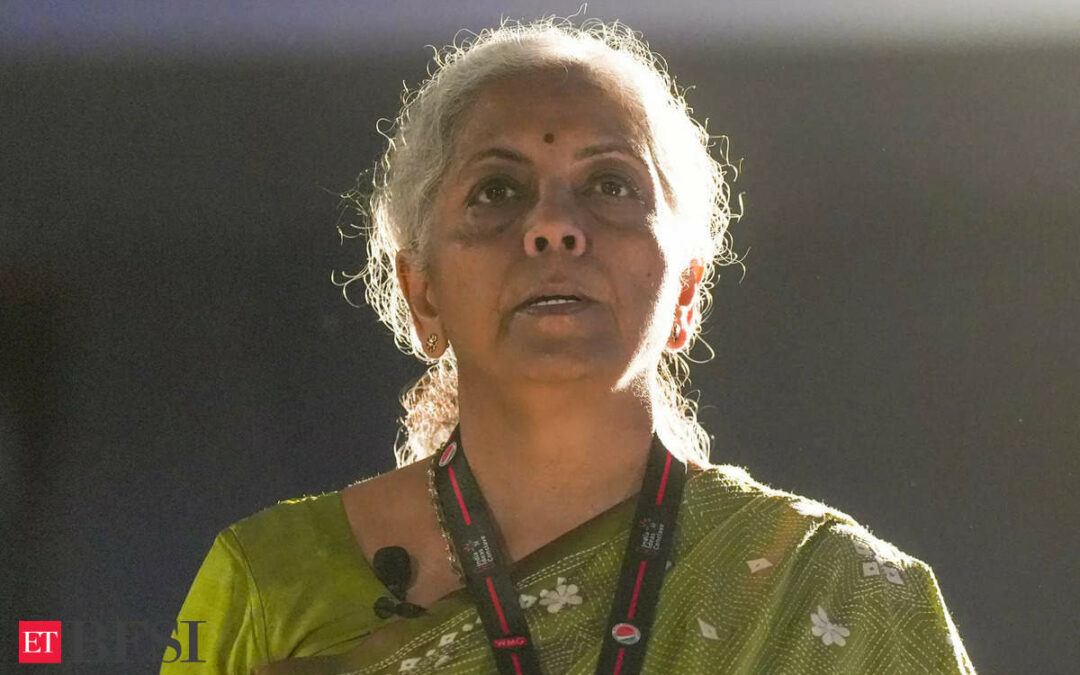

As the Winter Session of Parliament begins on Monday, the Finance Minister Nirmala Sitharaman is set to move the Banking Laws Amendment Bill for passage.

The Bill was introduced in the previous Monsoon Session seeking enhanced services for depositors and provide investors access to unclaimed funds.

The proposed amendments in the Bill will affect the Reserve Bank of India Act, the Banking Regulation Act, and the State Bank of India Act, among others.

All the changes mentioned in the Bill were approved by the Union Cabinet prior to the beginning of the Monsoon Session itself.

Increase the number of nominees:

As per the proposal in the Bill, government seeks to raise the number of nominations allowed per bank account from the current limit of one to four.

Definition of substantial interest:

The Bill also proposes to redefine the concept of ‘substantial interest’ for bank directorships, raising the threshold from the existing Rs 5 lakh to Rs 2 crore.

The limit of Rs 5 lakh was set in 1968.

Transfer of unclaimed assets:

It facilitates the transfer of unclaimed dividends, shares, and interest or redemption of bonds to the Investor Education and Protection Fund (IEPF).

The individuals would then be able to claim transfers or refunds from the fund, ensuring the protection of investors’ interests.

Reporting dates for regulatory compliance:

The Bill also aims to adjust the reporting dates for regulatory compliance, proposing a shift from the current schedule of the second and fourth Fridays of each month to the 15th and last day of every month.

This change aims to standardise reporting timelines across all banks.

Director of a central cooperative bank:

The Bill has also allowed the director of a central cooperative bank to serve on the board of a State Cooperative Bank.

During her Budget speech, the Finance Minister had said, “To improve bank governance and enhance investors’ protection, certain amendments to the Banking Regulation Act, the Banking Companies Act, and the Reserve Bank of India Act are proposed.”

The Lok Sabha was adjourned on Monday, and is set to meet on Wednesday, November 27.

The Parliament will be commemorating the 75th anniversary of the Constitution on November 26.