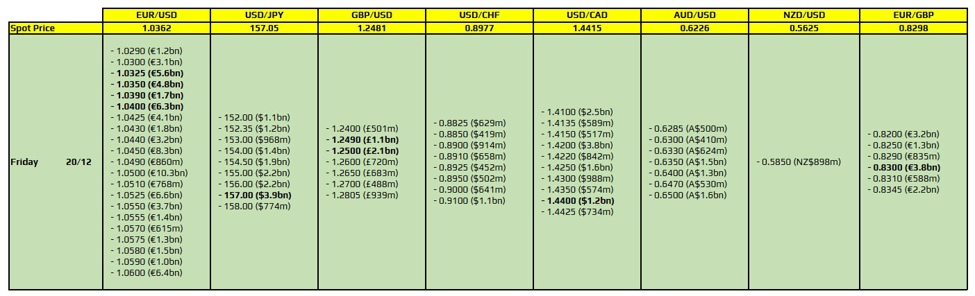

There are plenty of significant and massive expiries in play today, as highlighted in bold.

The very much larger ones are for EUR/USD and the ones to watch out for are layered between 1.0300 to 1.0400, given prevailing trading sentiment. The pair saw price action pulled towards 1.0400 yesterday before falling back after and the expiries above should provide a similar range before rolling off later in the day. That especially with little other market events to work with during the session ahead.

Then, there is one for USD/JPY at the 157.00 mark and that could offer a bit of a pull factor in European trading. So, just be mindful of that.

There are also large ones for GBP/USD around 1.2490-00 and that could help to keep a lid on things in the session ahead. The pair may be lurking to its lowest levels since May and the expiries will add as a defensive layer for sellers to try and keep the momentum running.

Then, there is one for USD/CAD at the 1.4400 mark but I wouldn’t attach much significance to this one. The pair is looking poised for an impressive technical breakout in December, with eyes on the 1.4500 and 1.4600 mark having more meaning at this stage.

And lastly, there is one for EUR/GBP at the 0.8300 mark. That might offer a bit of a pull factor in keeping price action more limited during the session ahead at least. That especially with the pair hoping for a firm break below 0.8300 on the monthly chart. That will be one to pay attention to when we approach the closing stages of December trading.

For more information on how to use this data, you may refer to this post here.