By RoboForex Analytical Department

EUR/USD remains stable at around 1.0483 as markets digest the implications of the latest FOMC minutes. The Federal Reserve signalled a potential pause in rate cuts if inflation reaccelerates but also indicated readiness to continue easing if economic indicators weaken.

Today promises heightened activity for EUR/USD due to a slew of US economic data releases. It is a significant day as the US will release its initial Q3 GDP estimate. After recording a 2.8% growth in Q2, market participants are keen to see if this momentum carried into the third quarter. Expectations suggest a robust period, potentially boosting the US dollar if the data exceeds forecasts.

Additionally, the US will unveil October’s figures for personal income and expenses, durable goods orders, and the core PCE price index. These data points could significantly influence the dollar’s trajectory, adding to today’s trading volatility.

Technical analysis of EUR/USD

H4 chart: The EUR/USD appears to be challenging the upper boundary of its recent downward trend. Current technical analysis suggest a potential upward move towards 1.0580. After reaching this level, a corrective pullback to 1.0460 may occur before another upward wave targets 1.0700. This bullish EUR/USD forecast is supported by the MACD, which shows a positive divergence as it approaches the zero line from below.

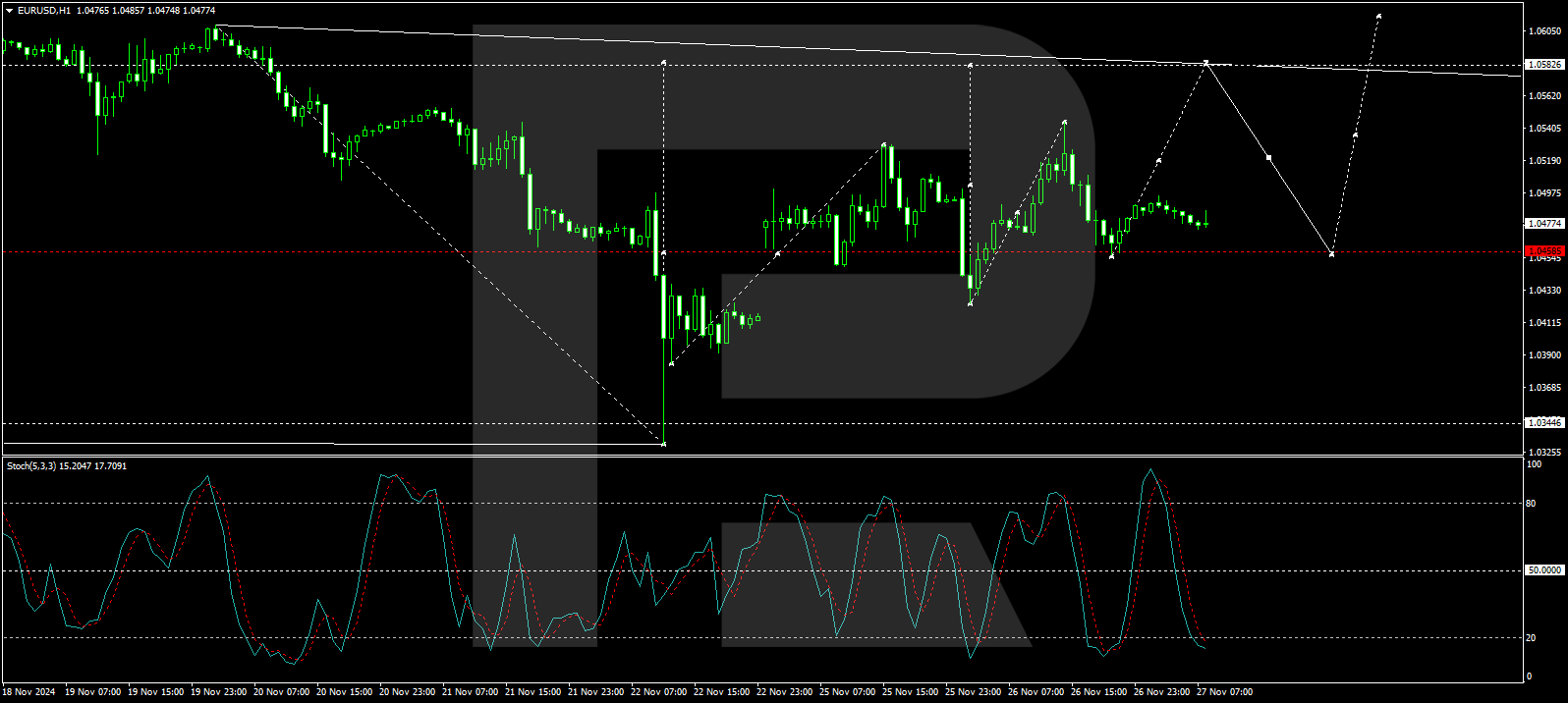

H1 chart: The shorter-term H1 chart indicates that EUR/USD is on an upward trajectory towards 1.0580, with the currency consolidating above 1.0460. A breakout above this consolidation could validate the move towards 1.0580. Subsequently, a retracement to 1.0460 may set the stage for further advances. The Stochastic oscillator signals potential upward momentum, suggesting an increase in buying pressure.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- EUR/USD Steady Ahead of Major US Data Releases Nov 27, 2024

- NZD/USD Hits Yearly Low Amid US Dollar Strength Nov 26, 2024

- Trump plans to raise tariffs by 10% on goods from China and 25% on goods from Mexico and Canada Nov 26, 2024

- Fast fashion may seem cheap, but it’s taking a costly toll on the planet − and on millions of young customers Nov 25, 2024

- “Trump trades” and geopolitics are the key factors driving market activity Nov 25, 2024

- EUR/USD Amid Slowing European Economy Nov 25, 2024

- COT Metals Charts: Weekly Speculator Changes led by Platinum Nov 23, 2024

- COT Bonds Charts: Speculator Bets led lower by 5-Year & 10-Year Bonds Nov 23, 2024

- COT Soft Commodities Charts: Speculator Bets led lower by Soybean Oil, Soybean Meal & Cotton Nov 23, 2024

- COT Stock Market Charts: Speculator Changes led by S&P500 & Nasdaq Minis Nov 23, 2024