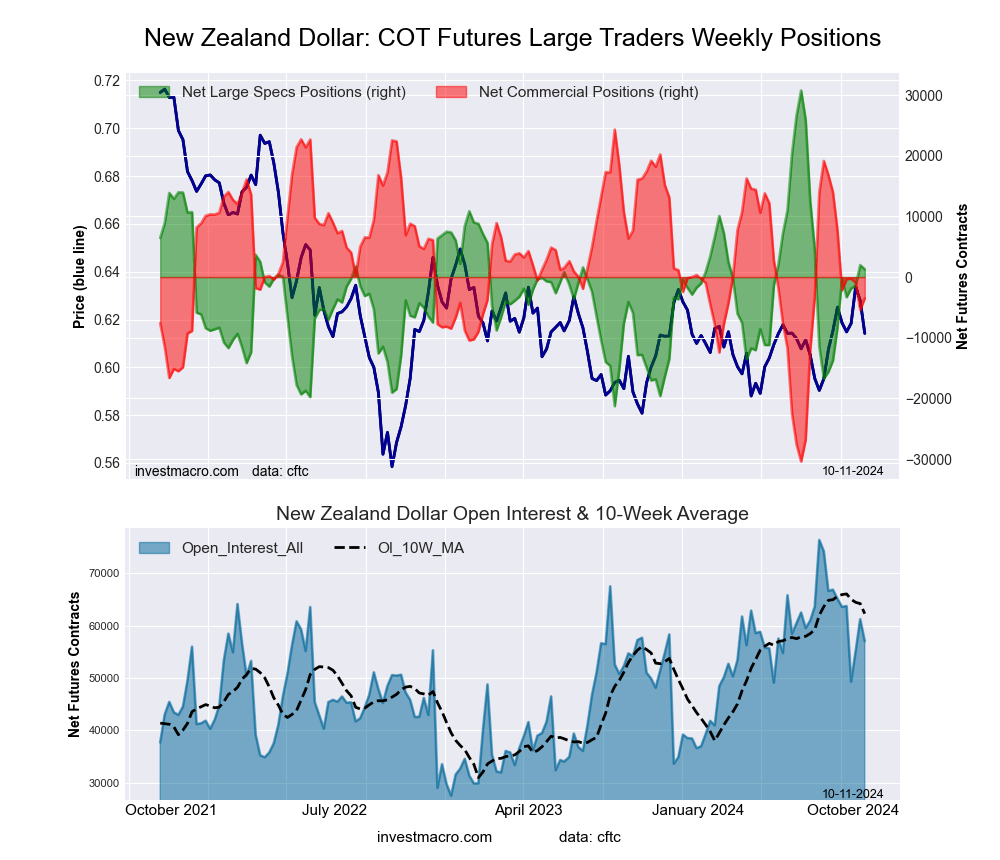

New Zealand Dollar (43.4 percent) vs New Zealand Dollar previous week (44.7 percent)

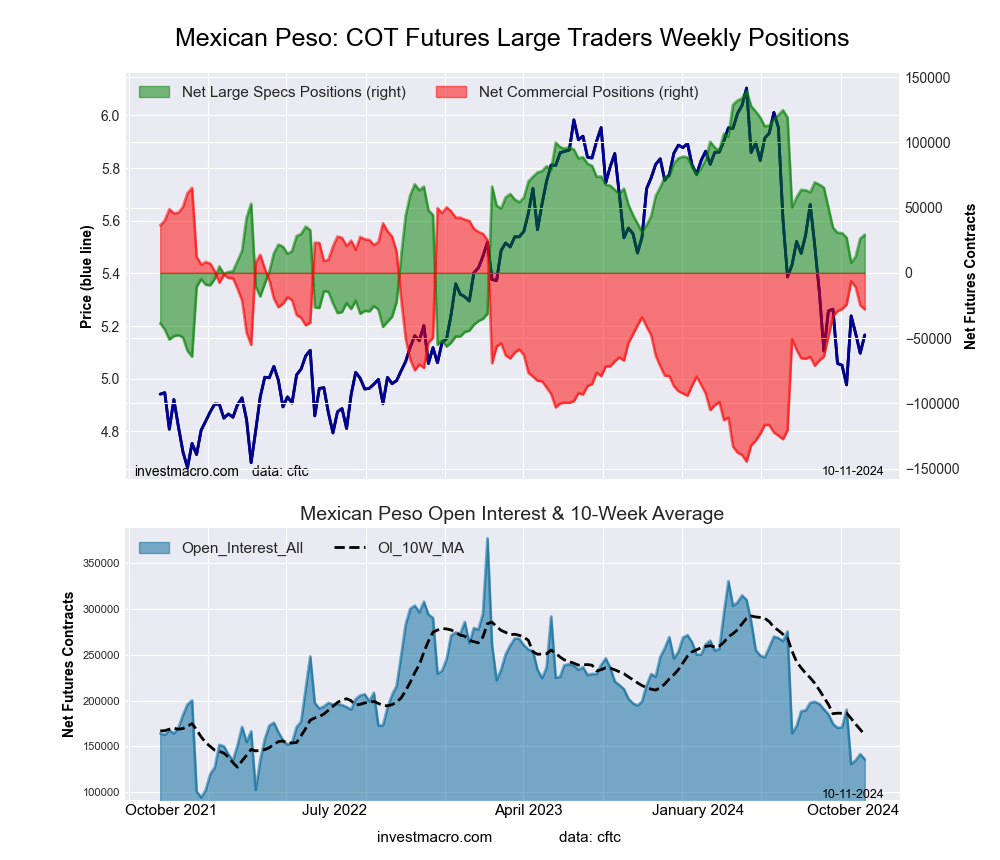

Mexican Peso (45.8 percent) vs Mexican Peso previous week (44.4 percent)

Brazilian Real (42.6 percent) vs Brazilian Real previous week (15.8 percent)

Bitcoin (47.1 percent) vs Bitcoin previous week (41.1 percent)

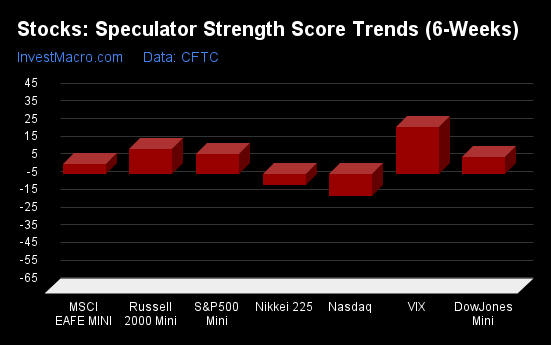

Brazilian Real & Australian Dollar top the 6-Week Strength Trends

COT Strength Score Trends (or move index, calculates the 6-week changes in strength scores) showed that the Brazilian Real (41 percent) and the Australian Dollar (37 percent) lead the past six weeks trends for the currencies. The New Zealand Dollar (18 percent), the Canadian Dollar (9 percent) and the Japanese Yen (4 percent) are the next highest positive movers in the 3-Year trends data.

The US Dollar Index (-44 percent) leads the downside trend scores currently with the EuroFX (-23 percent), Bitcoin (-17 percent) and the Mexican Peso (-1 percent) following next with lower trend scores.

3-Year Strength Trends:

US Dollar Index (-44.3 percent) vs US Dollar Index previous week (-37.2 percent)

EuroFX (-22.9 percent) vs EuroFX previous week (-0.3 percent)

British Pound Sterling (1.4 percent) vs British Pound Sterling previous week (11.8 percent)

Japanese Yen (4.3 percent) vs Japanese Yen previous week (13.3 percent)

Swiss Franc (4.4 percent) vs Swiss Franc previous week (5.8 percent)

Canadian Dollar (9.3 percent) vs Canadian Dollar previous week (42.3 percent)

Australian Dollar (37.3 percent) vs Australian Dollar previous week (37.9 percent)

New Zealand Dollar (18.5 percent) vs New Zealand Dollar previous week (30.3 percent)

Mexican Peso (-0.7 percent) vs Mexican Peso previous week (-4.1 percent)

Brazilian Real (40.8 percent) vs Brazilian Real previous week (12.1 percent)

Bitcoin (-16.8 percent) vs Bitcoin previous week (-21.7 percent)

Individual COT Forex Markets:

US Dollar Index Futures:

The US Dollar Index large speculator standing this week equaled a net position of -1,889 contracts in the data reported through Tuesday. This was a weekly decrease of -2,043 contracts from the previous week which had a total of 154 net contracts.

The US Dollar Index large speculator standing this week equaled a net position of -1,889 contracts in the data reported through Tuesday. This was a weekly decrease of -2,043 contracts from the previous week which had a total of 154 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 0.0 percent. The commercials are Bullish-Extreme with a score of 100.0 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 16.2 percent.

Price Trend-Following Model: Weak Downtrend

Our weekly trend-following model classifies the current market price position as: Weak Downtrend.

| US DOLLAR INDEX Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 58.6 | 23.5 | 11.2 |

| – Percent of Open Interest Shorts: | 65.9 | 13.6 | 13.7 |

| – Net Position: | -1,889 | 2,542 | -653 |

| – Gross Longs: | 15,016 | 6,016 | 2,869 |

| – Gross Shorts: | 16,905 | 3,474 | 3,522 |

| – Long to Short Ratio: | 0.9 to 1 | 1.7 to 1 | 0.8 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 0.0 | 100.0 | 16.2 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -44.3 | 40.0 | 7.3 |

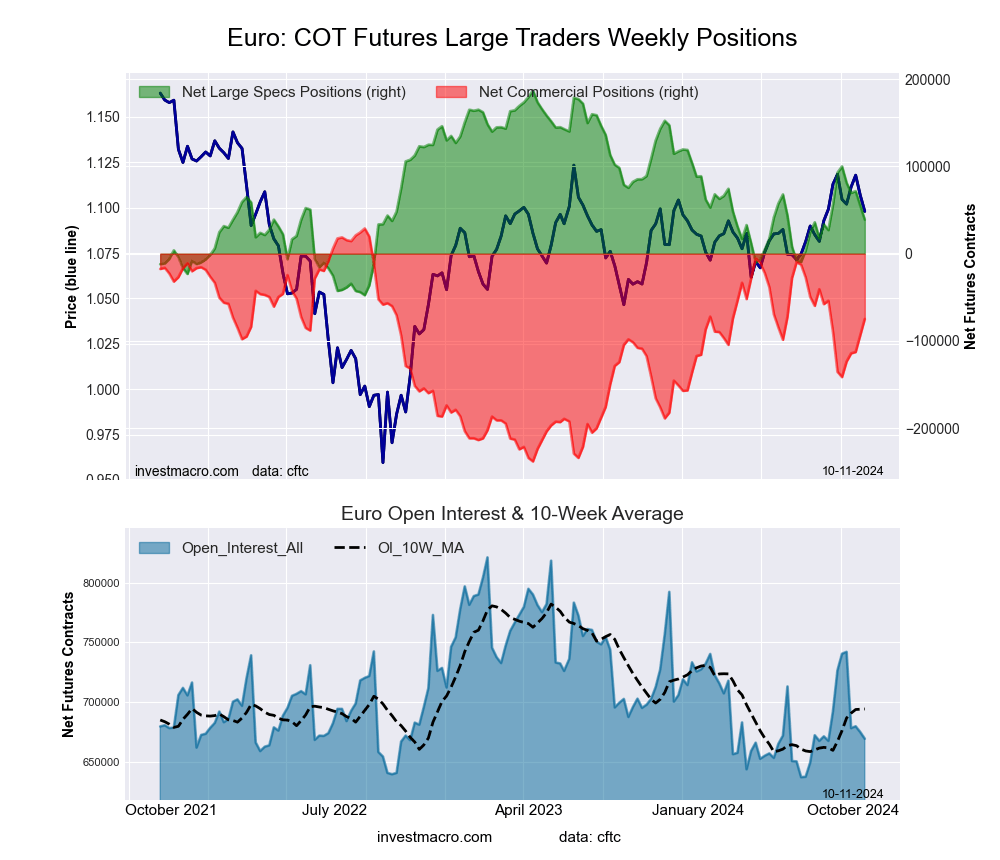

Euro Currency Futures:

The Euro Currency large speculator standing this week equaled a net position of 39,098 contracts in the data reported through Tuesday. This was a weekly decrease of -16,229 contracts from the previous week which had a total of 55,327 net contracts.

The Euro Currency large speculator standing this week equaled a net position of 39,098 contracts in the data reported through Tuesday. This was a weekly decrease of -16,229 contracts from the previous week which had a total of 55,327 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 37.0 percent. The commercials are Bullish with a score of 61.2 percent and the small traders (not shown in chart) are Bullish with a score of 51.6 percent.

Price Trend-Following Model: Weak Uptrend

Our weekly trend-following model classifies the current market price position as: Weak Uptrend.

| EURO Currency Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 26.0 | 57.5 | 12.6 |

| – Percent of Open Interest Shorts: | 20.1 | 68.7 | 7.2 |

| – Net Position: | 39,098 | -74,895 | 35,797 |

| – Gross Longs: | 173,866 | 384,954 | 84,183 |

| – Gross Shorts: | 134,768 | 459,849 | 48,386 |

| – Long to Short Ratio: | 1.3 to 1 | 0.8 to 1 | 1.7 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 37.0 | 61.2 | 51.6 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -22.9 | 22.7 | -15.7 |

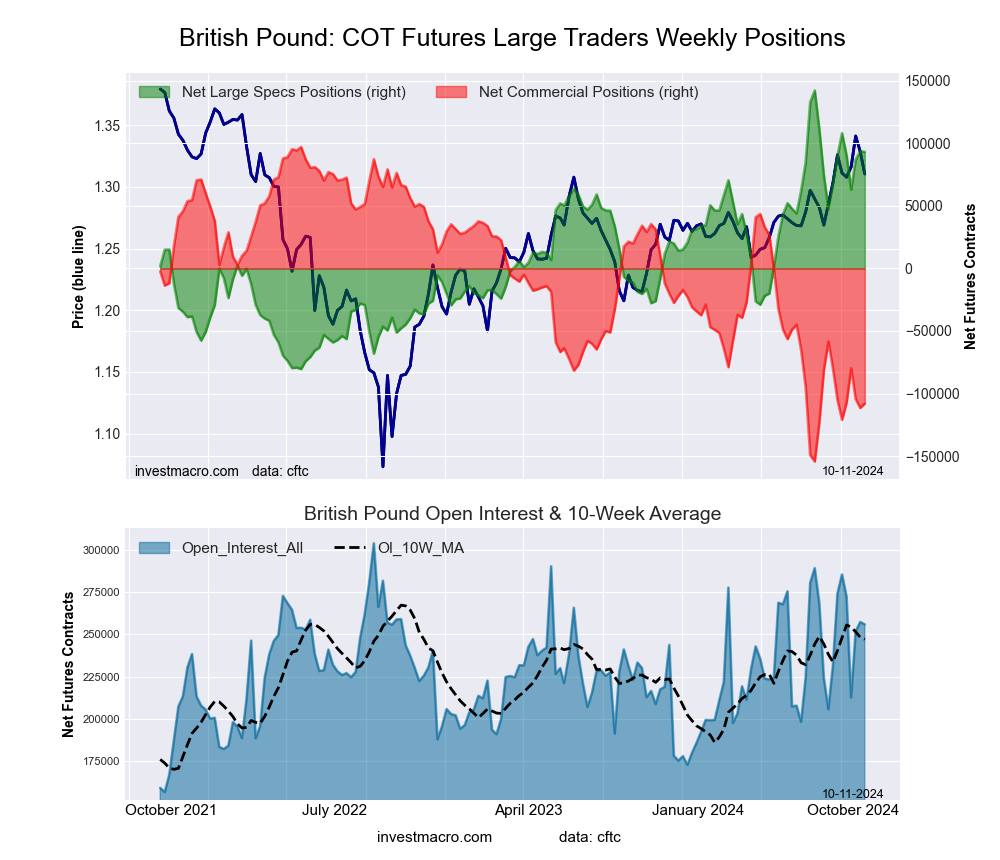

British Pound Sterling Futures:

The British Pound Sterling large speculator standing this week equaled a net position of 93,135 contracts in the data reported through Tuesday. This was a weekly lowering of -630 contracts from the previous week which had a total of 93,765 net contracts.

The British Pound Sterling large speculator standing this week equaled a net position of 93,135 contracts in the data reported through Tuesday. This was a weekly lowering of -630 contracts from the previous week which had a total of 93,765 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 78.0 percent. The commercials are Bearish-Extreme with a score of 18.4 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 93.4 percent.

Price Trend-Following Model: Uptrend

Our weekly trend-following model classifies the current market price position as: Uptrend.

| BRITISH POUND Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 61.6 | 21.2 | 14.9 |

| – Percent of Open Interest Shorts: | 25.2 | 63.4 | 9.1 |

| – Net Position: | 93,135 | -108,008 | 14,873 |

| – Gross Longs: | 157,666 | 54,329 | 38,166 |

| – Gross Shorts: | 64,531 | 162,337 | 23,293 |

| – Long to Short Ratio: | 2.4 to 1 | 0.3 to 1 | 1.6 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 78.0 | 18.4 | 93.4 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish-Extreme | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 1.4 | -1.1 | -0.9 |

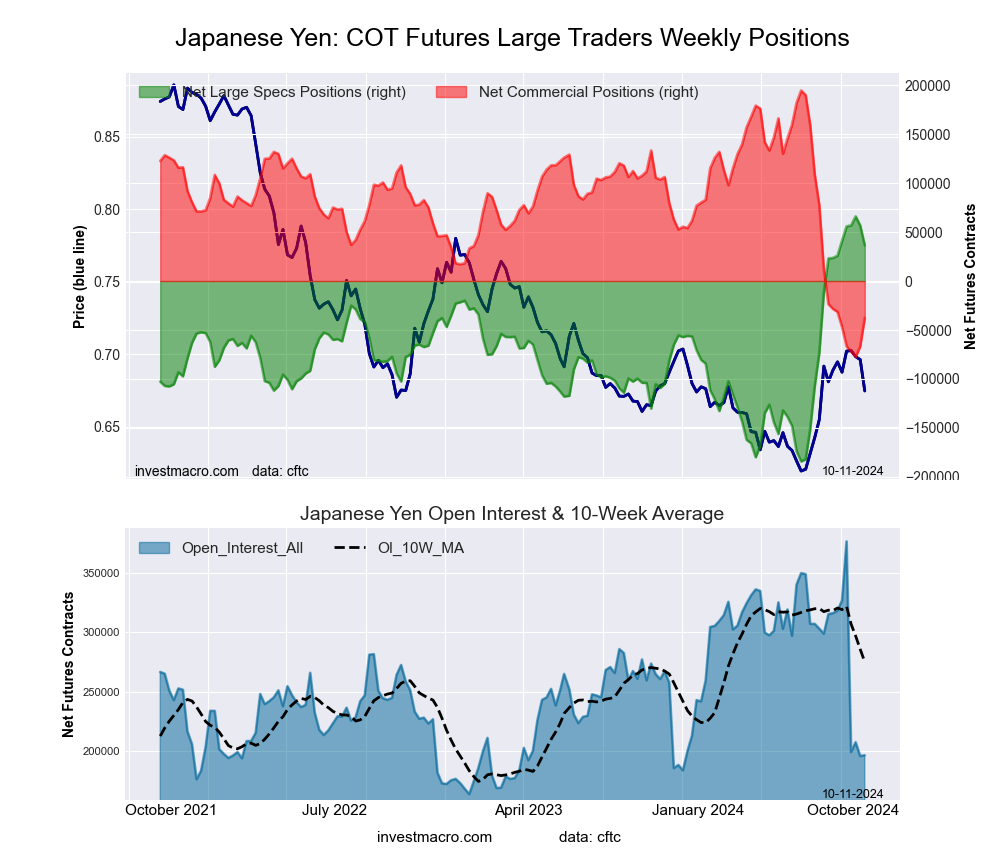

Japanese Yen Futures:

The Japanese Yen large speculator standing this week equaled a net position of 36,528 contracts in the data reported through Tuesday. This was a weekly lowering of -20,244 contracts from the previous week which had a total of 56,772 net contracts.

The Japanese Yen large speculator standing this week equaled a net position of 36,528 contracts in the data reported through Tuesday. This was a weekly lowering of -20,244 contracts from the previous week which had a total of 56,772 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 88.2 percent. The commercials are Bearish-Extreme with a score of 14.6 percent and the small traders (not shown in chart) are Bullish with a score of 66.4 percent.

Price Trend-Following Model: Uptrend

Our weekly trend-following model classifies the current market price position as: Uptrend.

| JAPANESE YEN Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 42.5 | 37.4 | 18.2 |

| – Percent of Open Interest Shorts: | 24.0 | 56.6 | 17.6 |

| – Net Position: | 36,528 | -37,659 | 1,131 |

| – Gross Longs: | 83,679 | 73,626 | 35,746 |

| – Gross Shorts: | 47,151 | 111,285 | 34,615 |

| – Long to Short Ratio: | 1.8 to 1 | 0.7 to 1 | 1.0 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 88.2 | 14.6 | 66.4 |

| – Strength Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 4.3 | -2.3 | -10.8 |

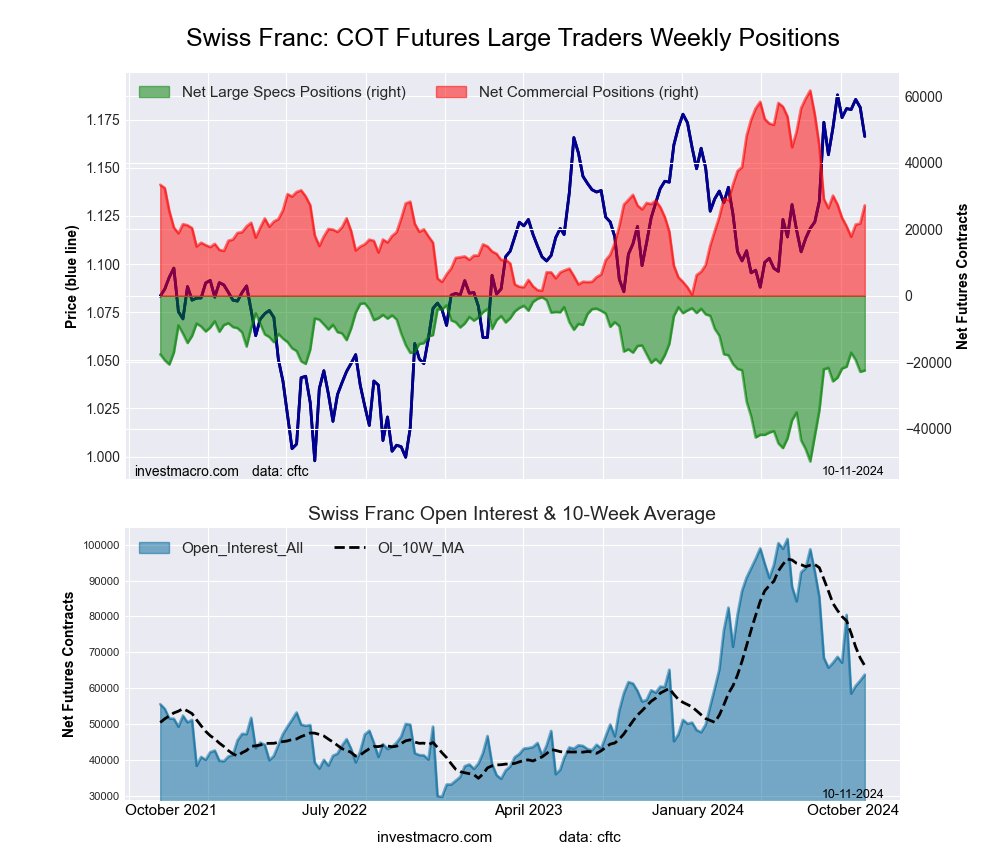

Swiss Franc Futures:

The Swiss Franc large speculator standing this week equaled a net position of -22,459 contracts in the data reported through Tuesday. This was a weekly lift of 395 contracts from the previous week which had a total of -22,854 net contracts.

The Swiss Franc large speculator standing this week equaled a net position of -22,459 contracts in the data reported through Tuesday. This was a weekly lift of 395 contracts from the previous week which had a total of -22,854 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 55.4 percent. The commercials are Bearish with a score of 43.8 percent and the small traders (not shown in chart) are Bullish with a score of 55.4 percent.

Price Trend-Following Model: Uptrend

Our weekly trend-following model classifies the current market price position as: Uptrend.

| SWISS FRANC Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 11.9 | 69.7 | 17.4 |

| – Percent of Open Interest Shorts: | 47.1 | 27.1 | 24.8 |

| – Net Position: | -22,459 | 27,158 | -4,699 |

| – Gross Longs: | 7,619 | 44,473 | 11,109 |

| – Gross Shorts: | 30,078 | 17,315 | 15,808 |

| – Long to Short Ratio: | 0.3 to 1 | 2.6 to 1 | 0.7 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 55.4 | 43.8 | 55.4 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 4.4 | -0.5 | -8.6 |

Canadian Dollar Futures:

The Canadian Dollar large speculator standing this week equaled a net position of -89,151 contracts in the data reported through Tuesday. This was a weekly lowering of -19,148 contracts from the previous week which had a total of -70,003 net contracts.

The Canadian Dollar large speculator standing this week equaled a net position of -89,151 contracts in the data reported through Tuesday. This was a weekly lowering of -19,148 contracts from the previous week which had a total of -70,003 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 48.0 percent. The commercials are Bullish with a score of 51.6 percent and the small traders (not shown in chart) are Bearish with a score of 39.4 percent.

Price Trend-Following Model: Weak Uptrend

Our weekly trend-following model classifies the current market price position as: Weak Uptrend.

| CANADIAN DOLLAR Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 9.6 | 75.2 | 13.5 |

| – Percent of Open Interest Shorts: | 49.3 | 36.8 | 12.2 |

| – Net Position: | -89,151 | 86,230 | 2,921 |

| – Gross Longs: | 21,643 | 168,983 | 30,344 |

| – Gross Shorts: | 110,794 | 82,753 | 27,423 |

| – Long to Short Ratio: | 0.2 to 1 | 2.0 to 1 | 1.1 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 48.0 | 51.6 | 39.4 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 9.3 | -8.2 | -2.8 |

Australian Dollar Futures:

The Australian Dollar large speculator standing this week equaled a net position of 33,422 contracts in the data reported through Tuesday. This was a weekly boost of 18,894 contracts from the previous week which had a total of 14,528 net contracts.

The Australian Dollar large speculator standing this week equaled a net position of 33,422 contracts in the data reported through Tuesday. This was a weekly boost of 18,894 contracts from the previous week which had a total of 14,528 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 100.0 percent. The commercials are Bearish-Extreme with a score of 0.0 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 93.6 percent.

Price Trend-Following Model: Uptrend

Our weekly trend-following model classifies the current market price position as: Uptrend.

| AUSTRALIAN DOLLAR Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 54.2 | 28.7 | 15.9 |

| – Percent of Open Interest Shorts: | 38.0 | 53.1 | 7.7 |

| – Net Position: | 33,422 | -50,253 | 16,831 |

| – Gross Longs: | 111,561 | 59,057 | 32,659 |

| – Gross Shorts: | 78,139 | 109,310 | 15,828 |

| – Long to Short Ratio: | 1.4 to 1 | 0.5 to 1 | 2.1 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 100.0 | 0.0 | 93.6 |

| – Strength Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 37.3 | -34.3 | 12.6 |

New Zealand Dollar Futures:

The New Zealand Dollar large speculator standing this week equaled a net position of 1,281 contracts in the data reported through Tuesday. This was a weekly decline of -689 contracts from the previous week which had a total of 1,970 net contracts.

The New Zealand Dollar large speculator standing this week equaled a net position of 1,281 contracts in the data reported through Tuesday. This was a weekly decline of -689 contracts from the previous week which had a total of 1,970 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 43.4 percent. The commercials are Bearish with a score of 49.2 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 81.7 percent.

Price Trend-Following Model: Weak Uptrend

Our weekly trend-following model classifies the current market price position as: Weak Uptrend.

| NEW ZEALAND DOLLAR Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 46.1 | 44.0 | 9.5 |

| – Percent of Open Interest Shorts: | 43.8 | 50.1 | 5.6 |

| – Net Position: | 1,281 | -3,503 | 2,222 |

| – Gross Longs: | 26,287 | 25,088 | 5,417 |

| – Gross Shorts: | 25,006 | 28,591 | 3,195 |

| – Long to Short Ratio: | 1.1 to 1 | 0.9 to 1 | 1.7 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 43.4 | 49.2 | 81.7 |

| – Strength Index Reading (3 Year Range): | Bearish | Bearish | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 18.5 | -20.4 | 19.9 |

Mexican Peso Futures:

The Mexican Peso large speculator standing this week equaled a net position of 29,193 contracts in the data reported through Tuesday. This was a weekly advance of 2,894 contracts from the previous week which had a total of 26,299 net contracts.

The Mexican Peso large speculator standing this week equaled a net position of 29,193 contracts in the data reported through Tuesday. This was a weekly advance of 2,894 contracts from the previous week which had a total of 26,299 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 45.8 percent. The commercials are Bullish with a score of 55.6 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 9.1 percent.

Price Trend-Following Model: Downtrend

Our weekly trend-following model classifies the current market price position as: Downtrend.

| MEXICAN PESO Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 40.7 | 53.8 | 3.2 |

| – Percent of Open Interest Shorts: | 19.2 | 74.3 | 4.2 |

| – Net Position: | 29,193 | -27,901 | -1,292 |

| – Gross Longs: | 55,327 | 73,035 | 4,374 |

| – Gross Shorts: | 26,134 | 100,936 | 5,666 |

| – Long to Short Ratio: | 2.1 to 1 | 0.7 to 1 | 0.8 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 45.8 | 55.6 | 9.1 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -0.7 | 0.7 | 0.7 |

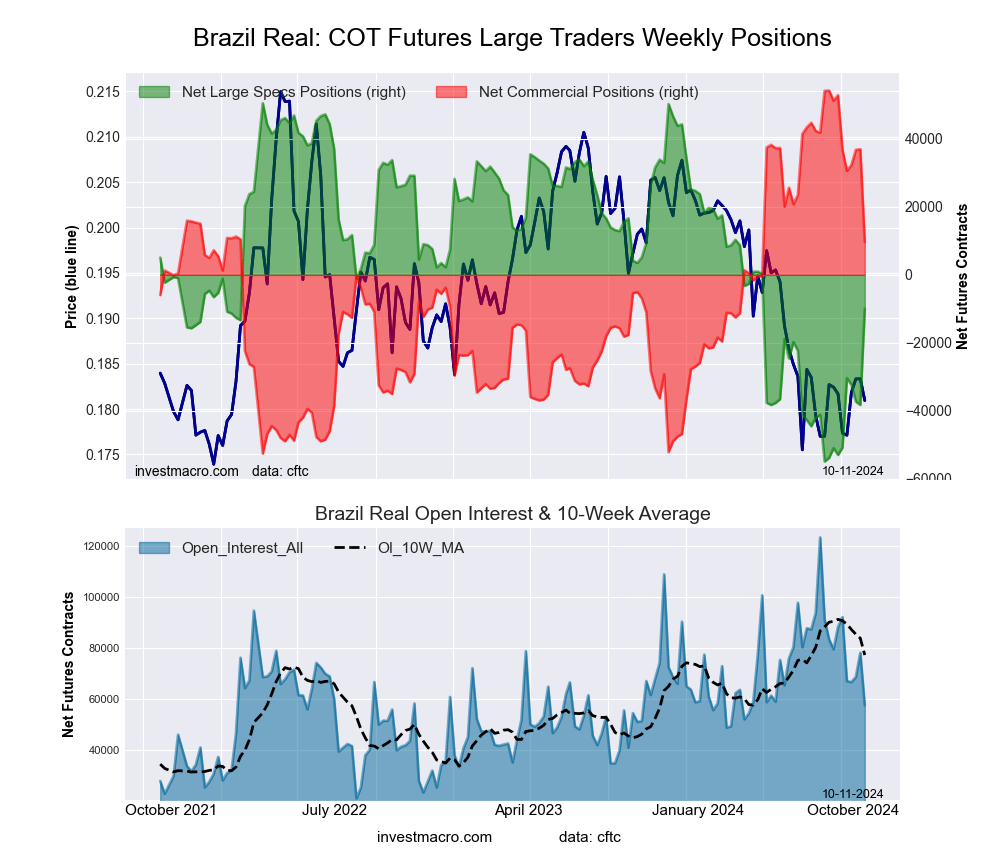

Brazilian Real Futures:

The Brazilian Real large speculator standing this week equaled a net position of -9,979 contracts in the data reported through Tuesday. This was a weekly boost of 28,276 contracts from the previous week which had a total of -38,255 net contracts.

The Brazilian Real large speculator standing this week equaled a net position of -9,979 contracts in the data reported through Tuesday. This was a weekly boost of 28,276 contracts from the previous week which had a total of -38,255 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 42.6 percent. The commercials are Bullish with a score of 58.3 percent and the small traders (not shown in chart) are Bearish with a score of 22.8 percent.

Price Trend-Following Model: Strong Downtrend

Our weekly trend-following model classifies the current market price position as: Strong Downtrend.

| BRAZIL REAL Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 43.7 | 50.0 | 4.5 |

| – Percent of Open Interest Shorts: | 61.1 | 33.3 | 3.9 |

| – Net Position: | -9,979 | 9,637 | 342 |

| – Gross Longs: | 25,201 | 28,804 | 2,598 |

| – Gross Shorts: | 35,180 | 19,167 | 2,256 |

| – Long to Short Ratio: | 0.7 to 1 | 1.5 to 1 | 1.2 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 42.6 | 58.3 | 22.8 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 40.8 | -40.5 | 1.2 |

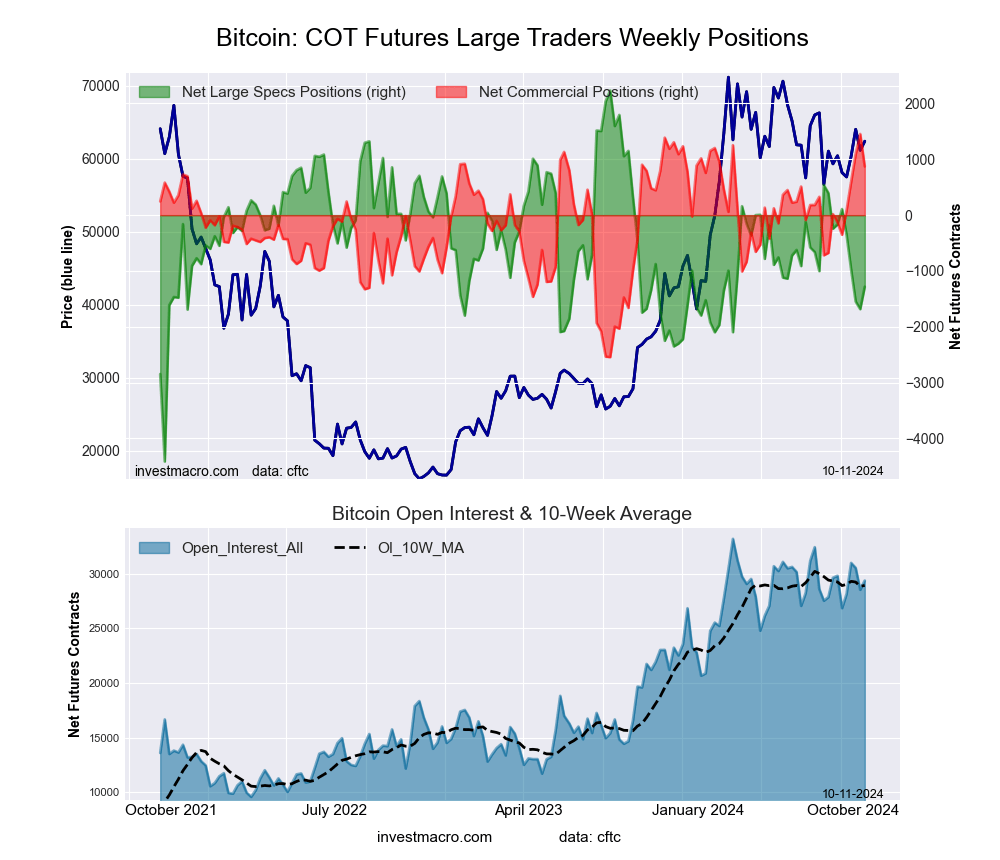

Bitcoin Futures:

The Bitcoin large speculator standing this week equaled a net position of -1,282 contracts in the data reported through Tuesday. This was a weekly gain of 402 contracts from the previous week which had a total of -1,684 net contracts.

The Bitcoin large speculator standing this week equaled a net position of -1,282 contracts in the data reported through Tuesday. This was a weekly gain of 402 contracts from the previous week which had a total of -1,684 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 47.1 percent. The commercials are Bullish-Extreme with a score of 85.5 percent and the small traders (not shown in chart) are Bearish with a score of 22.3 percent.

Price Trend-Following Model: Weak Downtrend

Our weekly trend-following model classifies the current market price position as: Weak Downtrend.

| BITCOIN Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 82.5 | 6.2 | 4.3 |

| – Percent of Open Interest Shorts: | 86.8 | 3.3 | 2.9 |

| – Net Position: | -1,282 | 872 | 410 |

| – Gross Longs: | 24,233 | 1,827 | 1,250 |

| – Gross Shorts: | 25,515 | 955 | 840 |

| – Long to Short Ratio: | 0.9 to 1 | 1.9 to 1 | 1.5 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 47.1 | 85.5 | 22.3 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish-Extreme | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -16.8 | 25.1 | 2.5 |

Article By InvestMacro – Receive our weekly COT Newsletter

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators) as well as their open interest (contracts open in the market at time of reporting). See CFTC criteria here.

- COT Metals Charts: Speculator Bets led by Steel & Palladium Oct 12, 2024

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & US Treasury Bonds Oct 12, 2024

- COT Soft Commodities Charts: Speculator Bets led higher by Corn & Soybeans Oct 12, 2024

- COT Stock Market Charts: Speculator Bets led by MSCI EAFE-Mini & VIX Oct 12, 2024

- Gold Recovers Amid Mixed US Economic Indicators Oct 11, 2024

- Hurricane Milton is putting downward pressure on natural gas and upward pressure on oil Oct 11, 2024

- Investors expect inflationary pressures to ease in the US. The People’s Bank of China launched a mechanism to support the stock market Oct 10, 2024

- AUD/USD Stabilises Near Monthly Low Amid Mixed Signals Oct 10, 2024

- USDInd: Eyes 100-day SMA ahead of US CPI data Oct 10, 2024

- RBNZ cut the rate by 0.5%. RBI kept the rate at 6.5% for the tenth consecutive meeting Oct 9, 2024