Worldpay today announced the launch of its innovative Authentication Optimization Service, a patent-pending solution designed to maximize payment approval rates and minimize unnecessary friction for merchants using 3D Secure (3DS) to authenticate payments.

This service is widely available to merchants that accept payments in non-3DS regulated markets.

“With the Authentication Optimization Service, we’re using AI and deep transaction insights to help merchants capture more revenue and deliver seamless payments, especially in markets where strong consumer authentication isn’t required,” said Cindy Turner, chief product officer at Worldpay. “At Worldpay, security and seamlessness aren’t mutually exclusive — they’re critical components in how we optimize every payment. Our scale, data, and technology turn declines into approvals, helping clients win back missed revenue, while reducing the kind of friction at checkout that can lead to abandoned carts.”

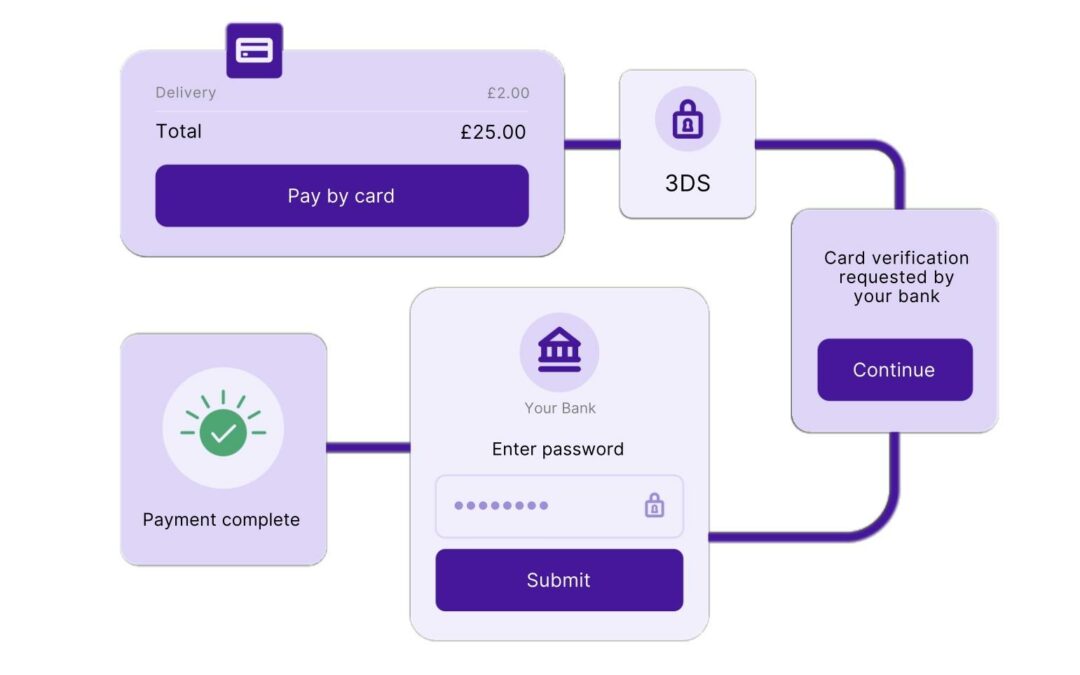

The new service uses artificial intelligence to leverage payment insights across billions of global transactions processed by Worldpay. It makes real-time decisions on when to apply 3DS to authenticate the transaction or directly authorize the payment based on factors such as risk and issuer preference.

This AI-powered solution goes beyond rigid, rules-based systems by intelligently routing transactions to 3DS authentication only when truly necessary — either for regulatory compliance or when Worldpay’s data indicates a high probability of issuer acceptance. This targeted approach reduces unnecessary friction while maintaining security and compliance standards.

“At Visa, we understand the need to ensure both security and seamless payment experiences,” said James Mirfin, SVP, head of risk and identity solutions at Visa. “We are proud to be a part of Worldpay’s new Authentication Optimization Service, which will help merchants boost approvals while maintaining high levels of security. Data-driven, adaptive approaches like this can help bridge the gap between merchant needs and issuer risk management — delivering better outcomes for everyone in the payments ecosystem.”

The Authentication Optimization Service is patent pending and represents Worldpay’s ongoing commitment to innovation in payment authentication.