The following is a guest editorial courtesy of Carolane de Palmas, Markets Analyst at Retail FX and CFDs broker ActivTrades.

Silver and Gold have surged to impressive new heights in 2025, posting gains of 51% and 43% respectively, making them some of the year’s top-performing metals. Silver recently climbed above $44.90, marking its highest level in 14 years, while Gold reached a fresh all-time high near $3,752, according to ActivTrades’ trading data. The yellow metal’s rally has been so strong that it has significantly outpaced U.S. stock indexes this year. But what factors are driving these record-breaking gains, and is there potential for prices to continue climbing?

Silver Reached Its Highest Level in 14 Years

Silver’s surge to its highest level in 14 years in 2025 is closely tied to its unique dual role in the global economy. Unlike Gold, which is valued primarily for its monetary and safe-haven appeal, Silver has become indispensable to modern industry. Its critical use in electronics, solar panels, and data centers places it at the heart of sectors that are experiencing rapid expansion. Renewable energy is a powerful force in the Silver market. As the use of solar panels accelerates, so does the demand for silver. In 2024, global Silver demand reached an all-time high of 1.2 billion ounces, with a substantial portion of that increase directly tied to photovoltaic applications, according to the Silver Institute.

Fueled by the growing electric vehicle industry and its need for charging infrastructure, industrial consumption surged 7% to 700 million ounces. At the same time, the rise of artificial intelligence has dramatically increased electricity requirements worldwide, further boosting investment in renewable energy projects and data-driven infrastructure, all of which consume Silver at scale. This broad-based industrial demand has ensured that Silver is a material necessity in the global shift toward cleaner energy and digital transformation.

On the supply side, the picture is even tighter. The Silver market has been running a deficit for four consecutive years, with an annual shortfall of around 240 million ounces—and that gap continues to widen. Global inventories are now at multi-year lows, creating an imbalance between demand and available supply. When this structural deficit is combined with persistent geopolitical and economic uncertainty, it provides powerful tailwinds for Silver prices, propelling it to levels not seen in over a decade.

The investment story has also become a critical driver of Silver’s momentum. With the U.S. dollar weakening and bond markets turning volatile, investors have been encouraged to look beyond traditional financial assets for diversification. In this environment, Silver has begun to emerge as more than just an industrial metal—it is increasingly seen as a safe-haven asset. Gold has long been the default refuge for investors in times of economic and geopolitical uncertainty, but in 2025 the spotlight has noticeably widened to include Silver. The metal is developing safe-haven characteristics of its own, offering investors a hedge against instability while remaining more accessible thanks to its lower entry price compared to Gold.

This affordability has become especially relevant as Gold prices continue to hover near historic highs. For many, Silver provides a cheaper alternative to gain exposure to precious metals, and the relative undervaluation is highlighted by the Gold-Silver ratio. As of late September, the ratio is around 85, well above the 20-year average of about 60, suggesting that Silver still has significant room to catch up with its yellow cousin. Although the ratio briefly surged to extreme levels during the COVID-19 crisis (above 125) and touched 107 in April 2025, it remains elevated compared with long-term norms, reinforcing the perception that Silver offers better relative value.

So what can we expect from Silver prices? While short-term volatility in Silver prices is almost inevitable, the structural drivers—persistent supply deficits, booming industrial demand, and rising investment inflows—suggest that the metal could stay strong in 2025 and beyond. If these trends hold, Silver could even challenge its all-time highs above $50 in the coming years.

Silver Weekly Prices – Source: ActivTrades

Gold Experiencing Its Biggest Rally Since 1979

Gold is in the midst of a historic rally, climbing more than 40% this year and setting up its strongest annual gain since 1979. According to Dow Jones Market Data, the scale of this surge outpaces even the run-ups seen during the Covid-19 crisis or the 2007–09 recession. The momentum has been building for nearly three years, as central banks and Chinese investors steadily accumulated bullion. Now, Gold futures are not just breaking records—they are rising at a pace not witnessed since the inflationary shock of the late 1970s, when a global energy crisis rattled economies worldwide.

A powerful wave of investment has also come from exchange-traded funds. Morningstar Direct reports that the net assets in U.S. ETFs tied to physical Gold have swelled by 43% since January, with March and April marking two of the biggest monthly inflows in over a decade. Physical demand is not limited to institutional investors: consumers are also piling in, with U.S. retailer Costco selling one-ounce bars that have become a surprising hit among younger buyers seeking both diversification and security.

The political and macroeconomic backdrop has magnified Gold’s appeal. President Trump’s efforts to reorder global trade have fueled inflationary pressures while clouding growth forecasts. His administration’s pressure campaign on the Federal Reserve has raised questions about the central bank’s independence, unsettling markets further. At the same time, the U.S. dollar has endured its weakest first half in more than 50 years, eroding confidence in one of the world’s most trusted safe-haven currencies. Ongoing wars in Ukraine and other regions have only reinforced the need for refuge in hard assets like Gold.

Monetary policy expectations are another major driver. Hopes for additional Federal Reserve rate cuts have supported prices, with the latest reduction and accompanying guidance from Chair Jerome Powell signaling that more easing could follow as the labor market shows signs of strain. Investors are watching closely for confirmation in Powell’s remarks and upcoming inflation data, particularly the U.S. core personal consumption expenditures index, which could shape the trajectory of further policy adjustments.

What makes this rally particularly striking is Gold’s decoupling from traditional market signals such as yields. Historically, bond yields have been the benchmark for precious metal pricing, but investors are increasingly treating Gold as the ultimate indicator of long-term uncertainty. With stagflation risks, ballooning government deficits, and geopolitical strains weighing heavily on sentiment, Gold has proven itself a reliable hedge regardless of whether rates rise, fall, or remain stagnant.

Just like with Silver, short-term volatility is very likely. But with strong central bank demand, surging ETF inflows, political and economic instability, and a weakening dollar all converging, the conditions are in place for Gold to test new highs.

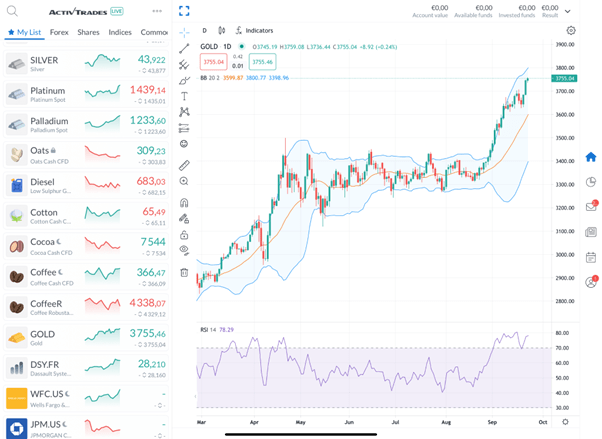

Gold Daily Prices – Source: ActivTrades

How to Take Advantage of High Silver & Gold Prices

Against a backdrop of economic uncertainty, persistent geopolitical risks, and a Gold market already trading at a premium, Silver has emerged as both an industrial cornerstone and a credible safe-haven alternative. At the same time, Gold continues to attract strong interest from investors and central banks alike, benefiting from trade tensions linked to Trump’s tariffs, ongoing conflicts in Ukraine and the Middle East, and the growing trend of countries seeking to diversify reserves away from the U.S. dollar.

For those who believe prices will continue to rise, there are several ways to gain exposure. The most straightforward option is to buy physical Silver or Gold and ensure it is securely stored. However, investors who prefer not to deal with storage can turn to financial products such as exchange-traded funds (ETFs) that track Gold or Silver. These are widely regarded as the most liquid, tax-efficient, and low-cost way to participate in the precious metals market, particularly as part of a diversified portfolio. Many analysts suggest keeping direct exposure to Gold and Silver limited to a small portion of one’s overall holdings—typically under 3%.

For more active investors seeking to trade short-term price movements, contracts for difference (CFDs) can provide leveraged exposure to both the upside and downside of precious metals. Platforms such as ActivTrades offer this type of product, but it’s important to note that CFDs are high-risk instruments and not suitable for all investors. Used responsibly, they can offer tactical opportunities, but they should be approached with caution and only by those who fully understand the risks.

Sources: CNBC, The Wall Street Journal, Reuters, CME Group, Silver Institute

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.