If you’ve landed here, chances are you’re planning to launch a decentralized exchange that could change the game for your business, and you’re on the lookout for a reliable decentralized exchange development company that aligns perfectly with your vision. We know how important it is to make the right choice, and that’s why, in one of our previous articles, we’ve already put together a comprehensive guide on the Top 10 Decentralized Exchange Development Companies in 2024 to help you get started. That guide covers the leaders in the DEX development space and aims to make your decision-making process easier.

But we didn’t want to stop there. Because we know that picking just one company from this impressive list can still be a bit tricky. To make sure you’re fully informed, we’ve outlined the critical factors in this article that you need to consider when choosing the right DEX development company. Whether you’re looking for technical expertise, security, or long-term support, this guide will help you make the most informed decision possible.

And why take our word for it? At Codezeros, we’ve been in the trenches of DEX development. We’re an experienced and reputable company that knows how to build decentralized exchanges that not only work but thrive in today’s competitive environment.

So let’s get on with it, shall we?

What is DEX and What Sets It Apart from Traditional Exchanges?

Now, you might already have a solid understanding of what a decentralized exchange (DEX) is and how it works, especially if you’re gearing up to launch one. But it’s worth taking a step back to really get into the technical details, as this will help you better assess the capabilities of any development company you choose. After all, you want a partner who not only knows the technology inside and out but can also apply it to build something that lasts.

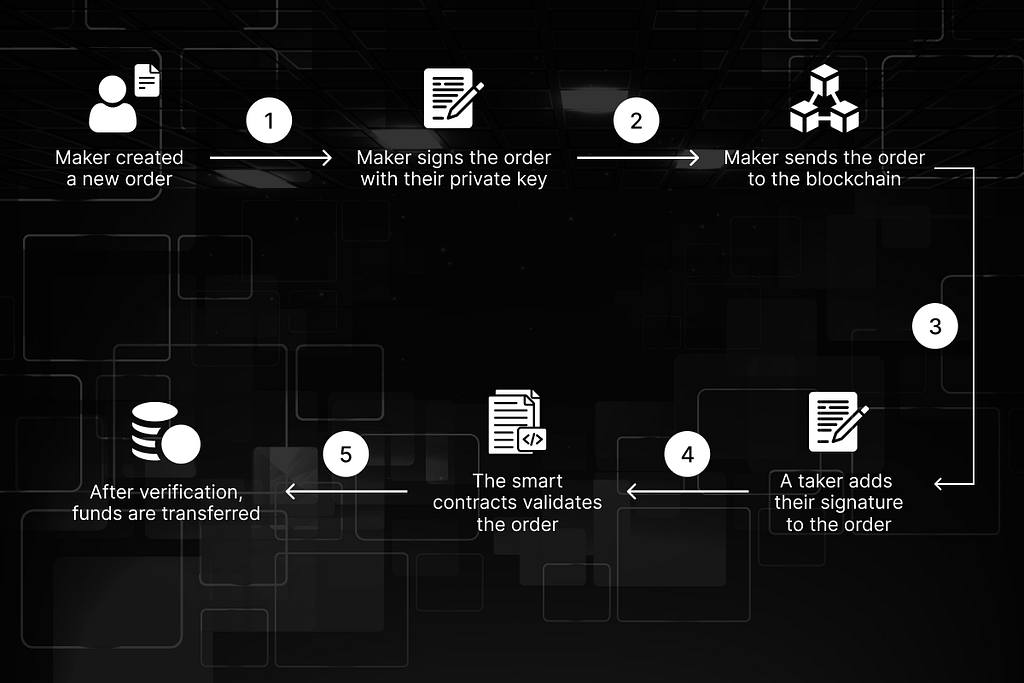

Decentralized exchanges (DEX) operate quite differently from traditional, centralized exchanges (CEX). While CEX platforms act as intermediaries that manage and control your funds during transactions, DEXs work through smart contracts, allowing peer-to-peer trading without a middleman. This direct connection improves privacy and shifts control into the hands of the users.

Key Technical Features of a DEX

- Smart Contracts: DEXs use smart contracts to automate trading processes and ensure transparency.

- Peer-to-Peer Trading: Trades on DEXs occur directly between users, without the involvement of intermediaries.

- Liquidity Pools: DEXs rely on liquidity pools, which are collections of funds provided by users, to facilitate trading.

- Governance Models: Many DEXs have decentralized governance models, allowing users to participate in decision-making.

These are the features that make a DEX truly decentralized and require deep technical know-how to implement effectively. That’s why choosing a technically adept development company is crucial — building a DEX isn’t just about making it functional but building it to be secure, scalable, and future-proof.

At Codezeros, we specialize in these decentralized solutions, combining our expertise with a clear focus on the key aspects of DEX development. Our team understands what it takes to bring all these elements together in a way that not only meets industry standards but also aligns with your long-term goals.

Key Factors to Consider in a DEX Development Company

Now that we’ve covered the key technical aspects of decentralized exchanges, it’s time to focus on what really matters when choosing the right development company for your DEX. The complexity of building a decentralized exchange means you need a partner who brings more than just coding skills to the table. Let’s check out the main factors you need to consider.

Technical Expertise

First and foremost, your chosen development company must have a deep understanding of blockchain architectures. Whether you’re building on Ethereum, Binance Smart Chain, Polkadot, or another platform, the ability to work with different blockchains is critical. Without this, your DEX may run into issues like scalability problems or compatibility limitations. The team should also be highly skilled in smart contract development, as that’s the foundation of any DEX. Additionally, expertise in auditing and security protocols is a must, as these help prevent vulnerabilities and ensure the safety of user funds.

Smart contract vulnerabilities can be exploited easily, so working with a DEX development company that follows best practices for writing and auditing smart contracts will give you peace of mind.

Experience with the DeFi Ecosystem

A solid grasp of the decentralized finance (DeFi) space is just as important as technical expertise. The decentralized exchange development company should have experience working with DeFi tools like yield farming, staking, and liquidity pools. This knowledge reflects that they understand the challenges of liquidity provision, market-making, and decentralized governance — elements that are integral to a successful DEX.

Ask whether the team has worked on projects that include features like decentralized autonomous organizations (DAOs) or governance models, as these can be crucial for the long-term success of your platform.

Customization and Innovation

No two DEX platforms are exactly alike. A cookie-cutter approach won’t help you stand out, so it’s important that your development partner can offer you flexibility and innovation. Look for a company that can customize the DEX to fit your specific needs, whether that’s adding unique trading features or incorporating innovative user experiences. The ability to integrate advanced functionality, such as automated market makers (AMMs) or cross-chain compatibility, could be the difference between a run-of-the-mill platform and something game-changing.

When evaluating a company, find out if they’ve been involved in building custom features that go beyond the standard DEX offerings.

Security Protocols

With the rise of DeFi platforms, security has become one of the biggest concerns in the crypto space. Building a secure DEX is critical, and you’ll want to work with a team that takes security seriously. This means conducting thorough smart contract audits and implementing effective protections against known vulnerabilities like reentrancy attacks and flash loan exploits.

A proficient DEX development company will have a clear strategy for protecting your DEX through automated testing, manual code reviews, and even bug bounty programs to catch potential threats early.

Regulatory Compliance Knowledge

Even in a decentralized ecosystem, regulation matters. Different countries have different rules when it comes to cryptocurrencies, and the last thing you want is to run into legal trouble after launching your DEX. Whether it’s meeting KYC (Know Your Customer) or AML (Anti-Money Laundering) requirements, having a team that understands the legal frameworks is crucial.

Make sure the DEX development company you choose is up-to-date on global regulatory trends so that your DEX can operate smoothly, no matter where your users are.

Technology Stack of a Leading DEX Development Company

Once you’ve identified the key factors to look for in a DEX development company, the next step is to evaluate the technology stack they use. The right technology stack can make or break your decentralized exchange, affecting everything from performance to security and user experience.

Backend Development

The backend technology is what powers the core functionality of your DEX, so it’s critical to choose a development company that understands blockchain infrastructures like Ethereum, Solana, and Cardano. Depending on your needs, the platform should also support multi-chain functionality to cater to a broader audience and offer cross-chain compatibility. This requires expertise not only in blockchain architecture but also in managing transaction speeds, consensus mechanisms, and overall platform scalability.

A well-structured backend makes sure that the DEX can handle a high volume of transactions without sacrificing performance or security.

Frontend Development

While the backend handles the mechanics, the frontend is what your users will interact with directly. A user-friendly interface can considerably improve user experience, making it easier for traders to navigate the platform. Leading DEX development companies use modern frontend frameworks like React, Angular, and Vue.js to build intuitive, responsive, and easy-to-navigate interfaces.

These frameworks offer the flexibility to create sleek designs that are compatible across devices so that your DEX can reach a wide range of users.

Smart Contract Development

Smart contracts form the core of any DEX. They are responsible for automating trades and securing transactions without the need for intermediaries. Proficiency in programming languages like Solidity, Rust, and Vyper is essential for building efficient smart contracts. These languages are commonly used for different blockchain ecosystems and offer advanced functionality like customizable trading logic and governance features.

Whether you’re looking for automated market makers (AMMs) or liquidity pool management, advanced smart contract functionality is crucial for facilitating smooth, efficient operations on your DEX.

Integration with Wallets and Liquidity Providers

Wallet integration is another important element to consider. Your DEX needs to connect with popular wallets like MetaMask, Trust Wallet, and others to enable smooth user access and fund management. Apart from the wallets, integrating with liquidity providers such as Uniswap and SushiSwap is vital for providing adequate liquidity on your platform, which in turn influences the user experience and trade execution speed.

Without these integrations, your users could face liquidity issues, leading to higher slippage or failed transactions — both of which can turn users away.

Testing and Deployment

The final piece of the puzzle is testing and deployment. DEX platforms operate in a complex and decentralized environment, which makes proper testing all the more important. Before going live, your DEX should be thoroughly tested on testnets to catch any potential bugs or vulnerabilities. Once the platform has passed this phase, deployment to the mainnet should follow, with regular monitoring to ensure continued performance.

Thorough testing reduces the chances of post-launch issues, while also helping to maintain trust among users who expect a secure, glitch-free experience.

Security Considerations for DEX Development

If there’s one thing that can make or break a decentralized exchange, it’s security. Given the high-profile vulnerabilities and exploits in the decentralized finance (DeFi) space, prioritizing security is non-negotiable. This section will highlight the common vulnerabilities in DEX platforms and the best practices to eliminate them. No matter how well-designed a platform is, without efficient security, it’s just one vulnerability away from disaster.

Common Vulnerabilities

DEX platforms, while offering decentralized control, also come with their own set of challenges, particularly in terms of security. Here are some of the most frequent vulnerabilities.

- Reentrancy Attacks: This occurs when a smart contract is tricked into calling itself repeatedly before the previous function is finished. It allows malicious actors to drain funds by exploiting the contract’s logic.

- Front-running: This is a form of manipulation where a third party observes a pending transaction and tries to execute a similar transaction at a higher priority, profiting from the price changes.

- Price Manipulation: Manipulating the price of assets in decentralized exchanges can occur, particularly in platforms that rely on oracles or have low liquidity. Attackers can artificially inflate or deflate asset prices to exploit arbitrage opportunities.

Understanding these vulnerabilities and their potential impact on your platform is essential when evaluating a DEX development company.

Security Best Practices

To protect your DEX from these risks, adhering to security best practices is key. Here are a few strategies every leading development company should follow.

- Regular Code Audits: Routine auditing is essential to keep smart contracts free from vulnerabilities. Audits should be conducted by both the internal development team and third-party experts to catch any potential issues before they are exploited.

- Bug Bounty Programs: Encouraging independent developers and ethical hackers to identify vulnerabilities through bug bounty programs adds an additional layer of security. By offering rewards for spotting bugs, DEX platforms can notably reduce the chances of undetected issues.

- Rigorous Smart Contract Testing: Before deployment, all smart contracts should go through rigorous testing, including automated checks and manual reviews. This helps identify edge cases that might otherwise go unnoticed.

At Codezeros, we take security seriously. From comprehensive smart contract audits to third-party testing, we cover every aspect to build your DEX on a solid, secure foundation. With a commitment to best practices, we help you launch with confidence, knowing your platform is protected against potential risks.

Support for Post-Development Needs

Building a decentralized exchange is only the beginning. The real challenge often comes after the platform is live. Just like any complex system, your DEX will need ongoing maintenance, upgrades, and improvements to keep it performing at its best.

Continuous Support and Upgrades

Once your DEX is operational, it’s not a set-it-and-forget-it situation. The cryptocurrency space moves quickly, and staying ahead requires ongoing updates to improve platform performance, upgrade protocols, and patch any vulnerabilities that might arise. Whether it’s rolling out new features, ensuring compatibility with the latest blockchain protocols, or fixing bugs that come up post-launch, continuous support is essential.

You’ll want to work with a DEX development company that provides reliable post-launch services, including monitoring, performance tuning, and security patching. This ongoing relationship can be the difference between a DEX that thrives and one that becomes obsolete as technology advances.

Community Building and Governance Features

Another critical aspect of post-development is engaging the community. Decentralized exchanges thrive when users feel invested in the platform. One of the most effective ways to nurture this engagement is through decentralized governance models, such as Decentralized Autonomous Organizations (DAOs). With a DAO, users can have a direct say in the platform’s future direction, whether it’s voting on new features, deciding on protocol upgrades, or managing liquidity incentives.

Community governance keeps your platform truly decentralized and responsive to the needs of its users. Building the infrastructure for such governance systems from the start can lay the foundation for long-term community-driven growth and sustainability.

At Codezeros, we offer comprehensive post-launch services and help integrate governance features that keep your DEX aligned with user expectations, keeping it relevant in the dynamic DeFi space.

Evaluating the Company’s Portfolio and Client Success Stories

When it comes to choosing the right DEX development company, one of the best ways to gauge their expertise is by reviewing their portfolio and client success stories. A company’s past projects can give you insights into their experience, reliability, and the kind of results they’ve delivered for others.

Importance of Reviewing the Company’s Portfolio

Looking at a decentralized exchange company’s portfolio provides a clear picture of their capabilities. Have they successfully built DEX platforms before? What kind of challenges did they face, and how did they overcome them? These are critical questions that can help you assess whether a company has the technical and practical expertise to deliver on your project.

You’ll want to focus on whether the company has experience in developing DEX platforms on various blockchain networks and whether those projects align with your vision. The more varied and technically challenging the portfolio, the better positioned the company is to handle your unique requirements.

Analyzing Success Metrics

It’s not enough for a development company to have built DEX platforms — you should also analyze the success of those projects. Key metrics like trading volume, security track record, and user growth offer insights into the effectiveness of the platforms they’ve built. A high trading volume indicates that users trust and actively use the DEX, while strong security practices show that the platform has stood up to the rigorous demands of the crypto space.

User growth over time also points to a platform’s ability to attract and retain traders, which is critical for the long-term success of any DEX. These metrics can help you determine whether the development company delivers platforms that are not only functional but also successful in the market.

At Codezeros, we’ve built a strong portfolio of DEX platforms that have seen noteworthy success in terms of security, user growth, and trading volume. Our experience speaks for itself, and we’re proud of the trust our clients place in us to deliver state-of-the-art decentralized exchanges.

Cost and Timeline Considerations

Once you’ve evaluated the technical capabilities and portfolio of a DEX development company, the next step is to consider the cost and timeline involved. Building a decentralized exchange is a significant investment, and understanding what drives these costs — and how long it will take to launch — is key to making an informed decision. This section breaks down the main factors influencing development costs and provides a realistic outlook on the timeline for delivering a secure and scalable DEX.

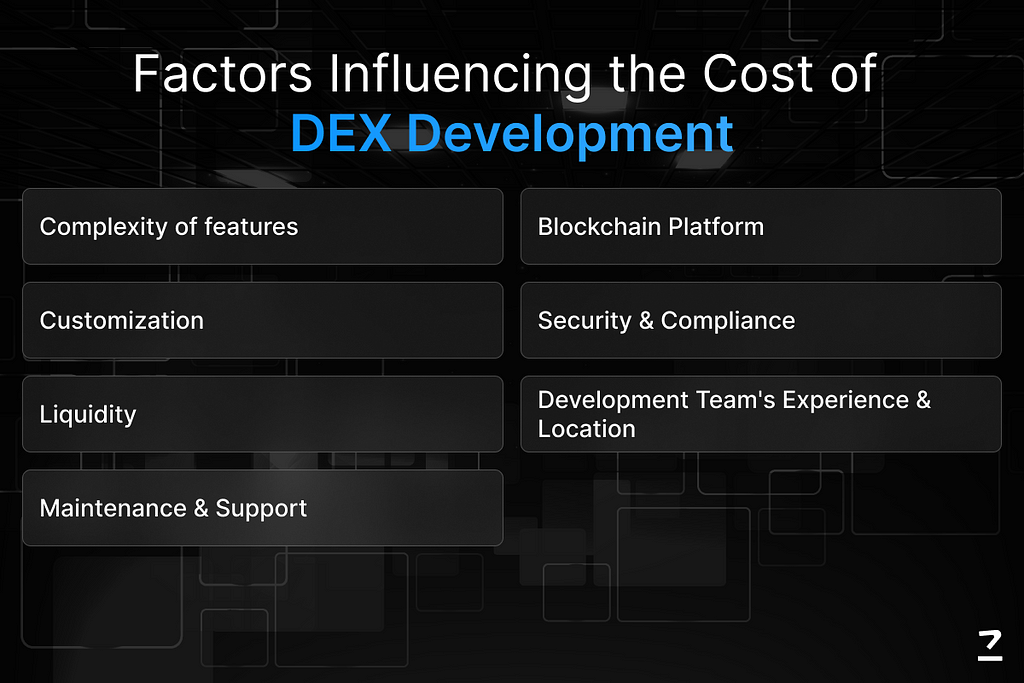

Factors Influencing the Cost of DEX Development

The cost of building a DEX can vary widely depending on several factors. The complexity of features is one of the primary drivers — basic DEX platforms with standard functionality will be less expensive than those incorporating advanced features such as cross-chain compatibility, automated market makers (AMMs), or governance systems.

Another major factor is blockchain integration. The choice of blockchain — whether it’s Ethereum, Solana, or Binance Smart Chain — will affect development costs based on transaction speeds, scalability, and the complexity of integrating with the chosen network. Security audits are also a significant cost consideration. Given the critical importance of security in DEX platforms, rigorous testing and third-party audits are essential, but they add to the overall expense.

Additional costs may include smart contract deployment fees, testing environments, and ongoing post-launch support. Each of these elements plays a role in determining the final development cost.

Realistic Timelines for Building a Secure and Scalable DEX

As with cost, the timeline for developing a DEX also depends on the complexity of the project. A basic DEX with standard trading functionality can take several months to complete, from initial planning to final deployment. However, if you’re incorporating advanced features like liquidity pools, staking options, or multi-chain support, the timeline can extend further.

Security is another area that can affect timelines. Testing and auditing smart contracts is not something that should be rushed, as it directly impacts the platform’s safety. While the development process might take longer with thorough security protocols in place, it’s a necessary step to ensure the long-term viability and trustworthiness of the exchange.

Ultimately, the cost and timeline of DEX development will vary depending on the complexity of the platform and the level of security involved. At Codezeros, we take a balanced approach to delivering cost-effective, timely solutions without cutting corners on quality. Our focus on efficiency ensures that your DEX is delivered on schedule while maintaining the highest standards of security and performance.

Why Choose Codezeros for DEX Development?

By now, you’ve seen the critical factors involved in building a decentralized exchange, from technical expertise to security protocols and ongoing support. But why should Codezeros be your development partner?

Proven Expertise

At Codezeros, we have a track record of delivering successful blockchain and DEX platforms that align with our clients’ goals. Our team brings extensive experience across various blockchain networks. Whether you’re looking to build a standard DEX or a highly customized platform with advanced features, we have the technical expertise to make it happen. We’ve worked with businesses of all sizes, helping them launch secure, high-performance DEX platforms.

Innovative Custom Solutions

No two businesses are alike, and we believe that your DEX should reflect your unique business needs. At Codezeros, we don’t offer cookie-cutter solutions. Instead, we work closely with you to understand your goals and build a DEX platform that’s specifically tailored to your business model. Whether you need advanced trading mechanisms, liquidity pool management, or multi-chain functionality, our team excels at delivering custom features that set your platform apart in a competitive space.

End-to-End Services

Building a DEX is a complex process, and we’re with you every step of the way. Our approach covers the entire lifecycle of your project, from initial consultation and development to security audits and post-launch support. We don’t just hand over the finished product and walk away. Our team remains engaged after deployment, offering continuous support, regular updates, and any additional services you may need to keep your platform running smoothly and securely.

Building the Future of Decentralized Finance with the Right DEX Development Company

As we conclude our exploration of what it takes to create a successful decentralized exchange, it’s clear that choosing the right DEX development company is crucial when it comes to decentralized finance. The insights we’ve shared about evaluating portfolios, understanding technology stacks, and prioritizing security highlight the importance of a strategic partnership in building an effective DEX.

At Codezeros, we believe in building secure, scalable, and innovative decentralized exchanges. Whether you need advanced trading features, integration with multiple blockchain networks, or a focus on long-term support, our team is ready to assist. We bring proven expertise to every project and have a clear track record of delivering reliable and user-friendly platforms that align with industry best practices.

If you’re looking for a development company that can handle the complexities of DEX development while offering practical solutions and a transparent approach, reach out to Codezeros. We’re here to discuss your goals, walk you through the process, and ensure your decentralized exchange is ready for the future.

How to Choose the Right DEX Development Company? was originally published in The Crypto Kiosk on Medium, where people are continuing the conversation by highlighting and responding to this story.