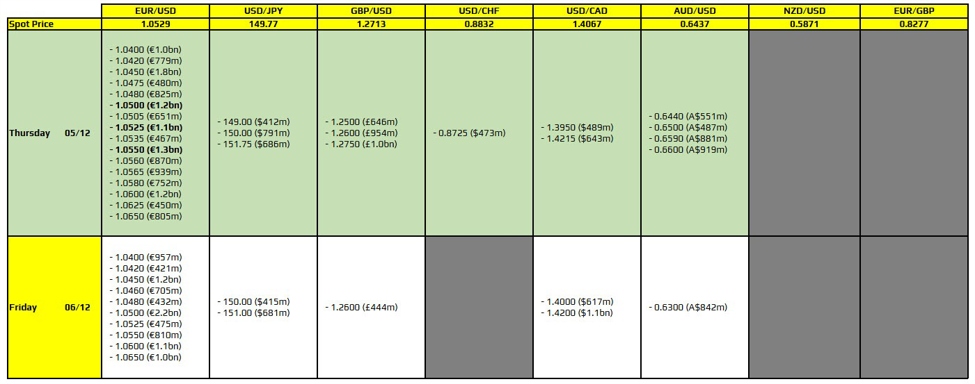

There are a couple to take note of on the day, as highlighted in bold.

They are for EUR/USD and layered in between 1.0500 through to 1.0550. As such, the expiries could play a role in terms of limiting price movements during the session ahead. That at least until we get to the US weekly initial jobless claims data later on. The pair has been weaving in and out of the 1.0500 mark in the last two days but is keeping just above the confluence of its key hourly moving averages of 1.0516-20 currently.

The French political situation remains a risk factor for the euro but with the no confidence motion passing yesterday, the pressure is now on Macron. However, we all know that he won’t budge and that means the political quagmire will perpetuate further for now.

As for the dollar, all eyes will be on the US jobs report tomorrow. That said, it is feeling a bit pinched after the softer ISM services report here. That also highlighted softer employment conditions, so it’s something to be wary about.

For more information on how to use this data, you may refer to this post here.