Former Reserve Bank of India governor D Subbarao said today that the central bank and other regulators need to include more people with a technology background as technology is coming in a big way in finance.

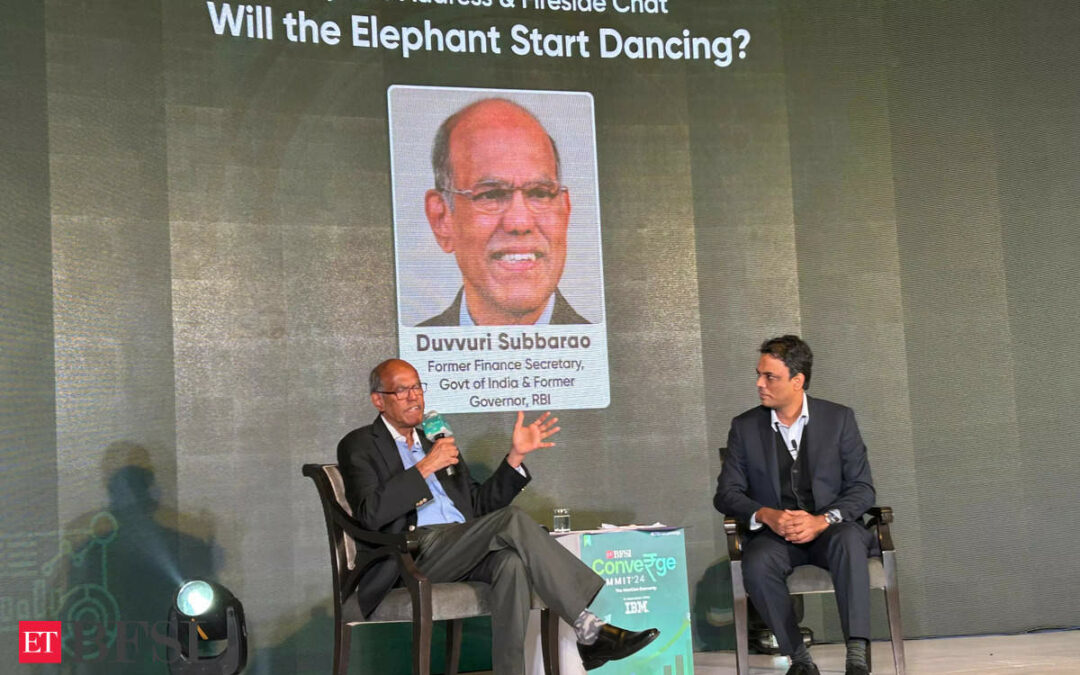

“The main purpose of RBI regulation is to maintain financial security and consumer safety. Regulation is changing, tech is coming in a big way, so the RBI must change,” Subbarao said delivering the keynote address at the ETBFSI Converge Summit 2024.

The big challenge before the RBI is to foster innovation without disruption, he said, adding that positive disruption is okay but RBI needs to have sufficient control.

“It is important to allow innovation without the financial sector getting out of hand and causing a negative disruption. They would need to retool themselves in order to catch up with technology,” he said

Describing cybercrime as a big challenge, the former finance secretary said if people lose money to cybercrime, there can be a big loss of confidence among the public.

He said it is important for the regulators to understand the psychology of poor people, “You need to understand poverty, what is important to the poor, whether it access to finance or cost of finance,” Subbarao said, adding that while their average daily income is low, it is uneven. “People have irregular income, they celebrate festivals, and conduct marriages, which needs to be taken into account, ” he said.

Recalling the instance of the prime minister chiding CMs of non-BJP ruled states for not reducing taxation on fuel, he said, “We have a combative, contentious federalism, we need cooperative federalism.”

Without cooperative federalism, it is difficult to implement the second-generation reforms, he said, adding that reforms must now address taxation, land, labour, and public-private partnerships.

He said India has the aspiration of becoming a developed country by 2047, but cannot become one without implementing second-generation reforms.

Subbarao said there is a vertical divide between states. “Of the 100 per cent taxes, 60 per cent are collected by the central government and 40 per cent by states, while 60 per cent of expenditure is done by states, while the Centre spends only 40 per cent, The macroeconomic gravity is shifting towards states,” he said.

Job creation

Stressing the importance of job creation, he said India’s population continues to grow, but the demographic dividend remains an illusion without adequate jobs.

“You cannot cash in the demographic dividend without creating jobs, agriculture cannot create jobs, jobs cannot come from the services sector. The software sector has 7-8 million jobs. We need to create jobs in the manufacturing sector where the potential is. “

He said about 10 million people enter the employment sector every year, but low-end jobs are being created. He said growth is coming from sectors that are not employment intensive.

On India aspiring to become a developed country, Subbarao said, a rich country by definition has a per-capita income of 21,000 dollars. “We need to grow 7.6 per cent every year for 25 years at a trot for that.”

“It is difficult, if not impossible, to become a rich country without quality education. Quality, not the quantity of educational institutions, shall result in a better quality of life. Reducing inequality is another aspect to this. Breaking the middle-income trap will help the nation to move towards the rich country status,” he said.

Subbarao said the Indian economy is growing at 7.5 per cent while consumption is growing at just 4 per cent. Is this growth from consumption or from the welfare measures of the government, he asked.

“What we are experiencing is catch-up growth, which is firing on government expenditure and services exports,” he said.